Best Payoneer Alternatives Shortlist

Here’s my shortlist of the best Payoneer alternatives:

Running a retail operation comes with its fair share of challenges. You need reliable payment solutions that work for your team and your customers. Payoneer might not always cut it, and I understand why you might be looking for alternatives.

I've spent years testing and reviewing software to help retail operators like you find the right tools. In this article, I'll share my top picks for Payoneer alternatives, focusing on what makes each option unique.

You'll discover solutions that address common pain points, such as transaction fees or integration issues. My goal is to provide a well-researched, unbiased review to help you make informed decisions. Let's dive into the options that could be the perfect fit for your business.

What is Payoneer?

Payoneer is an online payment solution that facilitates international money transfers for businesses and freelancers. It's commonly used by professionals such as freelancers, online sellers, and service providers who need to receive payments from clients worldwide.

Features such as multicurrency accounts, global payment services, and integration with marketplaces help users manage international transactions efficiently.

Overall, Payoneer provides a valuable service for those needing a reliable way to handle global payments.

Best Payoneer Alternatives Summary

This comparison chart summarizes pricing details for my top Payoneer alternative selections to help you find the best one for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for over 100 payment methods | Not available | From 2.9% + 30¢ | Website | |

| 2 | Best for personal and business use | Free plan available | From 2.99% + $0.49 per transaction | Website | |

| 3 | Best for contactless payments | Free demo available | From 1.80% + €0.25 | Website | |

| 4 | Best for scalable merchant services | Free demo available | From 2.60% + 10¢ per transaction | Website | |

| 5 | Best for modular payment solutions | Free consultation available | Pricing upon request | Website | |

| 6 | Best for multichannel payment processing | Free demo available | From $25/month | Website | |

| 7 | Best for integrated payments | Free demo available | From $99/month | Website | |

| 8 | Best for marketplace solutions | Free demo available | Pricing upon request | Website | |

| 9 | Best for flexible payment processing | Free account; just pay for processing fees | From 1.74% +10¢ per transaction | Website | |

| 10 | Best for customizable payment features | Free demo available | Pricing upon request | Website |

Why Trust Our Software Reviews

Best Payoneer Alternatives Reviews

Below are my detailed summaries of the best Payoneer alternatives that made it onto my shortlist. My reviews offer a detailed look at the key features, pros and cons, integrations, and ideal use cases of each tool to help you find the best one for you.

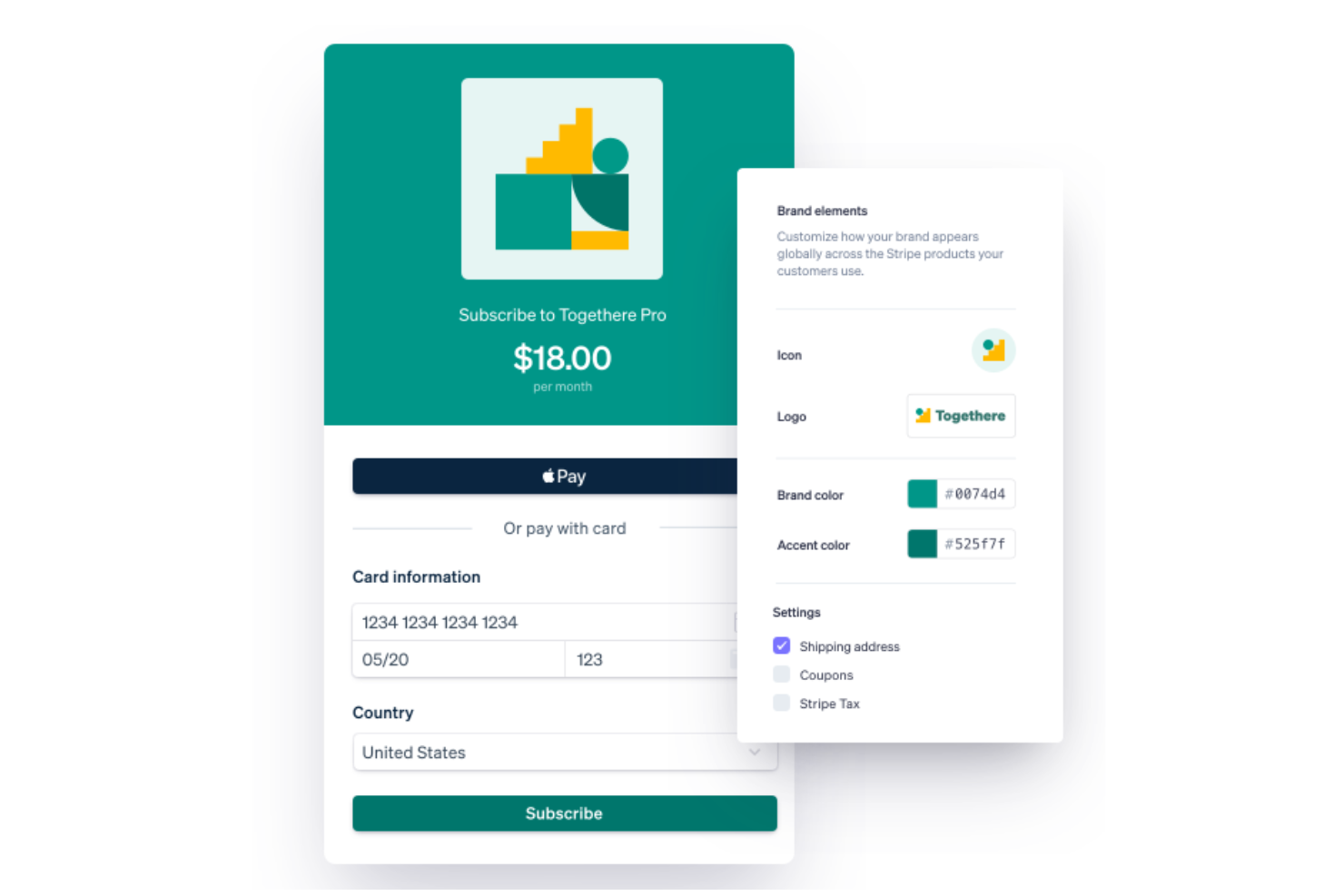

Stripe is a payment processing platform designed for businesses of all sizes to manage online payments. Its main user base consists of e-commerce platforms, subscription services, and marketplaces that require flexible payment solutions.

Why it's a good Payoneer alternative: Stripe offers support for over 100 payment methods, making it versatile for businesses engaging in international trade. Its customizable checkout features let you tailor the payment experience to fit your brand. With built-in fraud prevention tools and transparent currency conversion using mid-market exchange rates, you can protect your transactions and ensure cross-border pricing without needing additional software. The platform's scalability ensures it can grow with your business needs.

Standout Features and Integrations:

Features include a customizable checkout experience that aligns with your brand's identity, real-time reporting to keep track of your transactions, and automation for subscription billing options to manage recurring payments efficiently.

Integrations include Shopify, WooCommerce, BigCommerce, Adobe Commerce, QuickBooks, Xero, Salesforce, Squarespace, Wix, WordPress, and more.

Pros and cons

Pros:

- Real-time transaction reporting and analytics

- Customizable checkout features

- Flexible developer APIs

Cons:

- Documentation can be overwhelming

- Can be complex for non-developers

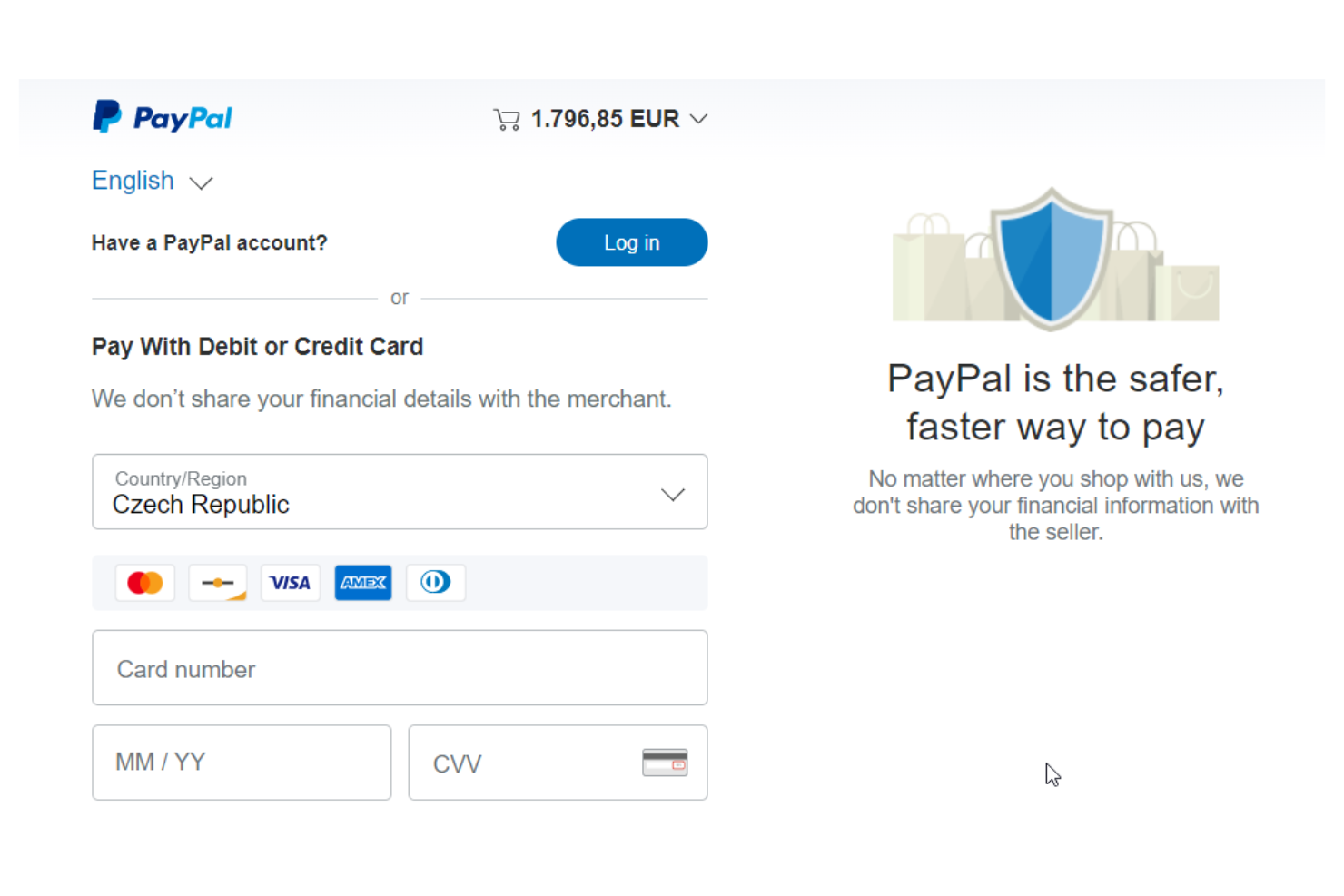

PayPal is an online payment system that allows individuals and businesses to send and receive money electronically. Users can link their national or local bank accounts to make bank transfers, process withdrawals, and manage receiving accounts for incoming payments. Its main users include online shoppers, freelancers, and businesses seeking a reliable way to handle digital transactions.

Why it's a good Payoneer alternative: PayPal supports international transfers in multiple currencies, including USD, GBP, and EUR, making it suitable for global business payments. The platform offers built-in currency exchange, applying its own exchange rate and FX rates when converting between currencies. With its user-friendly interface, you and your team can manage transactions with ease and connect other international accounts, such as Revolut and Wise. While transfer fees apply, PayPal's wide global acceptance and ease of use make it a convenient option for businesses and freelancers managing cross-border payments and looking to increase their global reach. PayPal's buyer and seller protection policies add an extra layer of security to your transactions.

Standout Features and Integrations:

Features include invoicing tools that help you bill clients effectively, a mobile app that lets you manage payments on the go, and recurring payment options for subscription services. PayPal also offers cryptocurrency support, allowing eligible users to buy, hold, and sell crypto.

Integrations include Shopify, WooCommerce, Adobe Commerce, BigCommerce, QuickBooks, Xero, Salesforce, Squarespace, Wix, WordPress, and more.

Pros and cons

Pros:

- Strong security measures

- User-friendly interface

- Global payment capabilities

Cons:

- Poor dispute outcomes

- Can have high transaction fees

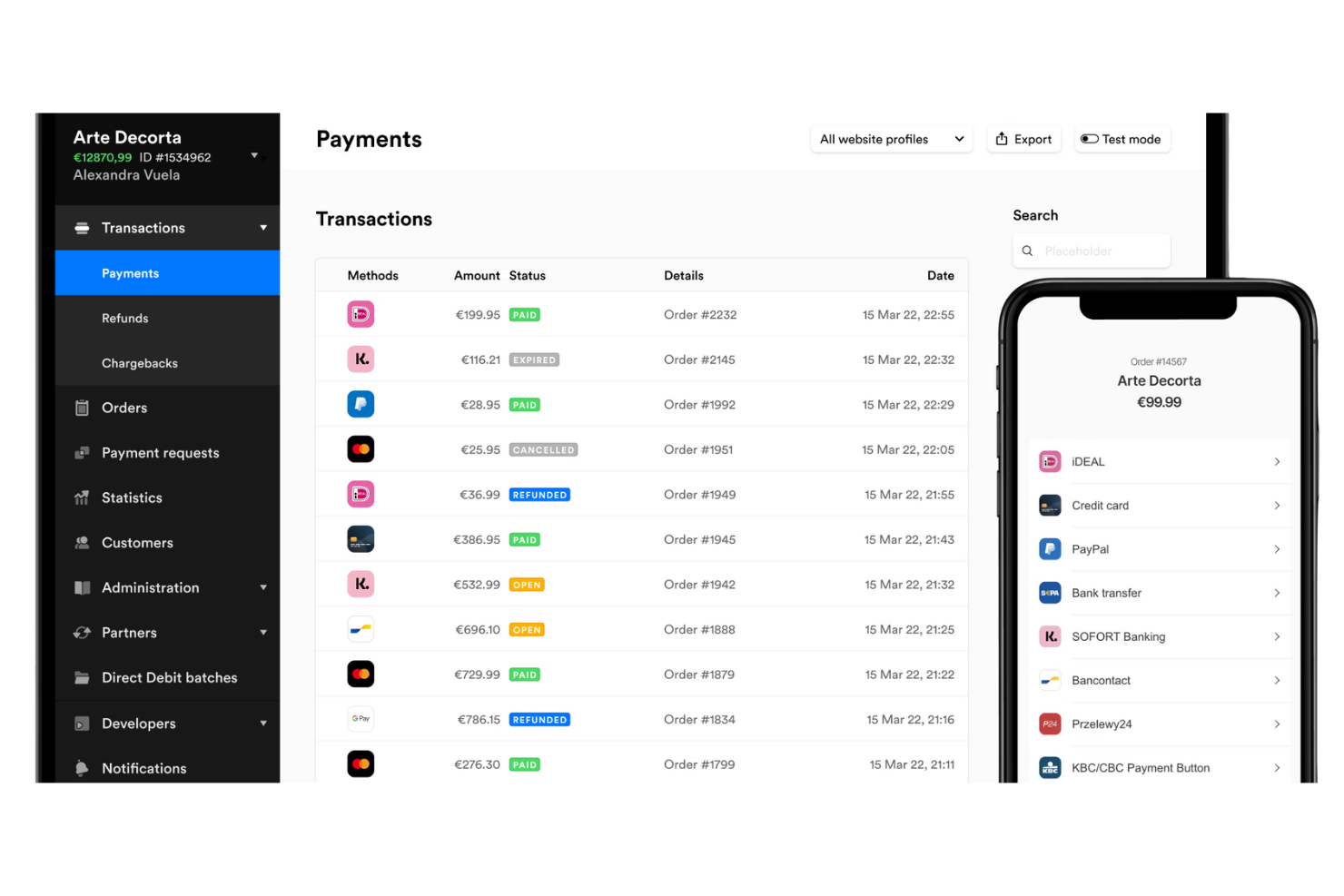

Mollie is a payment service provider that caters to businesses of all sizes, offering solutions for accepting online and in-person payments. It serves e-commerce platforms, subscription services, and other businesses needing flexible payment options.

Why it's a good Payoneer alternative: Mollie specializes in contactless payments, providing a smooth experience for both you and your customers. It supports a wide range of payment methods, allowing you to cater to various customer preferences. With its transparent pricing model, you avoid unexpected fees, making budgeting easier. Mollie's focus on contactless transactions and diverse payment options makes it a strong alternative for businesses wanting modern payment solutions.

Standout Features and Integrations:

Features include real-time payment tracking that helps you monitor transactions, easy-to-use dashboards that simplify payment management, and customizable checkout experiences that align with your brand.

Integrations include Shopify, WooCommerce, Adobe Commerce, BigCommerce, PrestaShop, Wix, Squarespace, Salesforce, Xero, QuickBooks, and more.

Pros and cons

Pros:

- Customizable checkout options

- Real-time transaction insights and payment tracking

- Transparent pay-as-you-go pricing

Cons:

- Limited advanced enterprise features

- Requires some technical setup

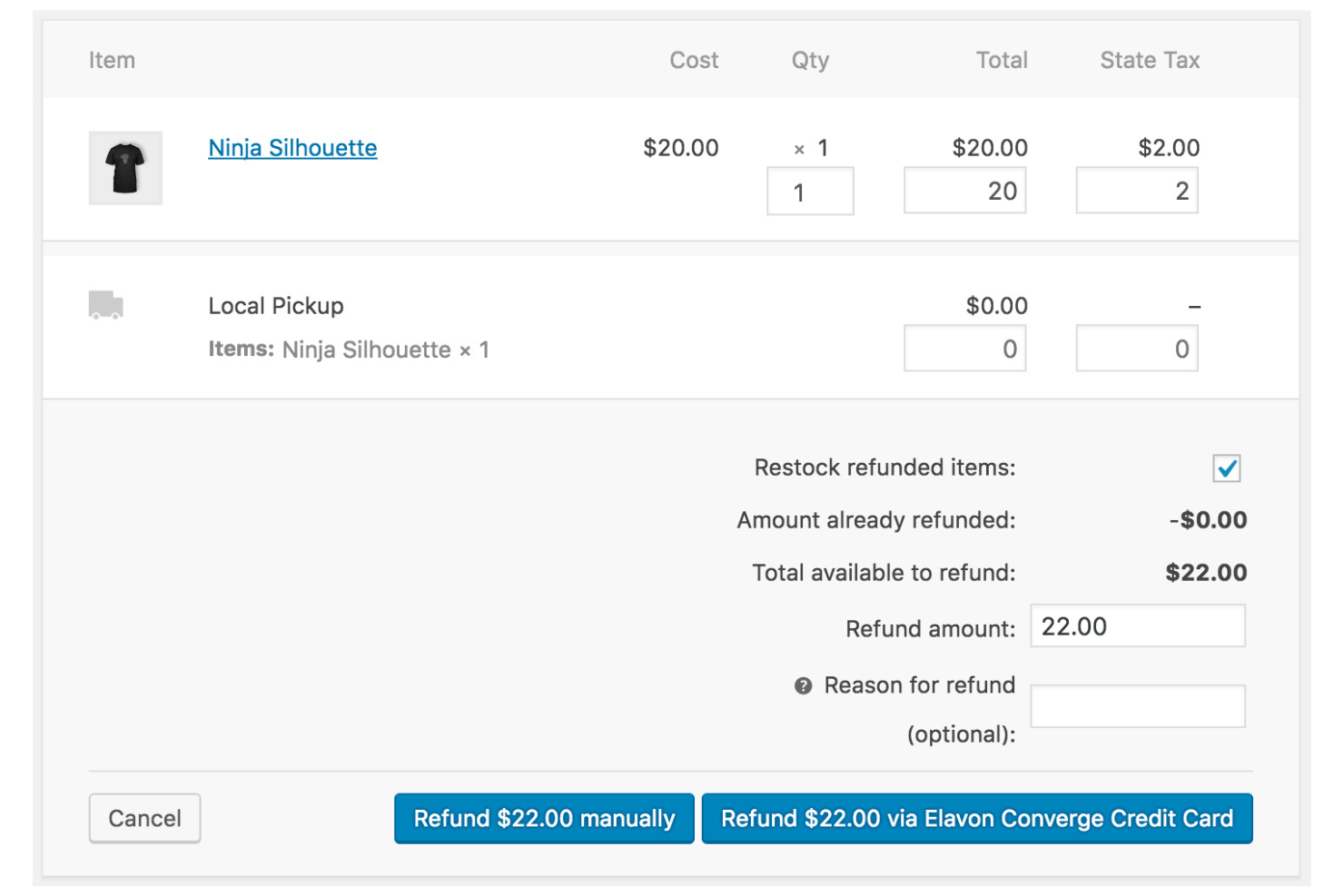

Elavon is a payment processing solution designed for businesses of all sizes, offering services such as in-store, mobile, and online payment acceptance. Its primary users include the retail, hospitality, and health care sectors that need reliable payment solutions.

Why it's a good Payoneer alternative: Elavon offers scalable merchant services suitable for businesses looking to grow. With its powerful security features, you can ensure safe transactions for your customers. The platform provides detailed analytics and reporting tools, helping you make informed business decisions. Its ability to handle a variety of payment methods, such as credit and debit card payments, as well as corporate cards, makes it a versatile choice for expanding businesses.

Standout Features and Integrations:

Features include advanced security measures that protect sensitive payment data, analytics tools that give insights into transaction trends, and mobile payment options that cater to on-the-go businesses.

Integrations include Shopify, QuickBooks, Xero, WooCommerce, Adobe Commerce, Salesforce, Oracle, SAP, Microsoft Dynamics, Square, and more.

Pros and cons

Pros:

- Detailed analytics and reporting

- Strong security and compliance features

- Scalable for growing businesses

Cons:

- Contract commitment required

- Funds may be held or delayed

NMI is a payment gateway platform that serves businesses needing customized payment processing solutions. Its main users include retailers, service providers, and software developers looking to integrate flexible payment options.

Why it's a good Payoneer alternative: NMI offers modular payment solutions that allow you to tailor the platform to your specific business needs. With its powerful API, you can integrate various payment methods into your existing systems. The platform's focus on security ensures that your transactions are protected, providing peace of mind for your team. NMI's customizable approach makes it a versatile option for businesses seeking a tailored payment experience.

Standout Features and Integrations:

Features include advanced fraud detection that helps protect your business, detailed analytics tools that provide insights into payment trends, recurring billing options that simplify subscription management, and support for global payouts, allowing businesses to accept payments from international customers.

Integrations include Shopify, WooCommerce, Adobe Commerce, BigCommerce, Salesforce, QuickBooks, Xero, NetSuite, Oracle, SAP, and more.

Pros and cons

Pros:

- Advanced security features

- Strong API for integrations

- Modular payment solutions

Cons:

- Configuration can be challenging for small teams

- Requires technical expertise

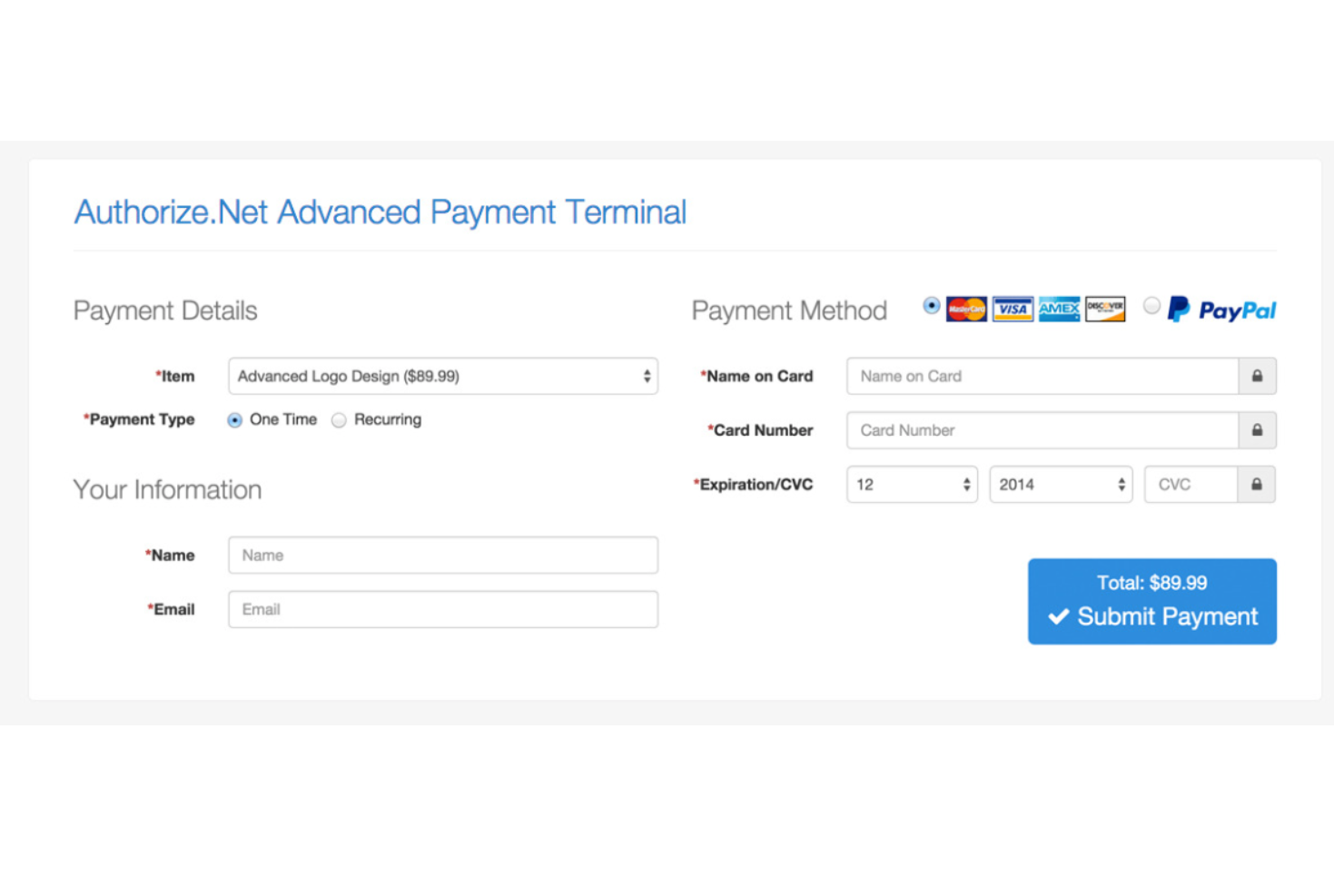

Authorize.net is a payment gateway solution catering to businesses that need to accept business payments through credit card, debit card, and ACH transactions. It supports online, in-person, or over-the-phone payment methods. It's popular among small to medium-sized businesses looking for reliable, high-volume payment processing.

Why it's a good Payoneer alternative: Authorize.net supports multichannel payment processing, allowing you to accept payments through various methods such as online, mobile, and POS systems, and supports major card networks such as Mastercard, Visa, and American Express. Its advanced fraud detection suite adds a layer of security to your transactions. This helps to protect sensitive account details and reduce chargebacks, which can be critical for maintaining customer trust. Recurring billing and invoicing capabilities help you manage ongoing payments. These features make it versatile for businesses needing diverse payment options.

Standout Features and Integrations:

Features include a virtual terminal that lets you process payments without a physical card reader, advanced fraud detection tools that help protect your business from fraudulent transactions, and recurring billing options that allow you to set up subscription services with ease.

Integrations include QuickBooks, Xero, Zoho, Shopify, Adobe Commerce, WooCommerce, BigCommerce, Salesforce, Square, and more.

Pros and cons

Pros:

- Easy recurring billing and subscription management

- Advanced security and fraud protection

- Multichannel payment acceptance

Cons:

- Complex pricing and transaction fees apply

- May require technical setup and integrations

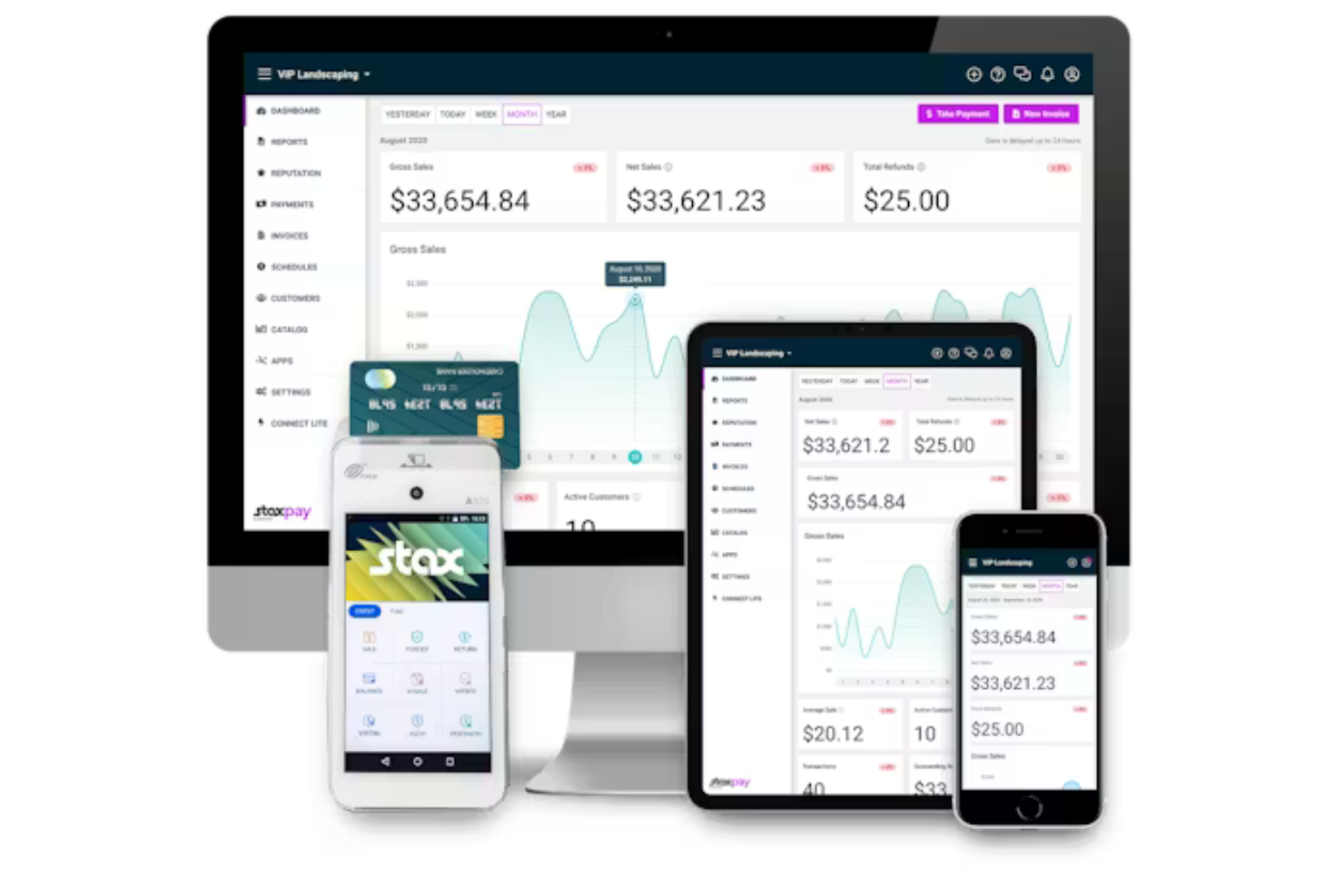

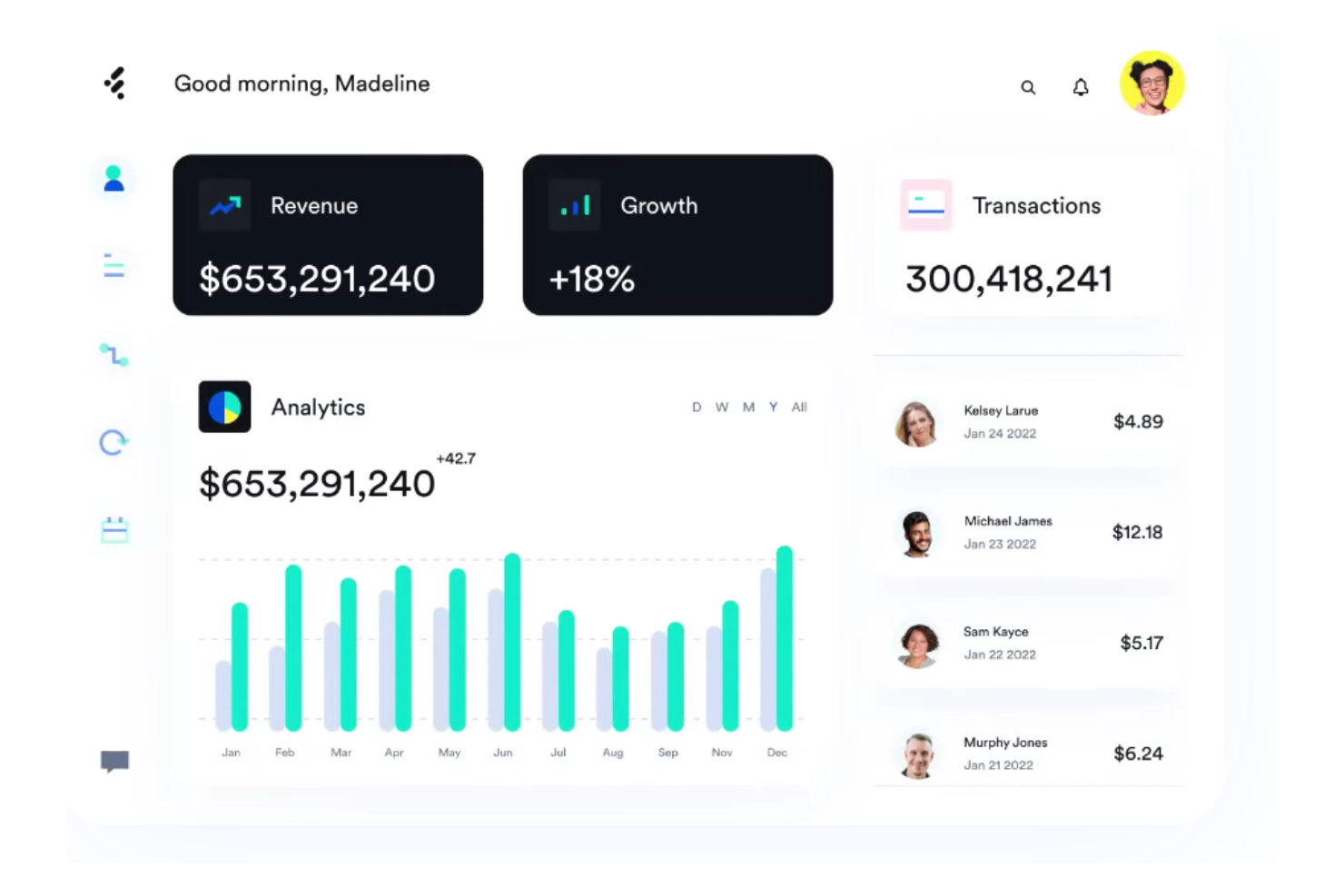

Stax is a payment processing platform designed for businesses seeking a unified solution for accepting payments online, in-store, and via mobile. Its primary users include small to medium-sized businesses that want to manage all payment types efficiently.

Why it's a good Payoneer alternative: Stax provides integrated payment solutions, allowing you to handle transactions across multiple channels from a single platform. With features such as real-time analytics, you can monitor sales and make data-driven decisions. The platform's flat-rate pricing model offers transparency, helping you manage costs effectively. Stax's focus on integration ensures that your payment processes are cohesive and easy to manage.

Standout Features and Integrations:

Features include real-time analytics that provide insights into your sales performance, a virtual terminal that enables you to process payments without physical hardware, and invoicing capabilities that simplify billing for your customers.

Integrations include QuickBooks, Xero, Salesforce, WooCommerce, Shopify, Adobe Commerce, BigCommerce, NetSuite, Zoho, Square, and more.

Pros and cons

Pros:

- Transparent flat-rate pricing

- Real-time sales analytics and reporting

- Integrated payment solutions

Cons:

- Limited international payment support

- Expensive for low volume

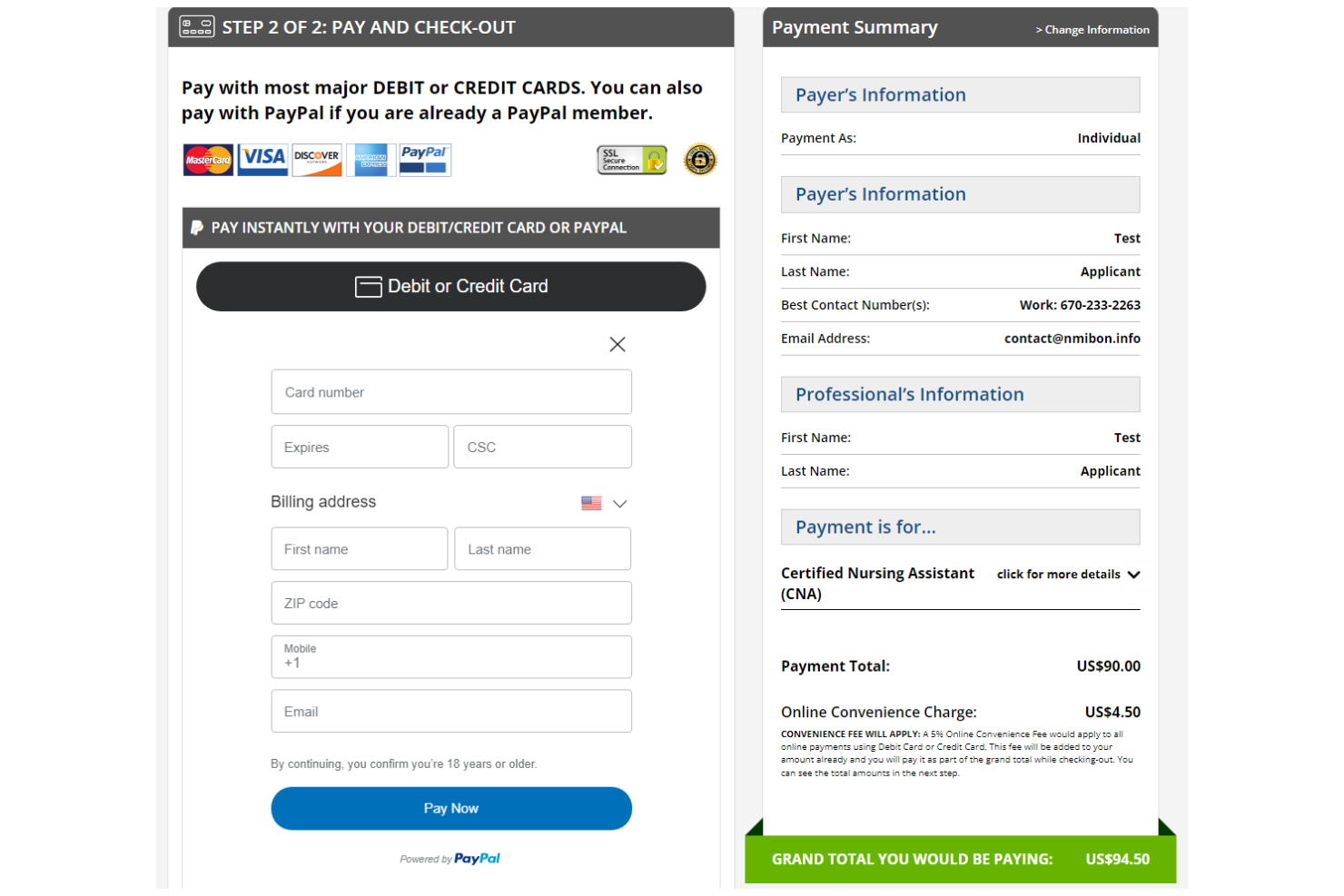

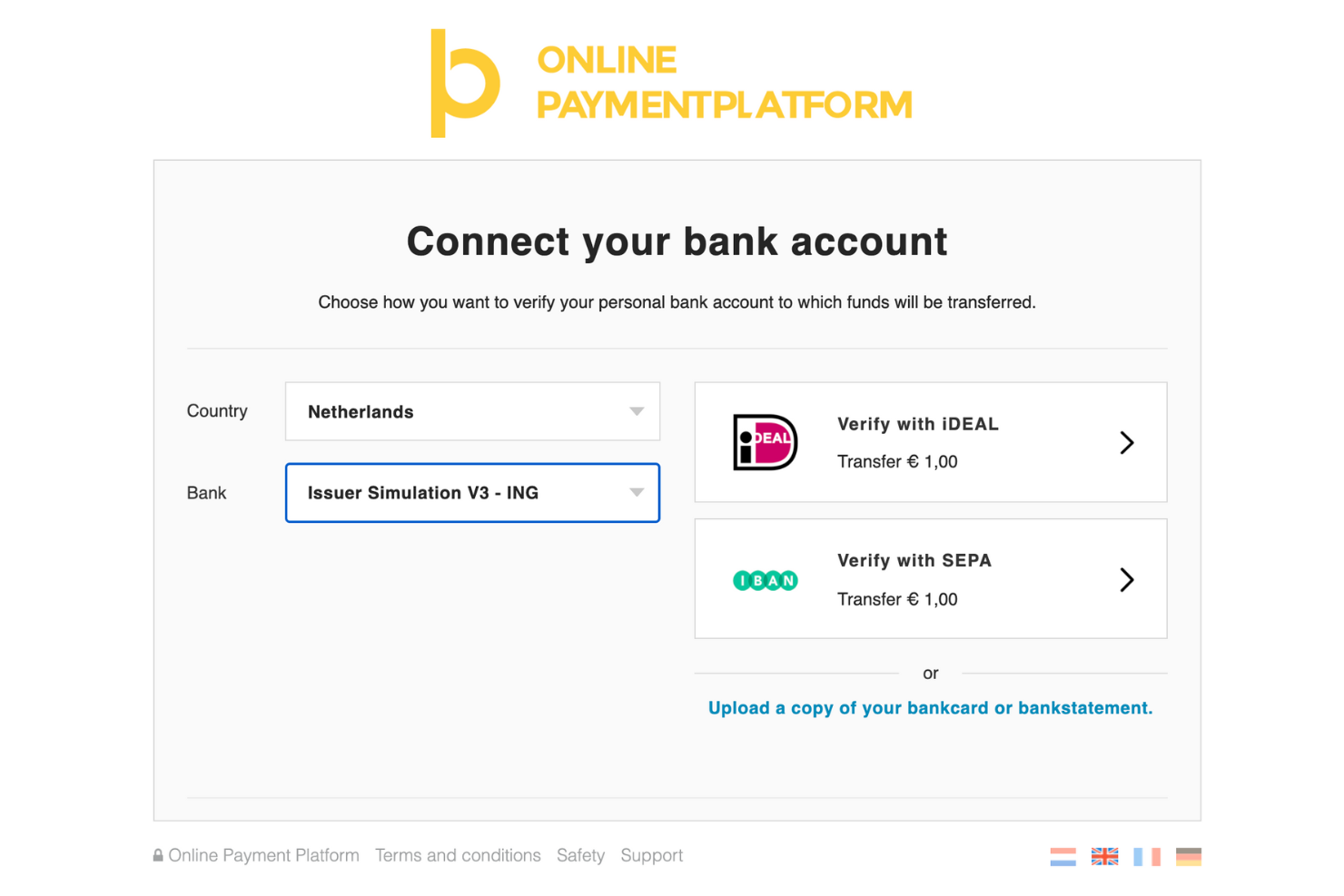

Online Payment Platform is a payment solution tailored for marketplaces, providing services such as customizable checkout, escrow services, and automation for efficient transaction management. It primarily serves businesses in industries such as auctions, automotive, and crowdfunding, offering tools to simplify transactions.

Why it's a good Payoneer alternative: Online Payment Platform caters specifically to marketplaces with features such as multisplit transactions, virtual cards, and escrow services. These capabilities ensure compliance with regulations such as PSD2, offering a secure environment for both buyers and sellers. Instant payouts and support for global business account transactions in multiple currencies and virtual IBANs provide flexibility for managing cross-border platform payments. The platform's focus on marketplace needs makes it an excellent option for businesses requiring specialized payment solutions.

Standout Features and Integrations:

Features include customizable onboarding processes that refine user registration, instant payouts that support cash flow, and virtual IBANs and virtual cards that simplify international transactions.

Integrations include Shopify, WooCommerce, Adobe Commerce, PrestaShop, BigCommerce, Salesforce, Xero, QuickBooks, SAP, Zoho, and more.

Pros and cons

Pros:

- Compliant with PSD2 regulations

- Supports multisplit transactions and escrow services

- Tailored for complex payout structures

Cons:

- Requires technical setup and understanding of PSD2 regulations

- Limited to marketplace solutions

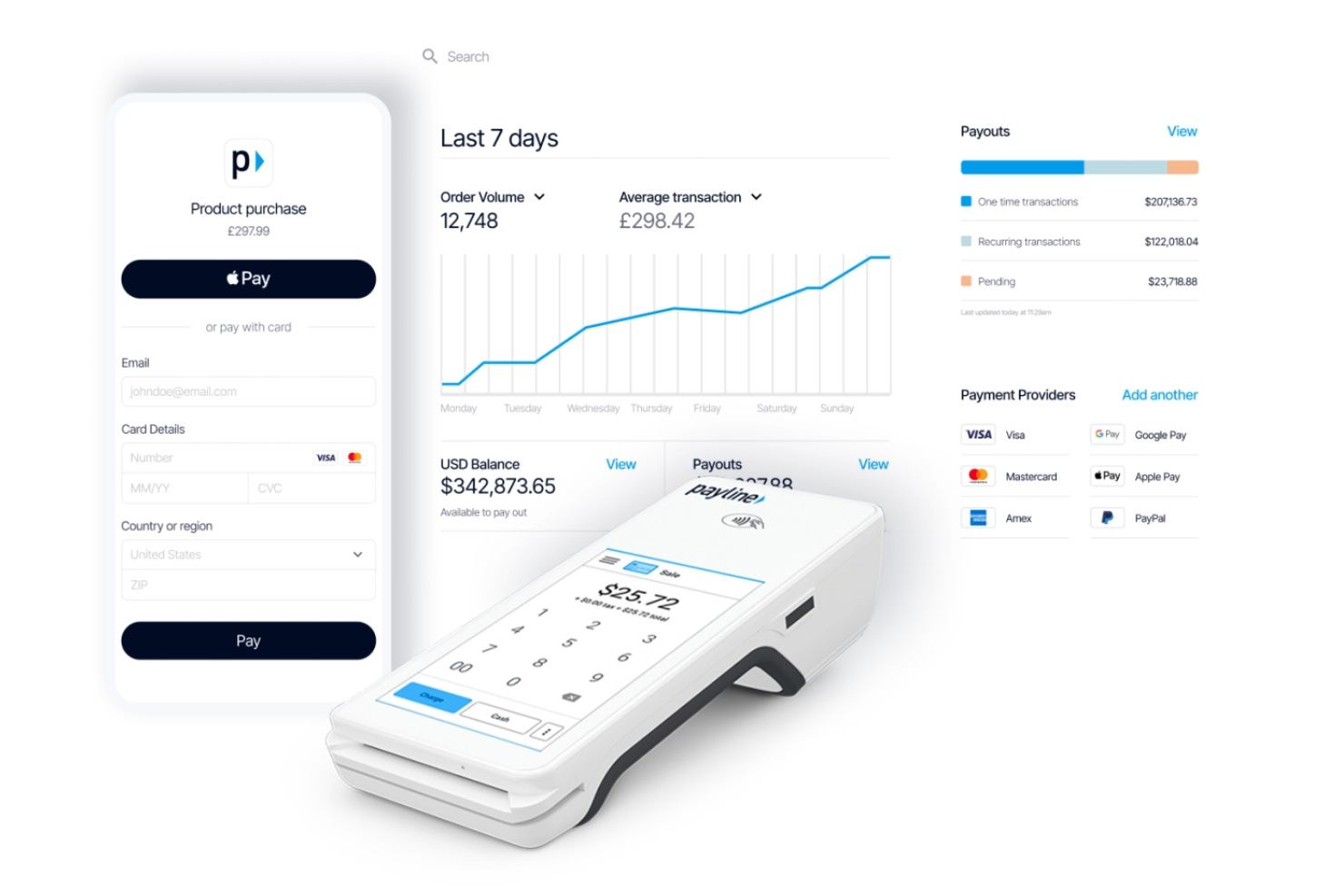

Payline is a payment processing solution that caters to businesses of all sizes, offering both online and in-store payment options. Its main user base includes retail, health care, and nonprofit organizations looking for adaptable payment solutions.

Why it's a good Payoneer alternative: Payline offers flexible payment processing that can be tailored to fit your business needs. With its transparent pricing and no hidden fees, you can manage your budget more effectively. The platform's mobile payment capabilities allow you to accept payments on the go, enhancing convenience for your team. Payline's focus on flexibility and transparency makes it a solid choice for businesses seeking adaptable payment solutions.

Standout Features and Integrations:

Features include advanced security measures that protect sensitive payment information, customizable payment options that let you tailor the system to your needs, and detailed reporting tools that provide insights into your transaction data.

Integrations include QuickBooks, WooCommerce, Shopify, Adobe Commerce, BigCommerce, Xero, Salesforce, Oracle, SAP, NetSuite, and more.

Pros and cons

Pros:

- Detailed reporting and analytics

- Transparent pricing structure

- Flexible payment processing

Cons:

- Multiple pricing tiers confusing

- May be complex for beginners

Finix is a payment infrastructure platform designed for businesses that want to manage their own payment processing. It primarily serves software platforms and marketplaces, providing tools to facilitate payments and improve financial operations.

Why it's a good Payoneer alternative: Finix offers customizable payment features that let you tailor payment solutions to fit your specific business needs. Its end-to-end payment processing capabilities give you more control over transactions. With its ability to support multiple payment methods, you can offer your customers flexibility in how they pay. The platform's focus on customization makes it ideal for businesses looking to create a tailored payment experience. Finix is considered one of the top Payoneer competitors, providing scalable solutions for businesses seeking flexible merchant services with a predictable monthly fee structure.

Standout Features and Integrations:

Features include detailed transaction reporting that helps you monitor financial performance, automated reconciliation processes that reduce manual work, and risk management tools that protect your business from fraudulent activities.

Integrations include Salesforce, QuickBooks, Xero, Shopify, WooCommerce, Adobe Commerce, BigCommerce, NetSuite, Oracle, SAP, and more.

Pros and cons

Pros:

- Automated reconciliation and efficiency tools

- End-to-end process control

- Highly customizable payment infrastructure

Cons:

- Complex setup and ongoing maintenance

- Requires technical expertise

Other Payoneer Alternatives

Here are some additional Payoneer alternatives that didn’t make it onto my shortlist but are still worth checking out:

- PayTrace

For B2B payment solutions

- WeChat Pay HK

For account payments within Hong Kong

- Alipay+

For cross-border payments from Asia

Payoneer Alternatives Selection Criteria

When selecting the best Payoneer alternatives to include in this list, I considered common buyer needs and pain points related to online payment solutions products, such as currency conversion fees and limited payment methods. I also used the following framework to keep my evaluation structured and fair:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Accept online payments

- Process refunds

- Support multiple currencies

- Generate invoices

- Provide payment tracking

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Advanced fraud detection

- Customizable checkout pages

- Real-time analytics

- Mobile payment capabilities

- Subscription management

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Easy navigation

- Intuitive interface

- Minimal setup requirements

- Accessibility across devices

- Clear documentation

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Access to chatbots for assistance

- Extensive webinars

- Use of templates for quick setup

Customer Support (10% of total score)

To assess each software provider's customer support services, I considered the following:

- Availability of 24/7 support

- Multiple contact channels

- Response time

- Access to a knowledge base

- Quality of support resources

Value for Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing

- Range of features offered

- Flexibility in pricing plans

- No hidden fees

- Trial or demo availability

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Feedback on reliability

- Comments on ease of use

- Opinions on customer service

- Satisfaction with features

- Overall value perception

Why Look for a Payoneer Alternative?

While Payoneer is a good choice for online payment solutions, there are a number of reasons why some users seek out alternative solutions. You might be looking for a Payoneer alternative because:

- You need lower transaction fees

- You require more diverse payment methods

- Payoneer's customer support isn't meeting your needs

- You need better integration with existing systems

- You're looking for more flexible pricing plans

- You need geographic availability beyond Payoneer's reach

If any of the above sound like you, you've come to the right place. My list contains several online payment solutions options that are better suited for teams facing these challenges with Payoneer and looking for alternative solutions.

Features

Here are some of the key features of Payoneer, to help you contrast and compare what alternative solutions offer:

- Multicurrency account: Manage funds in multiple currencies, making it easier for your team to handle international transactions.

- International payment processing: Send and receive payments globally, giving your business access to a wider market.

- Bulk payments: Pay multiple recipients at once, saving time on large-scale transactions.

- Invoicing: Create and send professional invoices to clients, simplifying your billing process.

- Payoneer card integration: Use your Payoneer card with Apple Pay for convenient in-store and online purchases.

- Secure transactions: Benefit from advanced security features such as two-factor authentication to protect your payments.

- Marketplace payments: Get paid through popular marketplaces such as eBay, expanding your business opportunities.

- Currency conversion: Convert currencies at competitive rates, minimizing the cost of foreign transactions.

- 24/7 customer support: Access support anytime you need help with your account or transactions.

What's Next:

If you're in the process of researching online payment solutions, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.