The 10 Best Sales Tax Software for Ecommerce Brands

Let’s look at our top 10 picks for ecommerce sales tax software before we get into the reviews and such.

"In this world nothing can be said to be certain, except death and taxes." So said Benjamin Franklin, at least. For ecommerce merchants, it's the taxes part we really need to worry about (the former to be left for another day). In this instance, we're talking sales tax.

Every transaction your store processes needs to account for variable sales tax rates based on where your customers live.

In the US, that’s a three-layer cake of complexity: state, county, and city tax rates. Add in varying tax rates for different product categories—like general merchandise, apparel, or food and beverage—and things can get messy fast.

That’s why you need software that doesn’t just crunch numbers but automates the heavy lifting: calculating, collecting, and filing sales taxes seamlessly.

You’re here because you know you need the right tool for the job—and you’re in good hands. With our experience in the ecommerce trenches, we’ve narrowed down the top sales tax software options to suit a variety of business needs.

Now, please scroll to continue.

Table of Contents

Why Trust Our Software Reviews

Comparing the Best Sales Tax Software for Ecommerce Stores

Good enough is not good enough when it comes to taxes. Here you can compare each sales tax tool by its base pricing. Then, go on to compare other features by clicking Compare Software below the table.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for SaaS products & other digital goods | 30-day free trial | From $19/month | Website | |

| 2 | Best for international sellers | Not available | From $43(35€)/month | Website | |

| 3 | Best enterprise sales tax solution | Free demo | Pricing upon request | Website | |

| 4 | Best for calculating, collecting, and filing sales tax with ease | Free plan + 30-day free trial available | From $39/month | Website | |

| 5 | Best for a global customer base | 7-day free trial available | From $29/month | Website | |

| 6 | Best for a range of integrations | Free demo available | Pricing upon request | Website | |

| 7 | Best for customizability | Not available | Pricing upon request | Website | |

| 8 | Best for tax compliance | 14-day free trial | From $49/month | Website | |

| 9 | Best for small businesses | Free trial | From $39.99/month | Website | |

| 10 | Best for access to tax experts | Free trial | From $47/month | Website |

The 10 Best Ecommerce Sales Tax Software for Simplifying Compliance

Now on to the reviews. For each sales tax software solution, we’ll explain what it does, why we picked it, its top features and integrations, plus the pros and cons you can expect.

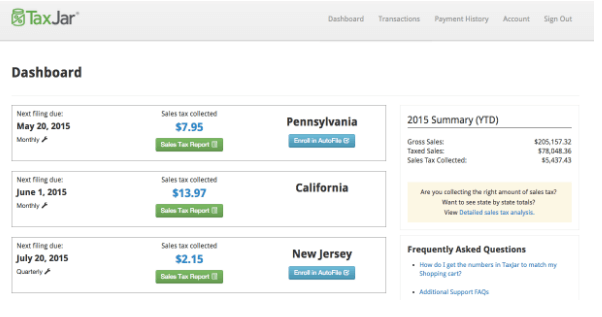

TaxJar is a cloud-based sales tax software designed to help ecommerce businesses manage their sales tax compliance. The software integrates with multiple ecommerce platforms, shopping carts, and marketplaces, and provides real-time sales tax rates and rules for all US states and territories.

Why I Picked TaxJar: TaxJar automates the sales tax calculation process, including tax exemptions and product taxability, and files sales tax returns on behalf of businesses. The software also offers features such as nexus detection, customer address verification, and sales tax reporting. With TaxJar, businesses can reduce the risk of sales tax errors and penalties, save time and resources on tax compliance, and focus on growing their business.

TaxJar Standout Features & Integrations

The standout features of TaxJar revolve around its ability to simplify compliance with economic nexus laws. It provides detailed insights into sales and transaction thresholds for different states, helping businesses track when they trigger sales tax obligations in various jurisdictions.

With proactive threshold alerts, TaxJar notifies businesses as they approach or surpass these thresholds, giving them the tools to stay compliant and avoid surprise tax liabilities.

Integrations include Amazon, BigCommerce, eBay, Ecwid, Etsy, Magento, Paypal, Quickbooks, Salesforce, Shopify, Square, Squarespace, Walmart, and WooCommerce.

Pros and Cons

Pros:

- Detailed reports and dashboards

- Economic Nexus insights

- Highly accurate sales tax calculations

Cons:

- Customer support sometimes slow to respond

- Limited international support

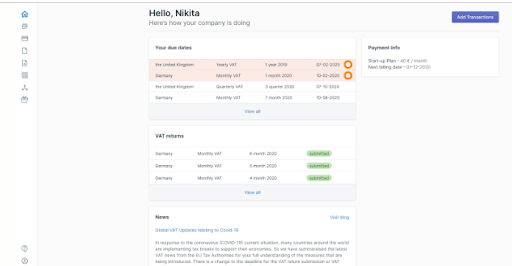

LOVAT streamlines tax compliance for businesses by automating the submission of tax reports and declarations, providing online accounting, and downloading sales information from multiple sources. With coverage in 57 countries worldwide, LOVAT also offers tax education, real-time support from professionals, and an extensive list of tracking tools.

Why I Picked LOVAT: LOVAT promises to solve the problem of tax reporting within minutes. LOVAT is light and fast, while still being robust enough to serve as an all-in-one solution for global VAT liabilities. Unless you are feeling generous, I highly recommend their VAT calculation system that makes sure you never overpay. LOVAT distinguishes itself through its AI-powered predictive tax compliance feature, which goes beyond basic tax calculations. This feature leverages machine learning algorithms to analyze a business's historical sales data, transaction patterns, and tax compliance history. It then uses this information to provide proactive recommendations and alerts to help businesses stay compliant with local sales tax laws.

LOVAT Standout Features & Integrations

The standout features of LOVAT focus on precision and accuracy with its real-time geolocation and jurisdictional tracking. Unlike many sales tax solutions that rely on zip codes or general locations, LOVAT leverages advanced geolocation technology—using GPS data and IP address analysis—to determine the exact location of a customer.

This ensures businesses can calculate and apply the correct sales tax rates down to the city or even street level, significantly reducing the risk of errors or audits.

Integrations include Shopify, Fulfillment by Amazon, eBay, Magento, WooCommerce, and Etsy.

Pros and Cons

Pros:

- Customizable and scalable

- AI-powered predictive insights

- Highly accurate tax calculations

Cons:

- Slight learning curve

- Limited integration with other systems

Vertex is a leading provider of enterprise tax software solutions, including sales and use tax calculation, returns, and exemption certificate management. The software is designed to automate the sales tax calculation process, and provides real-time sales tax rates and rules for all US states and Canadian provinces.

Why I Picked Vertex: Vertex integrates with multiple enterprise resource planning (ERP) systems, enabling businesses to manage their tax compliance across multiple jurisdictions from a single platform. The software also offers audit defense support, tax research, and global tax solutions. Vertex is known for its accuracy, scalability, and comprehensive coverage of complex tax regulations, making it a preferred choice for large enterprises and multinational corporations.

Vertex Standout Features & Integrations

The standout features of Vertex make tax compliance a breeze with its integrated automated returns and filing service. This functionality allows businesses to streamline the generation and filing of sales tax returns directly from the platform. Supporting e-filing and connecting with various tax authorities, it eliminates the manual hassle, saving significant time and effort for busy ecommerce operations.

Integrations include Accumatica, Adobe Commerce, BigCommerce, ChargeBee, commercetools, Elastic Path, IBM Cognos, Intuit, Kibo Commerce, Microsoft Dynamics 365, NetSuite, and dozens more in the areas of ERP, ecommerce, procurement, and point-of-sale.

Pros and Cons

Pros:

- Comprehensive sales tax automation capabilities

- Extensive global tax content and expertise

- All-in-one enterprise accounting solution

Cons:

- Complex initial implementation

- Pricing not appropriate for small biz

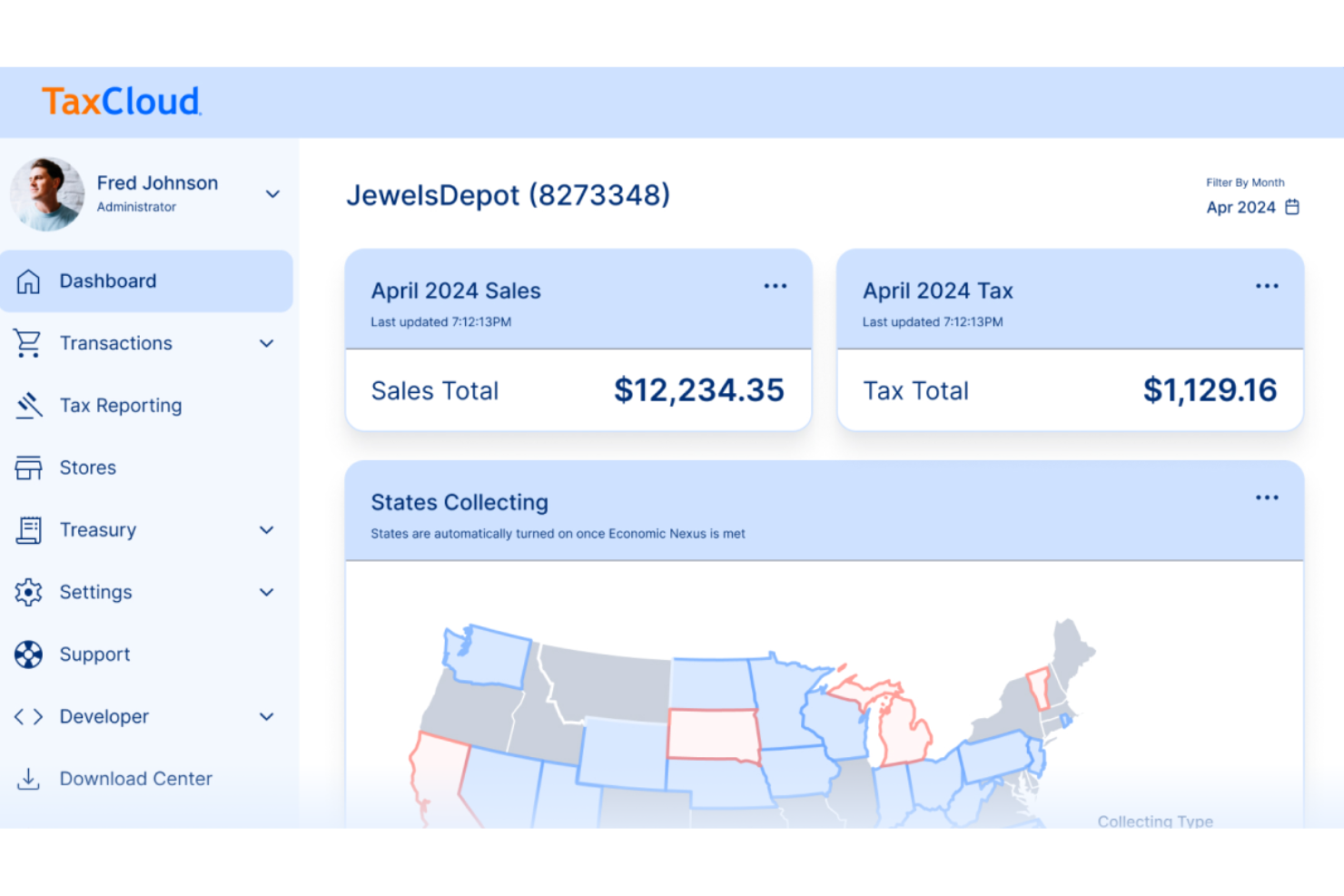

TaxCloud

Best for calculating, collecting, and filing sales tax with ease

With more than 15 years of experience in automating sales tax compliance across over 13,000 U.S. sales tax jurisdictions, TaxCloud provides comprehensive sales tax support and automation for ecommerce businesses of all sizes.

Why I Picked TaxCloud: TaxCloud's vast database of up-to-date tax rates and rules, along with its robust exemption certificate management, ensures precise tax calculations and compliance across a multitude of jurisdictions. Additionally, its no-cost service for businesses, which includes the handling of all state and local sales tax filings and remittances, makes it an attractive choice for small to medium-sized enterprises looking to streamline sales tax compliance without incurring significant expenses.

TaxCloud Standout Features & Integrations

Standout features of TaxCloud simplify sales tax compliance by automating and streamlining the process for businesses. These include sales tax filing and remittance, which reduce compliance burdens by automating the filing of tax returns and remitting payments to state authorities.

The platform provides accurate sales tax calculations for transactions across state, county, and city levels, along with economic nexus tracking that notifies businesses when they approach or exceed sales thresholds. It also supports exemption certificate management to handle exemptions seamlessly and offers robust audit support tools to prepare for and navigate tax audits effectively.

Integrations include Ability Commerce, BigCommerce, Quickbooks, Square, Stripe, Shopify, WooCommerce, Odoo, Volusion, Cart.com, Oracle NetSuite, Acumatica, Sage, and Magento.

Pros and Cons

Pros:

- Database of up-to-date sales tax rates and rules

- Integrations with a variety of ecommerce tools

- Collect sales tax automatically

Cons:

- May be too basic for larger enterprises

- Transaction volume limitations on lower plans

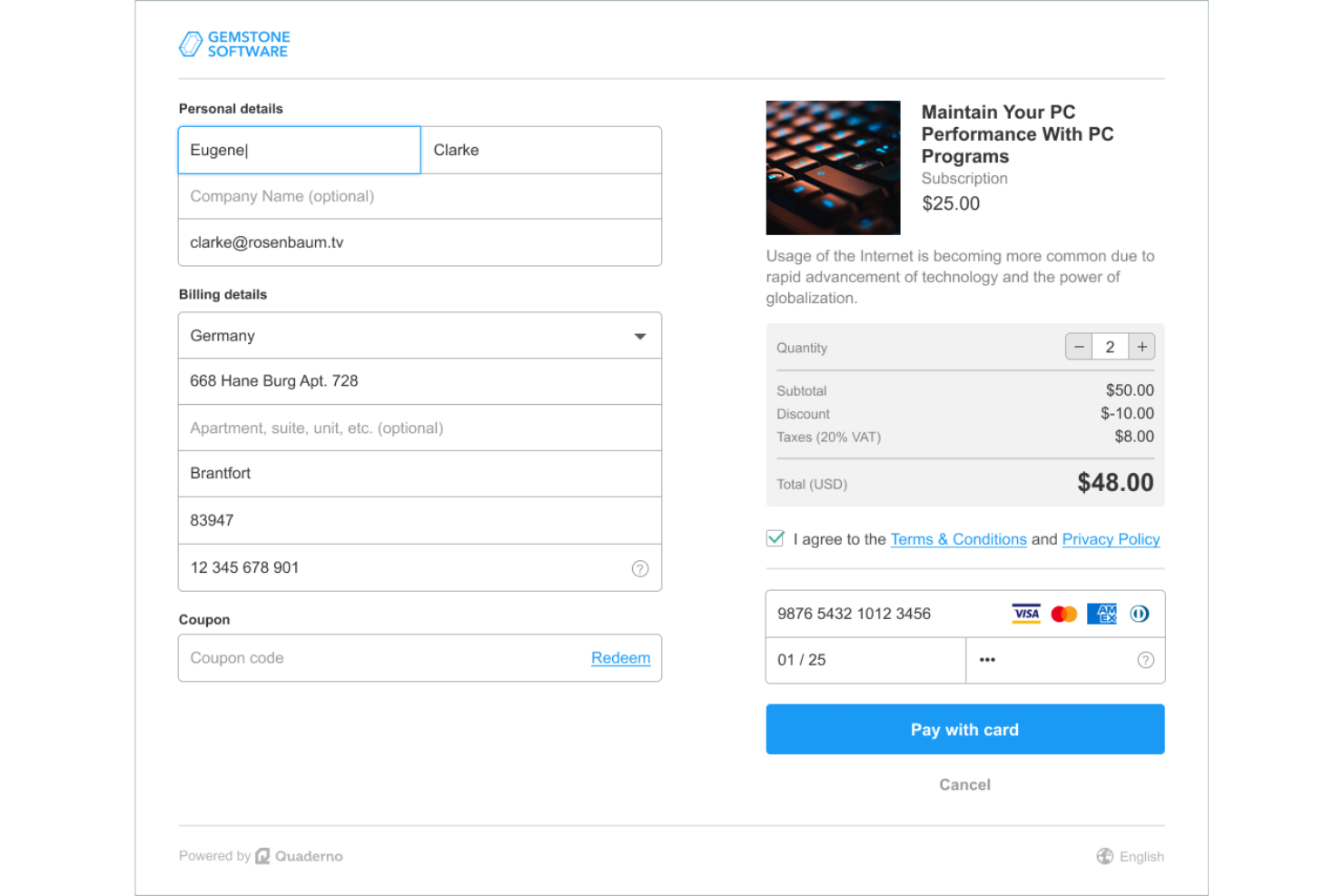

Quaderno excels as a sales tax software by simplifying the often complex process of sales tax compliance for e-commerce businesses. It offers robust automation features that enable accurate tax calculation and reporting for businesses operating globally.

Why I Picked Quaderno: Quaderno stands out for its seamless integration with various e-commerce platforms and payment gateways, ensuring that sales tax obligations are automatically managed during the customer transaction process. Its ability to handle multi-currency and multi-language transactions, coupled with its real-time tax rate updates, makes it a valuable tool for international sales, helping businesses navigate intricate sales tax regulations effortlessly. Quaderno also offers detailed tax reports and insights, facilitating transparency and ease of compliance for businesses of all sizes.

Quaderno Standout Features & Integrations

The standout features of Quaderno cater perfectly to businesses with a global customer base. Its robust support for multi-currency and multi-language transactions sets it apart, allowing businesses to automatically convert transaction amounts into the customer’s preferred currency while generating invoices and receipts in multiple languages.

This not only enhances the customer experience but also ensures accurate tax compliance across diverse markets. For ecommerce businesses operating internationally, Quaderno’s capabilities make managing tax compliance smoother and more inclusive.

Integrations include Braintree, GoCardless, Paypal, Square, Stripe, Shopify, CheckoutJoy, WooCommerce, Amazon FBA, Sendowl, Clickfunnels, Mighty Networks, Xero, and others. You can unlock more using Zapier, but this requires a separate account and may incur additional costs.

Pros and Cons

Pros:

- Seamless ecommerce integration

- Multi-currency and multi-language support

- Real-time tax rate updates

Cons:

- Doesn't include every US tax code

- Reporting could be more robust

Avalara is a cloud-based sales tax software designed to help businesses of all sizes automate their sales tax compliance. The software provides real-time sales tax rates and rules for all US states and territories, as well as VAT and GST for international jurisdictions.

Why I Picked Avalara: Avalara’s Avatax removes the no.1 pain point of accounting overwhelm by supplying sales tax calculations and rules based on geolocation and product classification. It offers more than 700 integrations. Use it to manage your data across various apps connected with your ecommerce platform. Apart from that, it removes tax from exempt sales and skillfully manages and organizes exempt documentation.

Avalara Standout Features & Integrations

The standout features of Avalara shine in its Cross-Border functionality, which simplifies the complexities of international sales tax and cross-border ecommerce. This feature is a big deal for businesses involved in global trade, providing access to a comprehensive database of international tax rules, rates, and regulations across more than 200 countries. Whether you're navigating VAT, GST, or other global tax requirements, AvaTax Cross-Border ensures compliance with ease.

Integrations include WooCommerce, Shopify, Quickbooks, Stripe, Magento, NetSuite, Sage, Infor, Amazon, BigCommerce, eBay, SAP, Amazon, and other systems and tools.

Pros and Cons

Pros:

- Seamless integration with numerous systems

- Scalable solutions for businesses of all sizes

- Automates the sales tax calculation process

Cons:

- Customer support sometimes slow to respond

- Costs based on the volume of transactions

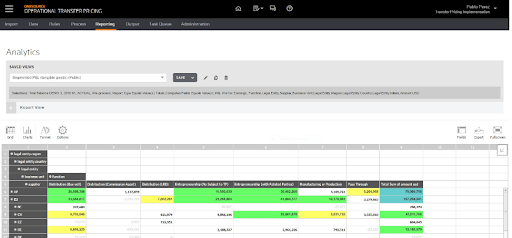

Thomson Reuters ONESOURCE is a tax compliance software that provides a range of tax solutions, including income tax, indirect tax, property tax, transfer pricing, and tax information reporting. ONESOURCE also offers a tax research database that provides users with up-to-date tax laws, regulations, and court cases from around the world.

Why I Picked ONESOURCE: Though it may sound like an old school news bureau, Thomas Reuters packs a massive punch in the world of ecommerce tax software. It uses the latest rules and rates to ascertain sales tax, use tax, VAT, and GST. It makes managing sales and use tax a breeze, with GST and VAT compliance done in a streamlined way through one system. The team also provides step by step sales tax guidance and answers, all in a single place.

ONESOURCE Standout Features & Integrations

The standout features of ONESOURCE are its flexibility and precision. This platform is highly customizable, making it a perfect fit for businesses of all sizes—whether you’re a scrappy startup or a sprawling multinational. By tailoring its tools to your unique tax compliance needs, ONESOURCE helps reduce the risk of tax errors, keeps you ahead of ever-changing tax laws, and boosts overall compliance efficiency. It’s like having a tax expert on call, 24/7.

Integrations include Acumatica, BigCommerce, Braintree, Cavallo, Coupa, Epicor P21, and EFI solutions.

Pros and Cons

Pros:

- Advanced reporting and analytics tools

- Integrates with various financial and ERP systems

- Comprehensive tax technology platform

Cons:

- Not for smaller businesses

- Can be complex to implement and use

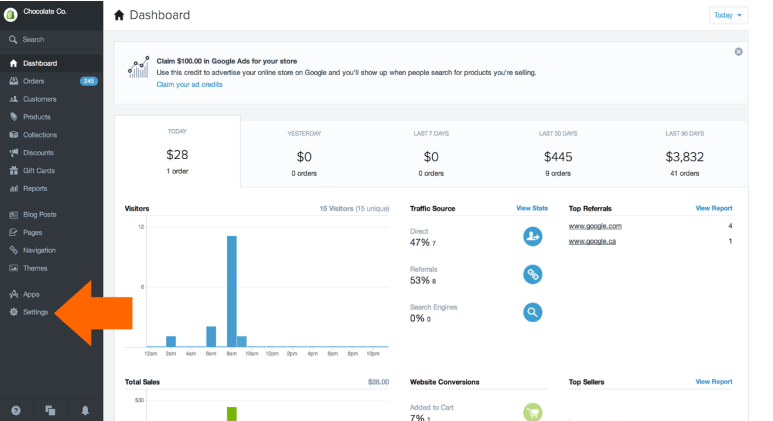

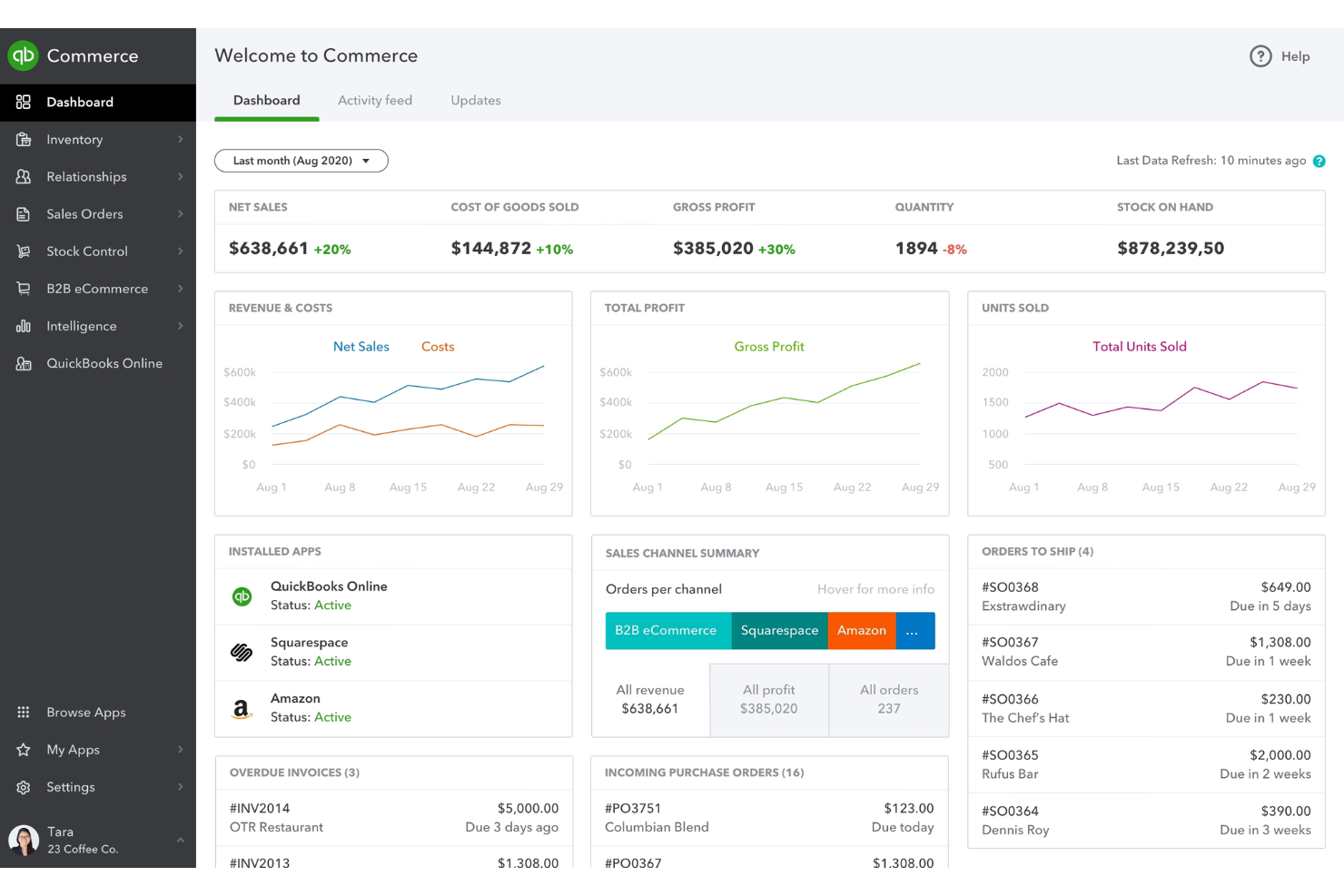

QuickBooks Commerce is an inventory and order management software designed to help businesses efficiently manage their inventory, sales, and order fulfillment processes. It offers a comprehensive suite of tools to streamline inventory tracking, sales order processing, and multi-channel sales management. It works with the base QuickBooks software to create a complete ecommerce sales tax and inventory solution.

Why I Picked QuickBooks Commerce: QuickBooks Commerce performs exceptionally well as an ecommerce sales tax software by providing businesses with robust and automated sales tax calculation and compliance features. It simplifies the complex task of sales tax management for online retailers by accurately calculating taxes based on various factors such as location, product type, and customer profiles. QuickBooks Commerce's integration with popular ecommerce platforms ensures that sales tax is automatically calculated during the checkout process, reducing the risk of errors and helping businesses maintain compliance effortlessly.

QuickBooks Commerce Standout Features & Integrations

Standout features of QuickBooks Commerce make it a go-to solution for multichannel sales tax automation. It handles accurate sales tax calculations while seamlessly integrating with a variety of ecommerce platforms, marketplaces, and sales channels.

This means you can centralize all your sales tax calculations and compliance efforts in one place—no more juggling tools or worrying about gaps in your tax coverage. If your ecommerce business has a sprawling online presence, this tool makes keeping up with tax compliance across multiple channels far less of a headache.

Integrations include over 450 business apps like Square, Stripe, Insightly CRM, Mailchimp, Shopify, eBay, BigCommerce, Magento, Squarespace, and Etsy.

Pros and Cons

Pros:

- User-friendly and intuitive interface

- Multi-currency and multi-location support

- Robust multi-channel sales management capabilities

Cons:

- Need base Quickbooks + QB Commerce

- Limited advanced analytics

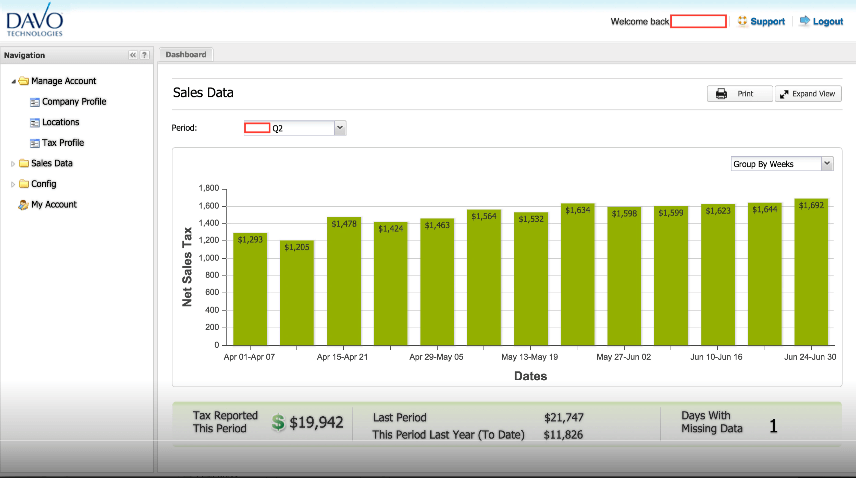

DAVO Sales Tax is a sales tax automation software designed for small businesses that operate in the United States. It automatically collects, files, and pays sales tax on behalf of businesses, simplifying the complex sales tax compliance process.

Why I Picked DAVO: DAVO Sales Tax integrates with a wide range of point of sale (POS) systems, accounting software, and payment processors, allowing businesses to automatically set aside sales tax from their daily sales and remit it to the appropriate state tax authority. The software also provides real-time sales tax rates and rules for all US states and territories, making it easier for businesses to stay compliant with changing tax laws.

DAVO Standout Features & Integrations

Standout features take the stress out of sales tax collection by doing things differently. Unlike most competitors that let sales tax pile up until the end of the reporting period, DAVO collects it daily. Every day, the tool automatically transfers the collected tax into a secure DAVO-held account, so when tax time rolls around, you’re not scrambling for funds—you’re already set.

Integrations include QuickBooks online, Clover, Square, Revel, and all the other major POS software.

Pros and Cons

Pros:

- Integration with point-of-sale systems

- Daily sales tax collection feature

- Fully automated sales tax filing and payment solution

Cons:

- Limited customization options

- Dependency on 3rd-party payment processors

Taxify is a cloud-based sales tax software designed to help businesses of all sizes automate their sales tax compliance. The software provides real-time sales tax rates and rules for all US states and territories, and integrates with a wide range of ecommerce platforms, shopping carts, and accounting software.

Why I Picked Taxify: Taxify is a product of the Sovos brand, one of the world’s leading voices in tax for the last 30 years. With over 14,000 tax jurisdictions spanning across 50 states, Taxify will keep the overburdened ecommerce sellers tension-free with accurate rates. It helps you automatically comply with tax changes and offers an easy way to auto-file tax returns. Also, it has readily available tax experts that will cater to your nuanced needs and questions.

Taxify Standout Features & Integrations

The key features of Taxify focus on automating the complex world of sales tax compliance. It handles everything from calculating sales tax—including exemptions and product taxability—to filing sales tax returns on your behalf. For added peace of mind, Taxify also offers audit support, equipping businesses with the necessary documentation to handle audit requests smoothly.

Integrations include Magento, Microsoft platforms, Oracle NetSuite, Quickbooks, SAP, and Shopify.

Pros and Cons

Pros:

- Intuitive and user-friendly interface

- Robust ecommerce integration options

- Comprehensive sales tax coverage

Cons:

- Not cost-effective for small biz

- Limited international coverage

Other Ecommerce Sales Tax Software Options

Here are a few more that didn’t make the top list.

- FastSpring

Tax software for subscription services

- TaxCalc

For self-employed individuals

- CCH Axcess Tax

For a variety of sales software & services

- Utility Software

Basic return-filing software

- 123 Sheets

To file HMRC VAT returns

Our Selection Criteria for Ecommerce Sales Tax Software

Choosing the right sales tax software for your ecommerce business is like picking the ultimate travel guide—you want someone who knows the territory, keeps you on track, and helps you avoid unnecessary detours.

We evaluated each tool with a weighted scoring system to make sure you’re getting the right fit for your needs.

Core functionality (25% of total weighting score)

The core capabilities are non-negotiables. These essential features handle the basics of sales tax compliance, so you can avoid errors and stay on the right side of the law.

- Automated tax calculations. Accurately applies local tax rates based on customer location—no manual math needed.

- Real-time compliance updates. Stays current with evolving tax regulations, so you’re always in the clear.

- Automated filing and remittance. Submits sales tax returns and sends payments directly to tax authorities without extra steps.

- Detailed reporting. Generates easy-to-understand reports for audits, financial analysis, or just plain peace of mind.

- Platform integrations. Plays well with major ecommerce platforms (Shopify, WooCommerce, BigCommerce), making it a seamless fit with your existing tech stack.

Additional standout features (25% of total weighting score)

These extra features can make your tax software go from good to great, giving you more control, flexibility, and peace of mind.

- Multichannel support. Manages tax for sales across multiple channels (Amazon, Etsy, eBay) without needing a separate tool.

- Tax exemptions and certificates. Handles exemptions automatically for B2B transactions or non-taxable items.

- Nexus tracking. Keeps tabs on where you’re liable for tax collection, so you’re covered as your business grows.

- Customizable reporting. Allows for reports that match your specific needs, whether for a quarterly review or year-end analysis.

- Multi-currency support. Perfect for international sellers, ensuring compliance with foreign tax rates and currency conversions.

Usability (10% of total weighting score)

Usability is all about making the software feel intuitive and easy to use. The more user-friendly, the quicker you can get your tax tasks done and focus on other priorities.

- Intuitive dashboard. Provides a clear view of tax liabilities, filings, and payments at a glance.

- Simple navigation. Keeps the setup and daily use straightforward without endless menus or hidden features.

- Efficient workflows. Smooth processes make tax tasks faster, letting you get back to running your business.

Onboarding (10% of total weighting score)

An effective onboarding experience makes a big difference in how quickly you can get up and running. We look for tools with strong support for new users.

- Training materials. From tutorials to webinars, these resources get your team up to speed fast.

- Interactive tours. Hands-on product tours to make sure you’re comfortable with each feature before you commit.

- Supportive setup. Access to onboarding specialists or setup guides, ensuring everything’s running smoothly from day one.

Customer support (10% of total weighting score)

Solid customer support is a lifesaver when issues arise. We rated each software’s support options, responsiveness, and resources for self-service.

- Responsive support team. Real humans available when you need them—ideally with ecommerce tax expertise, not just generic help desk answers.

- Variety of support channels. Chat, email, phone, and even Slack for some tools. Bonus points for live chat with short wait times.

- Proactive resources. Look for searchable knowledge bases, how-to videos, exemption certificate walkthroughs, and live training webinars to get users up to speed faster.

- Onboarding and guidance. Some providers offer one-on-one setup calls, personalized onboarding portals, or access to dedicated success reps—especially helpful if you’re scaling or have complex nexus needs.

Value for money (10% of total weighting score)

With value, it’s all about finding software that offers the features you need at a reasonable price. We looked at whether each tool delivers solid ROI.

- Competitive pricing. Solid value for your investment without skimping on essential features.

- Transparent costs. No surprise fees—what you see is what you pay.

- Flexible plans. Scales with your business, whether you’re a startup or selling globally.

Customer reviews (10% of total weighting score)

The best way to know if software lives up to its promises is to hear from real users. We analyzed reviews to find out what customers liked—and what they didn’t.

- High satisfaction rates. Look for tools with a reputation for reliability and positive user experiences.

- Praise for ease of use. Reviews that highlight the software’s intuitive design and functionality.

- Strong customer support ratings. Good customer service can make or break your experience.

- Favorable comparisons. High marks from customers who’ve compared it to the competition.

By weighing these criteria, you can find a sales tax software solution that’ll keep you compliant, save time, and reduce the stress of managing taxes—like having a tax wizard in your corner.

What is Ecommerce Sales Tax Software?

Ecommerce sales tax software is like your tax-savvy co-pilot, taking the wheel on calculating, collecting, and remitting sales tax for online sales.

It automatically syncs with your ecommerce platform, tracking down the right tax rates based on where your customers are and what they’re buying—no manual math required.

Why does it matter?

Because sales tax compliance is a moving target. Rates and rules change constantly across states, counties, and even cities. Good sales tax software keeps up with these regulatory changes, making sure you stay on the right side of the law while cutting down on costly errors.

The bottom line: This software takes a hefty admin load off your plate and saves you from tax-time headaches.

How to Choose the Best Ecommerce Sales Tax Software

Choosing sales tax software isn’t a one-size-fits-all deal. Here’s how to pick a solution that fits your business like a glove:

- Check for seamless integrations. Make sure the software plays nice with your ecommerce platform—whether it's Shopify, WooCommerce, BigCommerce, or something else. You want a tool that plugs right in and starts working without a long setup.

- Prioritize automated updates. Tax laws are like fashion trends—always changing. Your software should stay current with the latest tax rules automatically so you’re never caught off guard by new rates or regulations.

- Look for accuracy you can trust. Sales tax is serious business. Choose a tool with a rock-solid reputation for precision. That way, you’re not sweating over calculations or dealing with error-prone estimates that could come back to bite.

- Think about scalability. If you’re planning to grow, pick software that grows with you. Look for flexible pricing and features that expand as you do, so you’re not constantly upgrading or switching as your sales volume rises.

- Look for customization where it counts. Some tools let you tailor tax rules by product type, region, or channel. Others offer industry-specific workflows or let you build approval processes around your operations. This flexibility can be a game-changer for niche businesses or complex catalogs.

- Evaluate support and training resources. Even the best tools come with a learning curve. Make sure your pick has reliable customer support, plus helpful training materials or webinars, so you’re not left scrambling when you need answers.

In a nutshell: Go for sales tax software that’s easy to set up, accurate, and scalable, with top-notch support to keep you on track.

Trends in Ecommerce Sales Tax Software for 2026

As ecommerce booms globally, the tax landscape is becoming more complex, requiring robust software solutions to keep pace. Here’s what to expect in 2026:

- AI-driven compliance and forecasting. Artificial intelligence (AI) is moving beyond basic automation to predictive analytics, allowing software to foresee potential tax obligations based on sales data and legislative trends. This proactive approach will help ecommerce brands stay compliant amid shifting tax laws without scrambling to adapt after the fact.

- Marketplace-focused tax obligations. Marketplace facilitator laws continue expanding, making platforms like Amazon, Etsy, and eBay increasingly responsible for sales tax collection. However, as definitions evolve, sellers will still need tools that clarify their tax responsibilities within each marketplace. Look for software that adapts quickly to new marketplace requirements.

- Digital goods and services taxation. With digital goods and services (like SaaS) representing a larger share of ecommerce, more states are enacting or expanding sales tax laws around these items. Expect software to offer enhanced features for identifying and accurately taxing digital transactions, addressing new requirements for items like downloadable content or digital advertising.

- Simplified multistate and global compliance. The trend toward sales tax harmonization and simplification continues, with some states streamlining their tax requirements. Additionally, as ecommerce goes global, VAT compliance across jurisdictions is a priority. Cloud-based tax solutions are expected to offer even better cross-border capabilities, reducing the complexity of meeting international and multistate obligations.

- Blockchain for transparency and security. Blockchain technology is gaining traction for its potential to ensure accurate, tamper-proof records, especially useful during audits. By creating a transparent ledger of tax transactions, blockchain can help businesses navigate complex cross-border sales and build trust with customers.

These innovations position sales tax software as a key partner in ecommerce, helping businesses navigate a complex tax environment with greater ease and accuracy.

Key Features of Sales Tax Management Software

Great sales tax software does more than just slap on a tax rate. It’s a multi-tool designed to handle every tax hurdle that comes your way.

Here are the key features to keep an eye out for:

- Automated tax calculations. Calculates the correct rate for each sale based on the customer’s location and product type, sparing you the time and risk of doing it yourself.

- Real-time tax rate updates. Keeps up with the latest state and local tax changes automatically, so you’re always up to date without lifting a finger.

- One-click filing and remittance. Files returns and submits payments to tax authorities without you having to fuss over filing deadlines and paperwork.

- Crystal-clear reporting. Generates easy-to-read reports on tax collected, filed, and owed—so audits and year-end reviews aren’t just doable, they’re (almost) a breeze.

- Exemption certificate management. Automatically stores and validates exemption certificates, flags expired ones, and simplifies exempt sale reporting—making audit prep way less painful.

- Nexus tracking and alerts. Tracks where you have tax obligations and sends you a heads-up when new thresholds are reached, keeping your compliance radar sharp.

- Exemption management. Keeps track of tax-exempt transactions and exemption certificates, handling B2B sales and other exceptions with ease.

- Multichannel support. Manages tax collection across all your sales channels—from Shopify and WooCommerce to Amazon—without juggling multiple tools.

- Built-in international compliance. Simplifies VAT, GST, and other global tax requirements, letting you take on new markets without breaking a sweat.

- Custom configurations and workflows. Many tools let you tweak tax rules by region, product type, or sales channel. Some even use customer feedback to roll out industry-specific features that actually fit how you operate.

These features transform sales tax software from a “nice-to-have” to a “can’t-live-without” tool. In short, it’s your all-in-one solution for making tax compliance as smooth as it gets.

Benefits of Sales Tax Software for Online Retailers

Sales tax isn’t fun, but the right software makes it as close to painless as possible. Here’s how sales tax software can be your business’s tax-compliance superhero:

- Cuts down on time-sucking tasks. It’s like having an extra team member dedicated to taxes. From calculating rates to filing returns, the software automates the whole process so you can get back to the parts of your business that you actually enjoy.

- Keeps you on the straight and narrow. Manually calculating taxes across multiple states (or even countries) leaves way too much room for error. Sales tax software reduces the risk of mistakes that could trigger those dreaded penalties or, worse, audits.

- Tames the multistate madness. Each state seems to have its own idea of tax laws—fun! Sales tax software keeps track of each jurisdiction’s quirks and updates, so you don’t have to.

- Grows with you. Expanding to new states or online marketplaces? No problem. Sales tax software scales effortlessly, keeping up with your growth without missing a beat.

- Turns audits into a non-event. It’s hard to stress about an audit when you have software that keeps tidy, error-free records ready to go. Auditors can ask all they want; you’re prepared.

- Builds trust with your customers. No more surprises at checkout! Sales tax software ensures customers see the right tax amount from the start, giving them confidence that your store is on top of things.

- Opens doors to international markets. VAT, GST—whatever the tax type, software simplifies it so you can sell worldwide without getting bogged down in international tax headaches.

In a nutshell, sales tax software is like having a tax-savvy assistant who’s always on the ball, leaving you free to focus on building your business (and never worrying about tax compliance again).

Cost & Pricing of Sales Tax Software

Sales tax software pricing can vary, depending on the software’s depth and complexity. Here’s a rundown of what you can expect from each tier:

| Plan type | Average price | Common features | Best for |

|---|---|---|---|

| Free | Free (limited use) | Basic tax calculation, single-state filing, limited support | Small or low-volume businesses looking to dip their toes in the software world |

| Basic | $20 - $100/month | Core calculations, real-time tax rate updates, limited reporting | Startups, single-state sellers, and small businesses with straightforward tax needs |

| Professional | $100 - $300/month | Multi-state filing, automatic filing, enhanced reporting, integration with accounting systems | Growing businesses expanding into multiple states |

| Enterprise | $300+/month | Customizable options, full API access, advanced nexus tracking, dedicated support, international compliance | Large businesses with complex tax obligations or global sales reach |

Key considerations

- Free plans are a great way to test the waters with basic calculation and single-state coverage. These are ideal for very small businesses or those with low-volume sales that just need a basic tool to start.

- Basic plans are affordable for small businesses that need reliable core features like real-time calculations and basic compliance updates. Perfect for single-state operations or those with simple setups.

- Professional plans add more automation to the mix, like multi-state filing, integration with your existing systems, and extra reporting, making it a sweet spot for growing businesses.

- Enterprise plans cater to businesses that live in the deep end of tax complexity, with custom features, international compliance, and dedicated support teams to handle high volumes and unique tax requirements.

Additional costs to consider

- Implementation and integration fees. Getting the software smoothly embedded into your existing systems might come with setup fees.

- Premium support. While some level of support is usually included, dedicated account managers or priority response options can cost extra.

- Customization and training. Custom setups and team training sessions may also add to the final price tag, especially for larger teams or specific requirements.

Balancing features with your current and future needs will help you find a solution that grows with your business—without overburdening your budget upfront.

Ecommerce Sales Tax Software FAQs

I wanted to leave some space to discuss some of the most frequently asked questions related to ecommerce sales tax software.

How does ecommerce sales tax work, and when do I need to collect it?

Ecommerce sales tax is based on where your business has a “nexus” or significant connection—like an office, warehouse, or even just hitting a state’s sales threshold.

When you have a nexus in a state, you’re generally required to charge sales tax there. Thanks to recent laws, more states can require sales tax collection even without a physical presence, so it’s smart to stay updated!

What is sales tax nexus, and how do I know if I have it in a state?

Nexus is a fancy term for having enough presence in a state to owe sales tax there. You’ll have nexus if you’ve got a physical presence (like an office), employees, inventory, or if your sales exceed the state’s minimum threshold (aka economic nexus). Sales tax software can track nexus for you and let you know when you’ve reached it.

How do I manage sales tax for out-of-state and international orders?

For out-of-state orders, most states use the destination-based tax, so you charge tax based on the buyer’s location. For international sales, you may need to handle VAT or other taxes based on the country. Some sales tax software includes features for VAT compliance, so look for that if you’re selling internationally.

What happens if I miss collecting sales tax in a state where it’s required?

Missing sales tax collection can lead to some headaches—think penalties, interest, and even audits from state authorities. Using software helps you avoid this by automating the whole process, keeping you compliant and worry-free.

How does sales tax software integrate with my ecommerce platform, and is it easy to set up?

Most sales tax software integrates directly with platforms like Shopify, WooCommerce, or Amazon through APIs or plugins. Setup is usually straightforward: install the app, configure your settings, and the software starts handling tax calculations automatically.

What features should I prioritize in sales tax software for multi-state compliance?

For multi-state compliance, focus on automatic tax rate updates, nexus tracking, and multi-state filing support. These features keep you compliant as you expand and make sure you’re covered across different tax jurisdictions with minimal manual work.

How do I handle tax exemptions and certificates with ecommerce sales tax software?

Most sales tax tools support exemption management by letting you collect, store, and validate exemption certificates digitally. Some even flag expired or invalid certificates and help prepare documentation for audits. This ensures your B2B or nonprofit transactions stay compliant without manual tracking.

Other Types of Ecommerce Software

If you are looking for ecommerce sales tax software, I assume you are building out your online payment processing toolkit. Here are some additional resources you should check out:

- Payment Processing Software

- Buy-Now-Pay-Later (BNPL) Platforms

- Ecommerce Subscription Software

- Shopping Cart Solutions

What's Next?

If you're in the process of researching ecommerce sales tax software, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.