The Top Subscription Billing Software to Consider

Here are my top picks for subscription billing software:

The best subscription billing software automates recurring payments, simplifies subscription management, and gives you clear, real-time metrics to control your revenue streams.

If you’re wrestling with clunky billing systems, manual renewals, or unpredictable churn, this guide will show you tools that solve those headaches.

I’ve worked the trenches—from inventory to shipping to managing billing chaos—so I know what it takes to keep customers subscribed and cash flowing.

The right billing system not only handles flexible pricing models and billing cycles but also integrates with your CRM, payment gateways, and accounting software to streamline workflows and reduce failed payments.

For businesses looking to manage costs while implementing these systems, exploring free subscription management software can be a great starting point.

This post breaks down the top subscription billing platforms built to optimize your billing process, support growth, and improve customer retention.

Whether you’re scaling a startup or managing complex enterprise subscriptions, you’ll find software that fits your subscription business model and helps you take control of your billing lifecycle.

Why Trust Our Software Reviews

Comparing the Best Subscription Billing Software, Side-by-Side

This table compares use cases, pricing, and trial options to help you quickly find the right subscription billing software for your business.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for sales engagement | Free demo available | Pricing upon request | Website | |

| 2 | Best for flexible billing cycles | 14-day free trial | From $29/month | Website | |

| 3 | Best for open-source flexibility | Free trial + plan available | From $24/user/month | Website | |

| 4 | Best for SaaS businesses | Free demo available | From 5% + 50¢/checkout transaction | Website | |

| 5 | Best for managing subscriber lifecycles | Free trial available | From $7,188/year | Website | |

| 6 | Best for small businesses | Free demo available | Pricing upon request | Website | |

| 7 | Best for advanced subscription management | 14-day free trial + free demo available | From $25/month | Website | |

| 8 | Best for enterprise scalability | Free demo available | Pricing upon request | Website | |

| 9 | Best for global payment support | Free demo available | From 0.7% of billing volume | Website | |

| 10 | Best for global reach | Free demo available | Pricing upon request | Website | |

| 11 | Best for convertible subscriptions | 30-day free trial; free plan for 90 days | From $24.99/month + 2% on subscription orders | Website | |

| 12 | Best for customer self-management | 14-day free trial + free plan available | From $9/month + 2% transaction fee | Website | |

| 13 | Best for usage-based billing | Free demo available | Pricing upon request | Website | |

| 14 | Best for personalized subscriber experiences | Free demo | Pricing upon request | Website | |

| 15 | Best for no-code subscription management | Free demo available | From $499/month (billed annually) & 1% + 20¢ transaction fee | Website | |

| 16 | Best for Shopify brands | 14-day free trial | From $99/month + 1% subscriber GMV | Website | |

| 17 | Best for increasing average order value | Free plan available | From $99/month + 1% per transaction | Website | |

| 18 | Best for fast-growing startups | Free demo available | Pricing upon request | Website | |

| 19 | Best for financial reporting | Free demo available | Pricing upon request | Website | |

| 20 | Best for automated proration | Free demo available | From $499/month | Website |

The Best Subscription Billing Software, Reviewed

Here are detailed reviews highlighting features, pros, cons, and integrations to help you pick a platform that fits your billing needs and subscription model.

DealHub is built for revenue teams that need subscription billing tied directly to quotes, contracts, and renewals—not a separate system bolted on after the sale.

It’s a strong fit for B2B companies with complex pricing, multi-year deals, and sales-led motions that live inside Salesforce, Microsoft Dynamics, or HubSpot.

Why I Picked DealHub

I picked DealHub because it ties quoting, contracting, and subscription billing into one workflow, so your team creates billing schedules directly from approved quotes instead of re-entering data.

You get adaptive pricing tools for complex models—like usage-based or tiered plans—backed by guardrails and approval rules that keep margins intact.

I also like how renewals, upgrades, and co-terming automatically update the underlying subscription record, which removes the usual reconciliation headaches for RevOps.

DealHub Key Features

In addition to its CPQ roots, DealHub adds subscription-specific capabilities that matter when you’re managing recurring revenue at scale.

- Subscription Lifecycle Management: Manage new subscriptions, renewals, upgrades, and cancellations from one workflow that stays in sync with your CRM.

- Revenue Recognition Support: Generate clean, structured billing and subscription data your finance stack can use for revenue recognition and audit-ready reporting.

- Compliance Automation: Use tax, regulatory, and contract controls to reduce manual review for global customers and multi-entity setups.

- Billing Intelligence: Get insight into billing schedules, failed payments, and renewal exposure so you can proactively address churn and cash flow risk.

DealHub Integrations

Integrations include Salesforce, Microsoft Dynamics 365, HubSpot, NetSuite, QuickBooks, Xero, Sage Intacct, Stripe, Avalara, and Slack.

Pros and cons

Pros:

- Strong CRM and ERP integrations help RevOps and finance share a single view.

- Supports flat, tiered, and usage-based pricing for complex B2B subscriptions.

- Quote, contract, subscription, and billing data stay aligned in one platform.

Cons:

- Pricing is quote-based, so you’ll need a sales conversation to estimate costs.

- Best suited to sales-led teams already standardized on a major CRM.

New Product Updates from DealHub

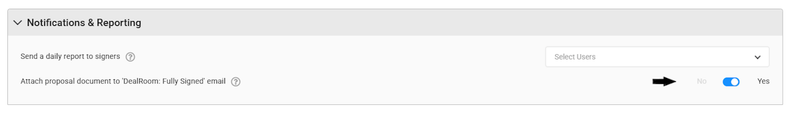

DealHub Automates Contract Attachments In Deal Won Emails

DealHub now automatically attaches fully signed contracts to Deal Won emails. This update streamlines post-signature communication and ensures stakeholders receive signed documents instantly. For more information, visit DealHub's official site.

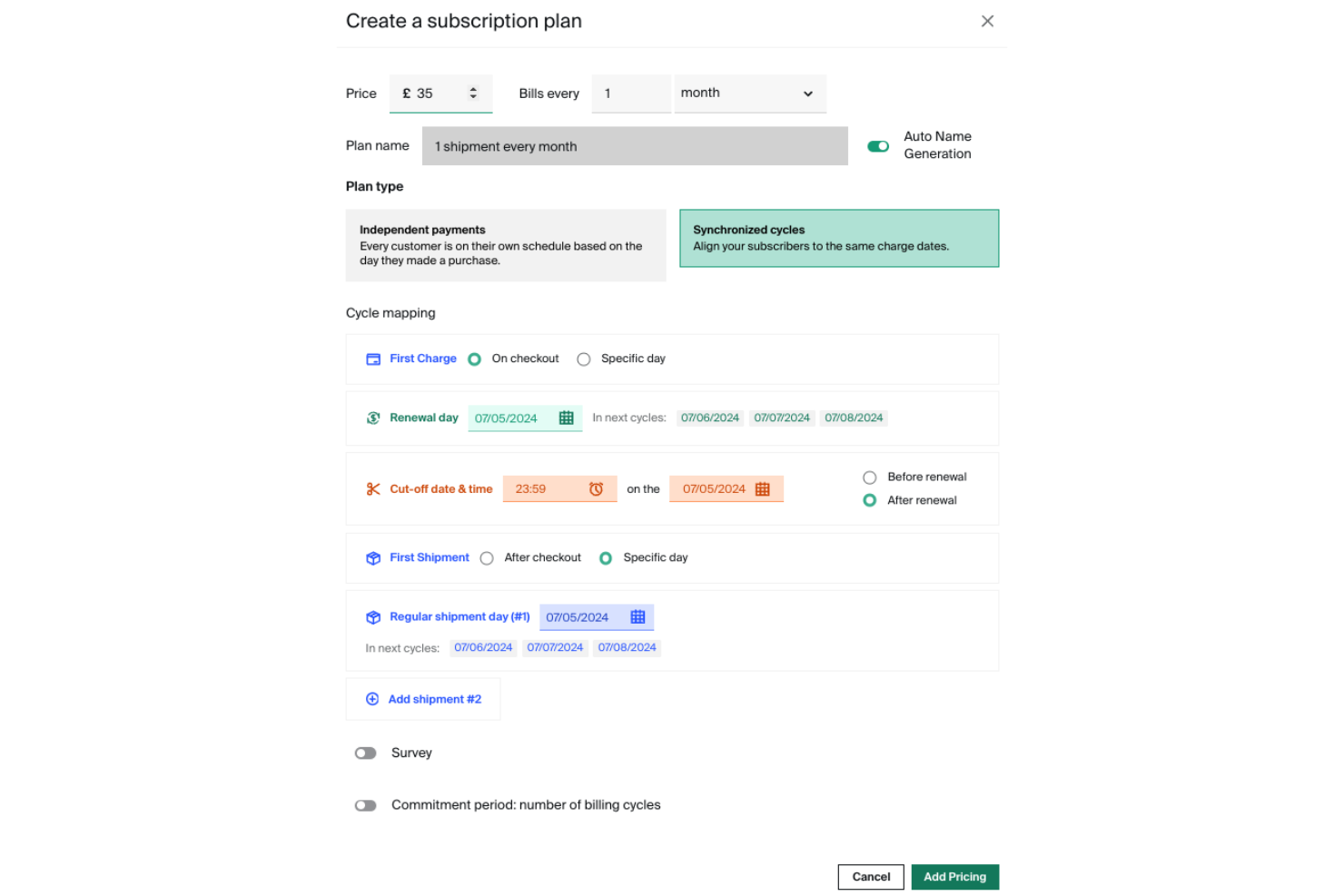

Subbly gives subscription-first brands a flexible way to run billing, customer choices, and recurring orders from one place.

It’s best for subscription box companies and membership-style businesses that need customizable billing cycles and reliable recurring payments.

Why I Picked Subbly

I picked Subbly because you can match your billing schedule to how customers actually buy—monthly, quarterly, or custom—through flexible cycle settings that keep invoices accurate.

That benefit is backed by helpful details like automatic prorations for mid-cycle plan changes, so your revenue stays consistent even when customers switch tiers.

I also like the “build-a-box” and survey tools, which let your team gather customer preferences and personalize shipments in a way that boosts retention.

Your customers get a self-service portal to pause, skip, or edit subscriptions, which cuts down support volume while keeping churn in check.

Subbly Key Features

Here are a few subscription-focused tools beyond billing flexibility.

- Checkout And Funnel Builder: Build optimized checkouts and upsell flows without separate landing-page software.

- Customer Profiles And Analytics: Track subscriber behavior and churn signals to target offers more intelligently.

- Shipping And Tax Management: Connect shipping rules and tax settings directly to recurring orders.

- Cancellation Management: Capture cancellation reasons and trigger win-back offers automatically.

Subbly Integrations

Integrations include Stripe, Google Pay, Apple Pay, Braintree, PayPal, and Authorize.net.

Pros and cons

Pros:

- Self-service portal lowers support tickets from plan edits and skips.

- Custom surveys and “build-a-box” flows personalize recurring shipments.

- Flexible billing cycles support subscription boxes, memberships, and hybrid models.

Cons:

- Smaller integration ecosystem for nonpayment tools.

- Website builder is more limited compared to full ecommerce platforms.

New Product Updates from Subbly

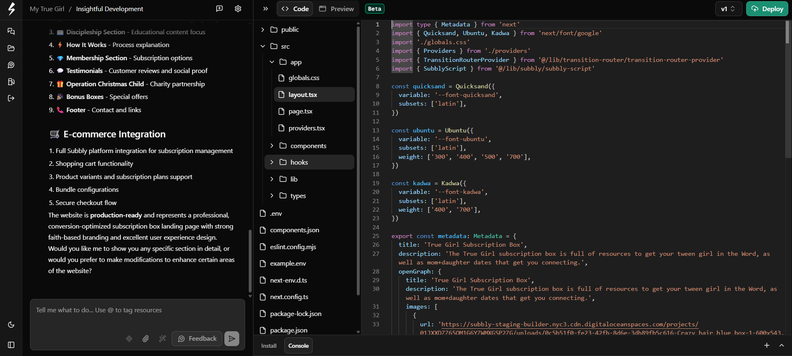

Subbly Launches AI Ecommerce Website Builder

Subbly launches a new AI Ecommerce Website Builder that automates website design and deployment, boosting efficiency and reducing costs. For more information, visit Subbly's official site.

Odoo Subscriptions helps you get out of spreadsheet chaos by centralizing recurring billing, renewals, and subscription changes in one place.

It’s a strong fit for service-based companies and SaaS teams that want open-source flexibility, tight links to accounting, and self-service tools for subscribers.

Why I Picked Odoo Subscriptions

I picked Odoo Subscriptions because it gives you serious control over recurring billing while keeping everything tied back to your sales and finance data.

You can define recurring plans, billing intervals, and pricing rules so invoices go out on time without your team chasing dates.

Your subscribers get a self-service portal where they can upgrade, downgrade, or cancel on their own, which reduces support tickets and makes your revenue changes easier to track.

Because the module is part of the wider Odoo ecosystem, your CRM, Sales, and Helpdesk teams see the same subscription records your finance team relies on. If you have edge-case billing scenarios or complex workflows, the open-source architecture means your developers or Odoo partner can tailor it to your exact model.

Odoo Subscriptions Key Features

Here are a few subscription billing features retailers and SaaS teams will actually lean on.

- Subscription Templates: Create reusable templates for plans, pricing, and billing frequency so new offerings are quick to launch.

- Consolidated Billing: Group multiple active subscriptions into a single invoice to cut down on fragmented customer billing.

- Revenue Metrics Dashboard: Track MRR, churn, and renewal performance from built-in reports instead of stitching data together.

- Multi-Currency Support: Bill customers in different currencies while keeping accounting and tax handling tied back to one system.

Odoo Subscriptions Integrations

Integrations include Odoo Invoicing, Odoo Accounting, Odoo CRM, Odoo Sales, Odoo Helpdesk, Odoo Website, Odoo eCommerce, and Odoo Marketing Automation.

Pros and cons

Pros:

- Customer portal lets subscribers self-manage upgrades, downgrades, and cancellations.

- Native link to CRM, Sales, and Helpdesk unifies subscriber lifecycle.

- Deep subscription billing automation across invoicing, renewals, and automatic payments.

Cons:

- Configuration and customizations often require technical admin or partner assistance.

- Full value usually depends on adopting the wider Odoo suite.

For SaaS teams tired of wiring together payment gateways, tax tools, and subscription logic, Paddle wraps everything into a single merchant-of-record platform that actually owns the messy billing work.

It’s best for software businesses selling globally that want flexible subscription models without building a compliance and finance team around their payments stack.

Why I Picked Paddle

I picked Paddle because its merchant-of-record model takes sales tax liability, chargebacks, and compliance off your plate through built-in tax/VAT handling, chargeback management, and customer billing support.

That lets your finance and ops teams focus on pricing, reporting, and forecasting instead of wrestling with filings and disputes.

For your product team, Paddle’s subscription engine supports bundles, seat-based plans, and add-ons so you can test real pricing strategies directly in your billing setup.

I also like that automatic proration and pausing/reactivating subscriptions are baked in, so you can offer mid-cycle upgrades and temporary pauses without manual adjustments or side spreadsheets.

Paddle Key Features

Beyond the merchant-of-record model, there are a few billing details your team will actually lean on day to day.

- Customer Portal: Provides a hosted portal where subscribers can update cards, adjust seats or products, and manage cancellations without your engineers building account management screens.

- Localized Checkout: Offers branded checkout flows with local currencies, languages, and payment methods so international buyers see pricing and options that match their market.

- Revenue Analytics: Uses ProfitWell Metrics data inside Paddle Billing to surface MRR, churn, and cohort trends from the same events driving your invoices and subscriptions.

- Dunning Automation: Runs card retries and recovery workflows via Retain so failed payments are chased automatically instead of by your support or finance teams.

Paddle Integrations

Integrations include HubSpot, Intercom, Databox, Braintree, Chargebee, Stripe, Recurly, Zuora, Uscreen, and Maxio.

Pros and cons

Pros:

- Built-in analytics and dunning tools help track growth and recover revenue.

- Flexible subscription engine supports bundles, add-ons, and seat-based pricing.

- Merchant-of-record model handles global tax, compliance, and chargebacks for you.

Cons:

- Focused on SaaS and apps; not ideal for physical retail.

- Pricing (5% + 50¢ per transaction) can exceed alternatives at scale.

For SaaS and subscription commerce teams juggling trials, renewals, and recurring invoices, Chargebee helps you untangle billing complexity, keep revenue compliant, and reduce failed payments.

It’s a better fit for fast-growing, multi-region subscription businesses with mixed pricing models than for tiny catalogs with very simple billing needs.

Why I Picked Chargebee

I picked Chargebee because it handles complex subscription lifecycles—trials, upgrades, pauses, renewals—through one system instead of scattered scripts.

Your team can test flat, tiered, and usage-based pricing in the same catalog, so you can match plans to real customer behavior without rebuilding billing logic.

Its dunning and smart retry engine gives you a tangible lift on failed payments by pairing custom schedules with targeted messaging.

Finance teams also get compliant revenue recognition with proper schedules and auditability, which keeps monthly closes from turning into spreadsheet surgery.

Chargebee Key Features

Beyond billing basics, Chargebee adds a few capabilities that matter once your subscription revenue starts to scale.

- Trials And Freemium Controls: Configure trial periods, freemium tiers, and conversion rules so marketing can test offers without engineering rebuilding billing logic each time.

- Self-Service Portal: Give customers a branded portal to update cards, change plans, and download invoices themselves, cutting down on support tickets for simple account changes.

- Tax And Compliance Tools: Manage multi-country tax rules, localized invoice formats, and compliance settings from a central hub rather than bolting on separate tax tools for each region.

- Reporting And Dashboards: Track MRR, churn, cohort performance, and subscription health across products and geographies from a single reporting layer that matches what’s in your ledger.

Chargebee Integrations

Integrations include Salesforce, HubSpot, NetSuite, Sage Intacct, Xero, QuickBooks, Stripe, PayPal, GoCardless, and Zendesk.

Pros and cons

Pros:

- Revenue recognition and audit trails support ASC 606 and IFRS 15.

- Flexible pricing engine supports flat, tiered, volume, and hybrid models.

- Smart dunning flows recover failed payments and cut involuntary churn.

Cons:

- Add-ons for RevRec, taxes, and advanced integrations increase total cost.

- Configuration depth creates a learning curve for non-technical operators.

Recurly gives small subscription businesses the billing muscle they need to handle recurring payments, reduce failed charges, and stay on top of revenue without hiring a full finance team.

It’s especially useful if you manage multiple plans, add-ons, or upgrades and want fewer billing headaches as you grow.

Why I Picked Recurly

I picked Recurly because it helps you keep more of your recurring revenue through customizable dunning campaigns that retry failed payments and send targeted follow-ups.

Your team also gets flexible plan controls—trials, coupons, add-ons, and usage or quantity-based pricing—so you can experiment with offers without rebuilding billing logic.

Finance teams benefit from automated revenue recognition and smooth syncing to accounting tools, which makes close processes much easier.

I also like that Recurly supports 140+ currencies and a wide range of payment gateways, giving you room to expand internationally without rebuilding your billing stack.

Recurly Key Features

In addition to its dunning and billing tools, Recurly gives you practical controls that make daily subscription operations easier.

- Revenue Recognition Automation: Converts subscription events into compliant revenue schedules and exports them to accounting tools.

- Global Payments And Currencies: Supports 140+ currencies and multiple gateways for local payment acceptance.

- Plan And Promotion Controls: Lets you configure plans, coupons, trials, and add-ons directly in the dashboard.

- Reporting And Subscriber Analytics: Tracks churn, MRR, cohorts, and plan performance from a central dashboard.

Recurly Integrations

Integrations include Salesforce, QuickBooks Online, Xero, NetSuite, HubSpot, Mailchimp, Zendesk, and Shopify.

Pros and cons

Pros:

- Native accounting integrations keep subscription and revenue data aligned.

- Flexible plan tools support trials, add-ons, and usage-based pricing.

- Smart dunning features help recover failed payments and reduce churn.

Cons:

- Some advanced features, like multiple dunning setups, require higher-tier plans.

- Native ecommerce integrations outside Shopify are limited or require extra setup.

Zoho Billing helps subscription businesses handle recurring invoicing, payments, and revenue events without drowning in manual tasks.

It’s best for SMB and mid-market teams juggling trials, tiers, and usage-based plans that need accuracy, automation, and strong financial controls.

Why I Picked Zoho Billing

I picked Zoho Billing because it gives your team precise control over subscription lifecycles—every upgrade, downgrade, and add-on is handled through automated billing logic.

You reduce errors thanks to usage tracking, itemized proration, and automated revenue events that otherwise require spreadsheet gymnastics.

I also like how customer portals cut support tickets by letting buyers update payment details, view invoices, and manage subscriptions on their own.

The real advantage is how well it fits into the broader Zoho ecosystem, giving you CRM-to-cash visibility without bolting together five different tools.

Zoho Billing Key Features

Alongside its subscription management tools, Zoho Billing adds operational features your finance team will use every day.

- Project Billing & Time Tracking: Bill based on hours, tasks, or staff to accurately charge for service work.

- Advanced Tax Management: Apply multi-region tax rules automatically to stay compliant across markets.

- Revenue & Churn Analytics: Track MRR, churn, retention, and aging reports to identify trends before they become problems.

- Mobile Access: Review invoices, payments, and customer details from iOS, Android, or desktop apps.

Zoho Billing Integrations

Integrations include Zoho CRM, Zoho Books, Zoho Analytics, Zoho Desk, Stripe, PayPal, GoCardless, Shopify, WordPress, and Slack.

Pros and cons

Pros:

- Automated dunning helps recover failed payments and boost retention.

- Tight integration with Zoho CRM and Books improves quote-to-cash accuracy.

- Strong billing logic handles trials, tiers, add-ons, and usage.

Cons:

- Some users report slower response times from customer support.

- Setup can be time-consuming for teams unfamiliar with subscription operations.

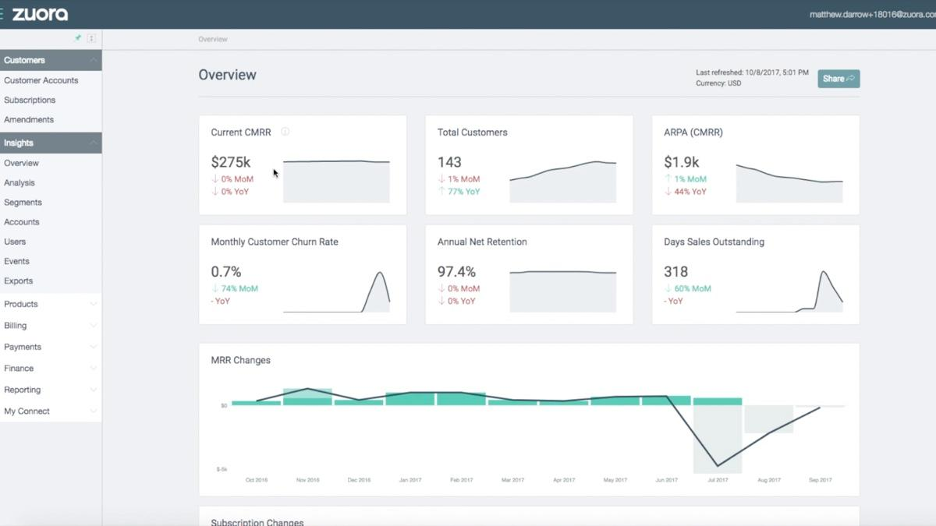

Zuora is built for enterprises that live in subscription chaos—complex pricing, global entities, and finance teams who actually care about ASC 606.

It’s a fit for large SaaS and B2B companies that need billing, usage, and revenue recognition to play nicely with ERPs instead of living in spreadsheets.

Why I Picked Zuora

I picked Zuora because it handles messy, real-world monetization—usage-based, hybrid, and multi-tier pricing—while still giving your finance team clean, auditable data.

You can roll out new plans, add-ons, and contract changes without rewriting billing logic every quarter, which matters when product is constantly tweaking packaging.

For your finance team, Zuora Revenue ties billing schedules to ASC 606-compliant recognition rules, so you get accurate revenue timing instead of guesswork in Excel. I also like that dunning, collections, and payment retries sit inside the same platform, so your team can reduce involuntary churn using actual customer behavior and payment history.

If you’re already running an ERP like NetSuite, SAP, or Workday, Zuora’s prebuilt connectors give you item-level or GL-summary sync, which means order-to-cash doesn’t become a brittle one-off integration project every time your business model evolves.

Zuora Key Features

In addition to its core billing engine, Zuora offers several enterprise-grade tools that matter when you’re running complex, high-volume subscriptions.

- Usage Metering And Billing: Capture granular consumption data, rate it against complex plans, and convert it into accurate invoices each cycle.

- Multi-Entity And Multi-Currency: Support multiple business units and currencies in one tenant while keeping financials clean for consolidation.

- Advanced Dunning And Collections: Configure targeted retry logic, notifications, and workflows to recover failed payments and reduce involuntary churn.

- Subscription Analytics And Dashboards: Monitor MRR, churn, and cohort behavior from billing-native data, giving RevOps and finance a shared view of performance.

Zuora Integrations

Integrations include Salesforce, NetSuite, Workday, SAP, Microsoft Dynamics 365, QuickBooks, Xero, Stripe, Adyen, and GoCardless.

Pros and cons

Pros:

- Prebuilt ERP connectors reduce manual reconciliation between billing and finance.

- Native revenue recognition helps teams meet ASC 606 requirements reliably.

- Handles complex usage, hybrid, and multi-tier billing at enterprise scale.

Cons:

- Pricing and complexity may be excessive for simple, single-entity subscription models.

- Enterprise deployments can be lengthy and need experienced implementation partners.

Stripe Billing gives you one place to manage recurring revenue, from subscription boxes and memberships to usage-based add-ons, across cards, wallets, and bank payments.

It’s a strong fit for retail and DTC teams that sell into multiple regions, need flexible pricing models, and care about clean, audit-ready revenue data.

Why I Picked Stripe Billing

I picked Stripe Billing because it lets you mix flat-rate, tiered, per-seat, and usage-based pricing in one catalog, so you can support everything from simple subscriptions to complex bundles without bolting on extra tools.

That flexibility is backed by real features like meters for tracking consumption and rate cards for packaging different recurring charges.

You also get predictable subscription changes thanks to built-in proration, so when customers upgrade mid-cycle or add products, your team doesn’t have to manually fix invoices or credits.

Smart retries and configurable dunning flows translate missed payments into recovered revenue, instead of churn you only spot in the quarterly numbers.

For your finance and ops teams, the link between Billing, invoicing, tax, and revenue recognition means subscription data flows into the same place you reconcile payouts and close the books. That helps you scale recurring revenue without turning every new pricing experiment into a spreadsheet war.

Stripe Billing Key Features

In addition to pricing flexibility, Stripe Billing includes tools your retail and DTC teams will actually use day to day.

- Usage-Based Billing Tools: Track metered events, apply rate cards, and bill customers in arrears based on real consumption, which works well for usage-based add-ons or premium service tiers.

- Smart Retries And Dunning: Configure retry schedules, email reminders, and card updater services to recover failed payments automatically and protect subscription revenue.

- Customer Billing Portal: Give shoppers a secure portal to update cards, change plans, pause or cancel subscriptions, and download invoices without involving your support team.

- Revenue And Tax Automation: Use Stripe’s revenue recognition and tax tooling to defer, recognize, and report recurring revenue correctly, while handling multi-country tax rules in the background.

Stripe Billing Integrations

Integrations include WooCommerce, Adobe Commerce (Magento 2), PrestaShop, Shopware, WHMCS, Salesforce, QuickBooks, Xero, NetSuite, and FreshBooks.

Pros and cons

Pros:

- Customer portal reduces support tickets by letting subscribers manage plans themselves.

- Smart retries and dunning workflows help you recover failed subscription payments.

- Flexible pricing models support boxes, memberships, and usage-based add-ons.

Cons:

- Overall Stripe fees can exceed lighter billing tools for very high volume.

- Advanced metering and pricing setups usually require developer involvement to implement.

BillingPlatform is built for companies dealing with complex billing—multi-currency, usage-based, and multi-entity setups that simpler tools can’t handle.

It’s ideal for finance teams that need precision, compliance confidence, and flexible pricing without engineering overhead.

Why I Picked BillingPlatform

I picked BillingPlatform for global operators because it supports advanced pricing models—flat, tiered, volume, and usage-based—so your billing engine can adapt as fast as your product does.

You can bill in dozens of currencies and localize invoices, and those benefits exist because BillingPlatform plugs into tax tools like Avalara to calculate VAT, GST, and sales tax automatically.

Your finance team also gets native revenue recognition tied directly to billing data, which helps you stay aligned with ASC 606 and IFRS 15 without juggling extra tools.

Its native integrations with Salesforce and NetSuite keep customer, order, and financial data in sync, giving sales and finance the same view of recurring revenue.

BillingPlatform Key Features

Here are a few practical tools that support subscription and usage billing at scale.

- Product Catalog And Pricing Engine: Configure complex bundles, discounts, and rating plans to launch new offers quickly.

- Customer Portal And Self-Service: Let customers update payment methods, download invoices, and manage subscriptions.

- Collections And Dunning Automation: Set rules for retries, reminders, and collections based on invoice status.

- AI Reporting And Forecasting: Analyze revenue trends and identify churn or payment risk from within the platform.

BillingPlatform Integrations

Integrations include Salesforce, NetSuite, Avalara, Stripe, Adyen, PayPal, Authorize.Net, and J.P. Morgan Payments.

Pros and cons

Pros:

- Built-in revenue recognition aligns billing and accounting rules.

- Native CRM and ERP integrations reduce reconciliation headaches.

- Broad pricing model support fits global subscription and usage billing.

Cons:

- Enterprise-level setup may exceed needs of smaller organizations.

- Implementation workload may be heavy for small teams.

Bold Subscriptions helps Shopify brands turn repeat purchases into predictable revenue with prepaid, convertible, and “subscribe and save” plans that fit how customers actually buy.

It’s best for DTC teams that want flexible subscription flows and a customer portal that gives subscribers real control, without rebuilding their entire tech stack.

Why I Picked Bold Subscriptions

I picked Bold Subscriptions because it gives you flexible ways to sell subscriptions—prepaid cycles, pay-as-you-go, and convertible kit-to-refill plans—so you can match your billing model to how customers naturally reorder.

Your team also gets a customer-facing portal where subscribers can skip, swap, or add products on their own, which increases retention because changes don’t depend on your support queue.

For migrations, Bold’s specialists and tooling help you bring subscribers over from other apps with mapped billing details and schedules, so you keep revenue continuity instead of forcing everyone to re-subscribe.

On top of that, integrations with tools like Klaviyo and Gorgias let you plug subscription events into your lifecycle messaging and support workflows, so renewals, failed payments, and cancellations trigger concrete actions—not manual spreadsheet checks.

Bold Subscriptions Key Features

Here are a few features that matter most if you’re choosing subscription billing software for Shopify.

- Revenue Maximizers™ Tools: Present upsells, add-ons, and upgrades at key subscriber touchpoints to increase average order value over time.

- Cancellation And Dunning Flows: Use reason-based cancellation flows and automated payment retries to save at-risk subscriptions before they churn out.

- Bulk Edit And Management: Adjust prices, products, and terms in bulk so you can roll out pricing changes or product swaps across large subscriber bases quickly.

- Shopify Checkout Compatibility: Run subscriptions through Shopify Checkout, including Shopify Payments and Shop Pay, so subscribers don’t have to re-enter payment details.

Bold Subscriptions Integrations

Integrations include Bold Upsell, Easy Bundles, Gorgias, Govalo, Klaviyo, Littledata, PageFly, Peel Insights, ReferralCandy, and Zapier.

Pros and cons

Pros:

- Migration services and tooling reduce churn when moving from another subscription app.

- Customer portal gives subscribers self-service control over edits, skips, and swaps.

- Flexible subscription types support prepaid, replenishment, and kit-to-refill flows.

Cons:

- Best suited to Shopify stores; not an option for non-Shopify tech stacks.

- Occasional app or theme conflicts may require developer help to troubleshoot.

PayWhirl helps Shopify merchants turn one-time buyers into subscribers by embedding subscription options directly into product pages, carts, and checkout.

It’s especially useful if you want customers to manage their own plans and payment details without sending your support queue into meltdown.

Why I Picked PayWhirl

I picked PayWhirl because it lives where your customers already are—inside Shopify product pages, carts, checkout, and customer accounts—so subscribing feels like a natural part of the buying flow.

You can give shoppers a self-service portal in their Shopify account where they can skip, pause, cancel, swap products, and update payment methods, which cuts down on “change my subscription” tickets while keeping renewal risk visible.

I also like that PayWhirl supports flexible selling plans, from “subscribe and save” discounts to different delivery cadences and prepaid options, so you can match billing rules to your actual inventory and merchandising strategy.

If you’re replatforming, PayWhirl’s import tools for existing subscriptions and payment methods help you bring recurring revenue over to Shopify instead of juggling multiple billing systems forever.

PayWhirl Key Features

Beyond the embedded widgets and customer portal, there are a few features that make PayWhirl practical for subscription-heavy retailers.

- Automated Dunning And Retries: Handles failed renewals with automatic retries and notifications so you recover more recurring revenue before a subscription actually lapses.

- Milestone Discounts And Loyalty: Lets you set automatic discounts after a certain number of renewals, rewarding long-term subscribers without manually issuing promo codes.

- Prepaid And Installment Plans: Supports prepaid subscriptions and installment payment plans, which helps you sell higher-ticket or seasonal products without wrecking cash flow.

- Subscription Analytics And Churn Tracking: Surfaces metrics like recurring revenue and churn so you can see which plans, products, and customer segments are worth doubling down on.

PayWhirl Integrations

Integrations include Shopify, BigCommerce, Stripe, Braintree, Authorize.net, PayPal, ShipStation, Klaviyo, Google Analytics, and Mailchimp.

Pros and cons

Pros:

- Bulk import workflows move existing subscriptions and payment methods into PayWhirl.

- Flexible selling plans support mixed frequencies, discounts, and prepaid subscription offers.

- Customer self-service portal inside Shopify accounts reduces subscription support tickets.

Cons:

- Some users report glitches when themes or other installed apps conflict.

- Primarily focused on Shopify; other platforms rely on older widgets.

Certinia is built for services businesses that live and breathe usage-based and recurring revenue, especially if you’re already committed to Salesforce.

It’s best for teams juggling complex contracts—mixes of subscriptions, consumption-based charges, and services—that need precise billing and clean handoffs into finance.

Why I Picked Certinia

I picked Certinia because it gives you granular control over usage events, so you can bill exactly on what customers consume instead of rough estimates.

Your team can capture metered usage, apply tiered or volume pricing, and push accurate charges straight into invoices.

You also get usage, subscription, and one-off charges in the same billing engine, which is a big deal if you sell hybrid bundles. That’s supported by configurable billing schedules and billing frequencies, so finance isn’t stuck stitching together multiple tools.

I like that it’s Salesforce-native, which means sales, services, and finance all see the same customer record and contract terms. That shared data model leads to fewer disputes, because what’s sold, what’s delivered, and what’s billed all line up in one system.

Certinia Key Features

In addition to usage-focused billing, Certinia includes several tools that help teams running complex recurring revenue models stay sane.

- Mixed-Model Billing: Bill subscriptions, usage, and project work in a single process.

- Contract And Amendment Management: Handle renewals, upgrades, and mid-term changes without rebuilding deals from scratch.

- Rating And Pricing Engine: Configure tiered, volume, or flat-rate pricing rules for different usage metrics.

- Billing Analytics Dashboards: Monitor billed vs. unbilled usage, aging, and trends from prebuilt Salesforce reports.

Certinia Integrations

Integrations include Salesforce Sales Cloud, Salesforce Service Cloud, Certinia Financial Management Cloud, Certinia Professional Services Cloud, and Certinia Customer Success Cloud.

Pros and cons

Pros:

- Flexible pricing and rating handle tiered and volume usage scenarios reliably.

- Salesforce-native architecture keeps CRM, contracts, and billing on one record.

- Strong fit for usage-heavy, services-led businesses with complex billing mixes.

Cons:

- Implementation and configuration effort can be significant for smaller teams.

- Best suited to Salesforce-centric orgs, less attractive if you’re off-platform.

Ordergroove is built for brands that care about how subscriptions actually feel, not just how they bill.

It’s best for midsize and enterprise retailers that want personalized, flexible programs across multiple ecommerce platforms without duct-taping three other tools together.

Why I Picked Ordergroove

I picked Ordergroove because it lets you design subscriber experiences that feel native to your store—right down to how offers appear on product pages, in the cart, and in account dashboards.

You can tailor promotions like “subscribe more, save more” or gifts-with-subscription based on what actually drives repeat orders for your customers.

You can spin up experiments on offers, cadences, and messaging, then see which combinations move enrollment and retention instead of guessing. That testing ability lives on top of subscription-first APIs, so product, growth, and engineering can collaborate without fighting the platform.

For brands worried about churn, the dedicated suite for involuntary churn gives you granular insight into payment failures and recovery paths, helping you capture more of the recurring revenue you’ve already earned.

I also like that the newer AI-driven capabilities sit inside this same environment, giving you suggestions and automation rooted in your actual subscriber data rather than generic best practices.

Ordergroove Key Features

Beyond the experience and churn tooling, there are a few practical features that matter for subscription billing teams.

- Subscription Experience Types: Support subscribe-and-save, memberships, bundles, discovery boxes, and prepaid plans from one platform.

- Subscriber Self-Service Portal: Let customers skip, swap, delay, or edit orders themselves to cut support tickets and improve retention.

- Integrated Checkout Experiences: Keep one checkout flow for one-time and recurring orders, avoiding duplicate catalogs or hacked-together carts.

- Migration And Launch Support: Use proven playbooks and tooling to migrate existing subscribers and go live without blowing up your recurring revenue.

Ordergroove Integrations

Integrations include Shopify, Shopify Plus, Magento/Adobe Commerce, BigCommerce, Salesforce Commerce Cloud, and commercetools.

Pros and cons

Pros:

- Enterprise-grade integrations keep subscription checkout aligned with core ecommerce platforms.

- Involuntary churn tools diagnose failed payments and improve recovery rates.

- Flexible subscription models across bundles, memberships, discovery boxes, and prepaid orders.

Cons:

- Feature depth can be overkill for very small catalogs or low-volume stores.

- Custom pricing and implementation are oriented toward midsize and enterprise brands.

Skio is built for Shopify brands that rely on recurring revenue and are tired of duct-taped subscription setups that break every time you grow.

It’s best for teams that care about retention, want tight control over subscription logic, and don’t have engineering capacity to babysit their billing stack.

Why I Picked Skio

I picked Skio because you get real control over subscription retention without needing developers on call—its visual flow builder lets your team launch cancellation saves, win-back offers, and upsell paths on your own.

Your subscribers get a modern experience too: passwordless login and quick-action links in emails or SMS let them skip, swap, or edit orders from their phone in a couple of taps.

I also like that Skio sits natively on Shopify checkout, so your subscription and one-time orders run through the same flow, which keeps tracking, taxes, and discount logic consistent.

For teams migrating off Recharge or Bold, Skio offers guided migrations, inventory checks, and subscriber validation so you’re not guessing whether renewals will fire correctly after the switch.

Skio Key Features

Beyond the retention flows, here are a few practical tools subscription teams will regularly lean on.

- Build-A-Box Subscriptions: Let customers assemble subscription bundles, which supports higher average order values and more tailored replenishment plans.

- Volume Discounts: Reward larger recurring orders with automatic tiered pricing, so you can nudge subscribers toward bigger baskets without custom coding.

- Bulk Subscription Editing: Update products, frequencies, or pricing across segments of subscribers in a few clicks instead of manual one-by-one changes.

- Dunning And Payment Recovery: Configure card expiry and failed-payment retries so you can rescue at-risk renewals instead of silently losing subscribers.

Skio Integrations

Integrations include Klaviyo, Attentive, Postscript, Rebuy, Yotpo Loyalty, Rivo, Gorgias, Zendesk, Triple Whale, and Daasity.

Pros and cons

Pros:

- Guided migrations help brands move from Recharge or Bold with reduced risk.

- No-code retention flows let you launch cancellation saves and win-backs quickly.

- Native Shopify checkout keeps subscription purchases aligned with existing store logic.

Cons:

- Pricing starts higher than some Shopify subscription apps, especially for startups.

- Analytics are improving but still lack very deep custom reporting options.

For Shopify brands that care about retention and higher subscription AOV, Smartrr gives you a subscriber portal, build-a-box flows, and native loyalty in one app—without needing in-house developers.

It’s best for DTC teams running on Shopify who want subscription billing, rewards, and analytics tightly tied into the storefront experience.

Why I Picked Smartrr

I picked Smartrr because it turns the customer portal into a revenue driver by giving subscribers tools to swap products, add one-time items, and adjust frequency from a fully branded interface.

That benefit is backed by its Shopify-native portal, which you can theme to your brand and enhance with upsell modules that encourage higher AOV.

You also get subscription journeys that fit real buying behavior, using sequential flows and build-a-box bundles to control product order, minimum cycles, and box composition.

Loyalty is built in, so you can reward subscribers with points, tiers, and perks inside the same portal they use for billing—making the experience stickier without adding extra apps.

Smartrr Key Features

Here are a few subscription-focused capabilities your team will actually use day to day.

- Flexible Billing Models: Support prepaid, sequential, and tiered pricing so you can align billing cadence and pricing with your products instead of forcing every subscription into the same schedule.

- Subscription Types Library: Offer replenishment plans, curated boxes, memberships, and digital subscriptions from a single app, giving you room to test new programs without adding more tools.

- Dedicated Subscription Shipping Profiles: Set shipping rules and rates specifically for recurring orders, so you can protect margins on heavy or low-priced items while still offering attractive delivery options.

- Advanced Analytics Dashboard: Monitor churn, LTV, and subscription cohorts in one place, then use those insights to adjust discounts, bundles, or loyalty incentives instead of guessing what’s driving retention.

Smartrr Integrations

Integrations include Attentive, Blueprint, Gorgias, Klaviyo, LoyaltyLion, Postscript, Recharge, and Shopify Flow.

Pros and cons

Pros:

- Subscriber portal encourages higher AOV through swaps and add-ons.

- Built-in loyalty rewards strengthen retention and reduce cancellations.

- Supports multiple subscription types for different product strategies.

Cons:

- Migration may require a waitlist and several weeks to complete.

- Pricing plus GMV fee can limit suitability for very small brands.

Loop Subscriptions helps Shopify brands turn one-time buyers into high-LTV subscribers by pairing flexible subscription plans with smart billing, retry logic, and retention tooling.

It’s a fit if you’re running a DTC storefront on Shopify and want higher AOV from bundles and prepaid plans without babysitting failed payments and cancel requests all day.

Why I Picked Loop Subscriptions

I picked Loop Subscriptions for Shopify teams that care about billing reliability and retention as much as they care about net-new signups. You get revenue protection through smart dunning and multiple payment retries, so churn from expired cards doesn’t quietly eat into your subscription P&L.

Your team can also design cancellation flows that capture reasons, surface tailored offers, or route subscribers into swaps and skips instead of hard cancels, which directly protects MRR.

For higher AOV, you can build fixed or “build-a-box” bundles and prepaid plans that encourage larger, longer-term commitments while still keeping billing logic connected to Shopify.

Loop also includes a branded, mobile-friendly portal where subscribers can update details themselves—reducing support tickets while keeping billing changes accurate and in sync with your store.

Loop Subscriptions Key Features

Beyond the portal and cancel flows, a few billing-focused features stand out for finance and ops teams.

- Smart Inventory Rules: Link subscription orders to Shopify inventory logic so recurring shipments don’t oversell or break your stock plans.

- Subscriber Rewards System: Layer loyalty-style rewards on top of subscriptions so long-term customers see tangible benefits tied to recurring billing.

- Workflow Automations & Bulk Actions: Use rules and bulk updates to adjust pricing, terms, or product mappings across large subscriber cohorts without manual order edits.

- Cohort Analytics & Revenue Reporting: Track churn, renewal, and LTV by cohort so you can validate pricing experiments, discount strategies, and new subscription offers.

Loop Subscriptions Integrations

Integrations include Klaviyo, Attentive, Omnisend, Postscript, Sendlane, Okendo, Yotpo Loyalty, Gorgias, Zendesk, and Google Analytics 4.

Pros and cons

Pros:

- Flexible subscription bundles and prepaid plans help lift average order value.

- Smart dunning and multiple retries reduce churn from failed recurring payments.

- Branded subscriber portal lets customers manage skips, swaps, and renewals.

Cons:

- Higher starting price than basic subscription apps once you outgrow free.

- Shopify-only platform, so not suitable for truly multichannel billing.

Subskribe is built for SaaS teams that need cleaner subscription operations as pricing complexity grows.

It solves the classic startup problem of scattered quoting, billing, and revenue data by keeping everything in one workflow.

Why I Picked Subskribe

I picked Subskribe because it unifies quoting, subscriptions, invoicing, and revenue schedules so your team isn’t stitching together data from multiple tools.

Its pricing engine supports usage-based models, ramps, and hybrid plans, giving you more flexibility when sales needs custom terms.

I also like how the revenue recognition module links directly to contracts and invoices, helping you maintain ASC 606 compliance without manual schedules.

And with built-in approval flows and Slack notifications, RevOps gets visibility into discounts, renewals, and plan changes without slowing deals down.

Subskribe Key Features

Here are a few capabilities that matter when you're managing subscription billing at scale.

- Advanced Analytics: Tracks ARR, churn, renewals, and expansion to show how subscription activity affects revenue.

- Zeppa Business Rules Engine: Lets you enforce pricing rules, approvals, and product logic without engineering work.

- Subscription Management: Supports upgrades, downgrades, co-terms, and proration for clean, accurate contracts.

- Invoicing And Tax Automation: Generates correct invoices for flat-rate and usage-based plans while applying relevant taxes.

Subskribe Integrations

Integrations include Salesforce, QuickBooks, Xero, Stripe, PayPal, HubSpot, Marketo, Slack, Google Analytics, and Zendesk.

Pros and cons

Pros:

- CRM and finance integrations reduce double-entry across teams.

- Revenue recognition ties directly to contracts and invoices for accuracy.

- Handles usage-based, ramped, and hybrid SaaS pricing models well.

Cons:

- Setup can be heavier than lightweight SMB billing tools.

- Designed for B2B SaaS, not subscription ecommerce use cases.

Sage Intacct is built for finance teams at subscription and SaaS businesses that live in spreadsheets today and are tired of wrestling with complex billing rules every month-end.

You get subscription billing tied directly to revenue recognition and reporting, so your team can handle tiered, usage-based, and contract billing without losing visibility into the numbers executives actually care about.

Why I Picked Sage Intacct

I picked Sage Intacct because it manages complex subscription models—like tiered, usage-based, and ramped contracts—through configurable billing rules instead of manual spreadsheets.

That makes upgrades, renewals, and proration more predictable for your finance team.

You also get automated revenue recognition tied directly to contracts, which helps your team stay compliant with ASC 606 and IFRS 15 without juggling side schedules.

I like that its financial dashboards connect billing activity to MRR, churn, and forecasted revenue, giving leadership a clearer read on performance.

Sage Intacct Key Features

Here are a few subscription-specific tools your finance team will actually use day-to-day.

- Multi-Entity Management: Support multiple entities, currencies, and charts of accounts while consolidating subscription revenue and billing at the push of a button.

- Dimensions-Based Reporting: Tag transactions with dimensions like customer, product, region, or subscription type to slice recurring revenue and churn however your leadership team wants to see it.

- Contract Templates: Use reusable templates for common contract and billing patterns so your team can launch new subscription offers without rebuilding schedules each time.

- SaaS Metrics Dashboards: Monitor key SaaS KPIs—such as MRR, CMRR, and churn—inside finance dashboards connected directly to your contract and billing data.

Sage Intacct Integrations

Integrations include Salesforce, ADP Workforce Now, Expensify, BILL (Bill.com), Avalara, Workday Adaptive Planning, MineralTree, and FloQast.

Pros and cons

Pros:

- Dimensions-based reporting gives leadership granular visibility into subscription performance.

- Built-in revenue recognition keeps finance teams aligned with ASC 606 and IFRS 15.

- Handles advanced subscription models, including tiered and usage-based billing.

Cons:

- Initial configuration for complex contracts and entities can be time-consuming.

- Best suited to midsize and larger subscription businesses with dedicated finance teams.

For finance and RevOps teams wrestling with mid-cycle changes and usage-heavy plans, Stax Bill takes the pain out of proration, renewals, and collections.

It’s best for SaaS and subscription businesses that need audit-ready revenue data, reliable automation, and support for more complex catalogs than “simple monthly plan” territory.

Why I Picked Stax Bill

I picked Stax Bill because it handles proration cleanly, so your mid-cycle upgrades and downgrades don’t turn into manual credit-note math.

That accuracy comes from configurable billing rules that calculate partial periods, add-ons, and plan changes without extra spreadsheet work.

Your finance team also gets reliable revenue recognition with earned-revenue views, which means audits lean on system data instead of manual schedules.

If you sell into multi-department or parent–child accounts, the hierarchy tools and consolidated invoicing reduce the back-and-forth needed to bill larger customers.

Stax Bill Key Features

Beyond the core subscription and invoicing workflows, Stax Bill layers on tools that make recurring billing less manual for both you and your customers.

- Hosted Registration Pages: Launch branded signup and checkout flows without rebuilding forms for every new plan.

- Self-Service Account Portal: Let customers update payment methods, view invoices, and adjust subscriptions without submitting tickets to your team.

- Advanced Reporting Library: Pull prebuilt cash, churn, and MRR reports so finance reviews and board decks start from live billing data.

- Surcharging Tools: Pass eligible card fees to customers while still giving them a no-fee debit option.

Stax Bill Integrations

Integrations include Salesforce, HubSpot, NetSuite, QuickBooks Online, Stripe, PayPal, Authorize.net, Avalara, and Zapier.

Pros and cons

Pros:

- Supports complex hybrid, usage-based, and tiered plans for growing SaaS catalogs.

- Includes ASC 606-ready revenue recognition so finance teams stay audit-ready.

- Account hierarchy and consolidated invoicing fit multi-entity or franchise customers.

Cons:

- Entry pricing is higher than many SMB-focused subscription billing tools.

- API and rate limits need planning for very high-velocity traffic.

Other Subscription Billing Software

Here are some additional subscription billing software options that didn’t make it onto my shortlist, but are still worth checking out:

- Maxio

For startup scalability

- PayPal Subscriptions

For fast, trusted checkout subscriptions

Our Selection Criteria for Subscription Billing Software

I based my evaluation on key areas that matter when picking subscription billing software. Here’s what I looked for and why it’s important:

Core functionality (25% of total score)

Core features are the backbone of any subscription billing platform. It has to handle the basics without fail:

- Manage recurring billing with accuracy and automation

- Automate invoicing to reduce manual work and errors

- Support multiple pricing models, including tiered and usage-based billing

- Ensure revenue recognition complies with accounting standards

- Provide subscription analytics that offer actionable insights

Additional standout features (25% of total score)

This is where platforms separate the contenders from the pretenders. Bonus points for features that handle real-world complexities:

- Advanced customization for unique billing cycles and pricing strategies

- Usage-based billing to track and charge customers based on actual consumption

- Integration with ERP, CRM, and accounting systems for seamless workflows

- Multi-currency support and built-in tax compliance for global businesses

Usability (10% of total score)

A powerful tool is worthless if your team can’t use it. I checked for:

- Intuitive interface that keeps the learning curve low

- Clear navigation that prevents wasted time hunting for features

- Consistent experience across devices and platforms

Onboarding (10% of total score)

Getting started should be smooth, not a headache. I looked for:

- Training videos and interactive product tours that speed up ramp-up

- Step-by-step setup guides that cover everything from billing cycles to dunning

- Access to responsive chat or support during onboarding

- Well-organized documentation for reference

Customer support (10% of total score)

When things go sideways, you need support that delivers. Here’s what counts:

- 24/7 availability or extended support hours

- Multiple contact channels—phone, chat, email—so you’re not stuck waiting

- Knowledgeable staff who actually understand subscription billing

- Active user communities or forums for peer support

Value for money (10% of total score)

The right platform should fit your budget without skimping on must-have features:

- Transparent pricing models with no hidden fees

- Competitive costs relative to features and scalability

- Flexible subscription plans that grow with your business

- Discounts or perks for annual payments

Customer reviews (10% of total score)

Real user feedback often reveals what sales pitches don’t:

- Consistent ratings across multiple review sites

- Common issues flagged and how providers address them

- Positive comments about key features and customer support

- Clear recommendations from actual users

What is Subscription Billing Software?

Subscription billing software is a billing solution that automates managing recurring payments and subscription plans.

It handles everything from flexible billing cycles and upgrades to dunning and revenue recognition, making the billing process smoother and more reliable.

Businesses with subscription models use it to reduce manual errors, optimize cash flow, and improve customer retention through streamlined billing workflows and real-time metrics.

How to Choose Subscription Billing Software

Picking the right subscription billing software means focusing on what actually moves the needle for your business: scalability, integrations, and billing flexibility.

Here’s a straightforward checklist to keep your search sharp and avoid getting overwhelmed by feature lists or confusing pricing models.

| Factor | What to consider |

|---|---|

| Scalability | Can the billing platform handle growing transaction volumes and more complex subscription models without breaking a sweat? |

| Integrations | Does it connect with your CRM, ERP, accounting software, and payment gateways to keep workflows smooth and data flowing? |

| Customizability | Can you tailor billing cycles, pricing models (tiered, usage-based, add-ons), and renewals to fit your business model? |

| Ease of use | Is the interface intuitive enough to onboard your team quickly and avoid costly mistakes in your billing process? |

| Pricing | Are pricing plans transparent and flexible? Watch for hidden fees on add-ons, API calls, or billing cycles. |

| Security | Does the software comply with industry standards (PCI DSS, encryption) to protect payment processing and customer data? |

Trends In Subscription Billing Software

Subscription billing software is evolving fast, and knowing where it’s headed helps you pick a platform that won’t hold you back. These are the trends shaping the next generation of billing solutions:

- AI-driven insights for churn and revenue growth. Tools now analyze subscriber data in real time to predict cancellations and recommend retention tactics. This helps boost customer retention and optimize recurring revenue.

- Flexible billing cycles and subscription models. More software supports custom billing frequencies, proration for upgrades or downgrades, and hybrid models like usage-based and tiered pricing, letting you tailor plans to customer preferences.

- Stronger security and compliance. Enhanced features like biometric authentication and automated dunning management protect customer data and reduce failed payments, building trust and safeguarding your business.

- Subscription bundling and add-ons. Platforms are enabling the combination of subscriptions with one-time purchases or service packages, creating more revenue streams and improving customer experience.

- Sustainability tracking. Some solutions now offer reporting on environmental impact, helping businesses meet sustainability goals and share progress with subscribers.

Features of Subscription Billing Software

The right subscription billing software comes loaded with features built to streamline your billing process and optimize recurring revenue:

- Automated invoicing. Cuts down manual errors by generating and sending invoices automatically for every billing cycle.

- Flexible billing cycles. Supports custom schedules—monthly, quarterly, or annual—with proration for upgrades, downgrades, and cancellations.

- AI-driven insights. Uses data analysis to track subscription metrics, predict churn, and suggest pricing strategies to boost retention.

- Usage-based billing. Bills customers based on actual consumption, ideal for SaaS and telecom industries with metered pricing.

- Customizable pricing models. Handles tiered pricing, add-ons, discounts, and bundled subscriptions for diverse revenue streams.

- Security features. Includes PCI compliance, encryption, and advanced fraud detection to protect payment processing and customer data.

- Subscription bundling. Lets you package subscriptions with one-time purchases or services to increase average order value.

- Real-time analytics and dashboards. Provides visibility into MRR, churn, customer subscriptions, and revenue recognition for smarter decision-making.

Benefits of Subscription Billing Software

Implementing the right subscription billing software delivers real advantages that go beyond just automating payments:

- Save time with automated billing. Reduce manual invoicing and retries, freeing your team to focus on growth.

- Improve billing accuracy and cash flow. Cut down on failed payments, proration errors, and missed renewals to keep revenue steady.

- Boost customer retention. Flexible pricing models and smooth upgrade/downgrade workflows improve the subscriber experience and reduce churn.

- Gain better financial visibility. Real-time dashboards and revenue recognition tools give you clear insight into MRR and revenue streams.

- Scale with confidence. Support complex subscription models, usage-based pricing, and global payment methods as your business grows.

- Stay compliant and secure. Automated dunning management and advanced security protocols protect your business and customers.

Costs and Pricing of Subscription Billing Software

Subscription billing software pricing varies based on features, user counts, and add-ons. Here’s a typical breakdown of common plans to help you budget and compare options:

| Plan type | Average price | Common features | Best for |

|---|---|---|---|

| Free plan | $0 | Basic invoicing, limited customer support, standard reporting | Startups and small businesses testing billing software |

| Personal plan | $5–25 per user/month | Automated invoicing, basic analytics, multi-currency support, email support | Small teams with simple subscription needs |

| Business plan | $30–75 per user/month | Flexible billing cycles, customizable pricing models, advanced analytics, priority support | Growing businesses with complex billing needs |

| Enterprise plan | $100–300 per user/month | Usage-based billing, ERP integrations, AI-driven insights, dedicated account management, compliance tools | Large enterprises with complex subscription billing |

Additional costs to consider

Many platforms charge extra for API calls, add-ons like dunning management or advanced analytics, and per-transaction fees—especially for payment processing through gateways like Stripe or PayPal. For enterprise subscription management software, these costs can scale significantly.

Some also impose limits on billing cycles or subscribers before charging more. Always check the fine print on pricing models to avoid surprises.

Subscription Billing Software FAQs

Here are some answers to common questions about subscription billing software:

Can subscription billing software handle multiple payment methods and currencies?

Yes—it’s table stakes. Any platform worth your time lets you take cards, ACH, digital wallets, and wrangles more currencies than your average airport kiosk.

That means fewer excuses when you land a customer in Berlin or Brisbane. Just double-check which methods are baked in and which come with extra fees—hidden “gotchas” are half the reason you’re probably switching in the first place.

How hard is it to switch subscription billing platforms?

It’s never fun, but it won’t wreck your month. Migration’s mostly about clean data and a vendor who actually picks up the phone.

Look for a tool that offers hands-on migration help, sane import/export options, and a setup flow that reads like plain English—not an IT crossword. Budget a few days to a couple of weeks for setup, depending on how messy your billing life is today.

What is dunning management, and why does it matter?

Dunning management is the grown-up way to say “don’t let expired cards kill my revenue.” These tools chase down failed payments by pinging cards a few times and nudging customers with reminders, so you’re not losing cash just because someone’s wallet got replaced.

Skip dunning, and you’ll watch your easy revenue trickle away—quietly, but consistently.

Can subscription billing software support complex pricing strategies like usage-based or tiered pricing?

Absolutely. Good software flexes for anything from all-you-can-eat SaaS to “pay as you grow” plans, or wild tiering schemes the CFO dreams up. That means usage, volume, cocktails of flat + metered—whatever keeps your margins fat and your customers hooked.

How does subscription billing software help with revenue recognition compliance?

It does the math so finance sleeps at night. Modern tools slice and dice what you’ve billed and what you’ve actually “earned” under ASC 606 or IFRS 15 nonsense, then spit out reports that’ll keep auditors out of your hair. If you’re still managing this by spreadsheet, you’re either a wizard or a bit of a glutton for punishment.

How can subscription billing software reduce involuntary churn?

By taking payment failure personally. These platforms use smart retries, card updater services, and clear emails to keep customers from dropping off over nothing but a glitchy card. Involuntary churn adds up—and killing it is one of the fastest ways to grow without lifting a finger in sales.

Can my subscribers manage their own plans or payments?

Yes, most solid billing platforms offer a self-serve portal. Letting customers upgrade, downgrade, or update their card means fewer support tickets and happier humans. You get paid faster and spend less time playing IT helpdesk. If your software can’t handle this, it’s time to move on.

Keep Your Billing On Repeat

Subscription billing doesn’t have to be a recurring headache.

The right software automates your billing cycles, cuts down on failed payments, and gives you real-time insight into your revenue streams and customer lifecycle. That means less time wrestling spreadsheets and more time growing your business.

With tools built to handle everything from flexible pricing models to dunning management and revenue recognition, you can optimize your billing process and keep subscribers coming back.

Pick a platform that fits your scale and complexity—whether commercial or open source subscription management solutions—and stop leaving money on the table.

It’s time to take control of your subscription billing and make your recurring revenue work for you. Or maybe you need a great subscription management platform instead? Either way, we got ya covered.

Retail never stands still—and neither should you. Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.