The 10 Best BNPL Platforms, Your Handy Shortlist

Let’s take a peek at our top players for BNPL services in 2026. You’ll find what each BNPL platform is best for before reading the reviews below. Pretty handy!

Big price tags can make shoppers hesitate—and merchants feel the pinch, too. High-ticket items slow down conversions, fuel cart abandonment, and shrink your ad ROI.

But what if the solution isn’t offering discounts, but offering flexibility?

Buy now, pay later (BNPL) platforms give customers the breathing room they crave, letting them split purchases into manageable, often interest-free payments—while you still get paid upfront.

It’s a win for both sides.

BNPL isn’t just for fast fashion or impulse buys anymore. From everyday essentials to luxury splurges, it’s changing how people pay across industries.

But with so many providers, features, and regional quirks, choosing the right BNPL partner is no small task.

This guide will help you cut through the noise. We’ve reviewed the top BNPL platforms for ecommerce, subscriptions, and more—so you can find the best fit for your business and your customers.

Why Trust Our Software Reviews

Comparing the Best BNPL Platforms for Online Retailers

While the below pricing comparison may not shed a ton of light on these top buy now, pay later services, click Compare Software after the table to see a comparison of all the other features.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for helping customers build credit | Not available | Pricing upon request | Website | |

| 2 | Best for fashion and luxury brand | Not available | Pricing upon request | Website | |

| 3 | Best for PayPal user | Not available | Website | ||

| 4 | Best for selling on Amazon | Not available | Pricing upon request | Website | |

| 5 | Best for global payments | Not available | Pricing upon request | Website | |

| 6 | Best for retailers selling essential services | Free demo | Pricing upon request | Website | |

| 7 | Best for subscription-based services | Not available | Pricing upon request | Website | |

| 8 | Best for encouraging responsible spending | Not available | Pricing upon request | Website | |

| 9 | Best for large purchases | Not available | Pricing upon request | Website | |

| 10 | Best travel industry installments | Not available | Pricing upon request | Website |

The 10 Absolute Best BNPL Platforms, Reviewed

Now, we’ve made it to the meat of the post—the reviews. Take a look at our top 10 BNPL services, each with why we picked it, standout features and integrations to look for, pros and cons, and a screenshot of the thing.

Sezzle provides transparent services that can help you empower your customer to make wiser purchasing decisions and build credit.

Why I picked Sezzle: It provides customers with transparency and financial education to help you empower your target audience. It helps you give customers opportunities to avoid late fees and allows younger shoppers to build credit using the Sezzle Up program. Sezzle will report their on-time installment payments to credit bureaus when your customers sign up for this program.

Sezzle offers a straightforward BNPL solution to your customers. There’s only one payment plan available; the 4 pay plan, which includes a 25% down payment when your customers make an order and three other payments. Your customers are required to complete all their payments within six weeks.

Sezzle Standout Features and Integrations

Features include credit and debit card processing, reporting to credit bureaus, payment rescheduling, and interest-bearing saving accounts.

Integrations include Shopify, CommentSold, WooCommerce, Magento, BigCommerce, Littledata, 3dcart, ResponseCRM, Cybersource, BuyItLive, and Salesforce Commerce Cloud.

Sezzle offers custom pricing upon request.

Pros and cons

Pros:

- High customer approval rate.

- Easy to set up.

- Helps attract customers.

Cons:

- Fees can be high.

- Customer support issues.

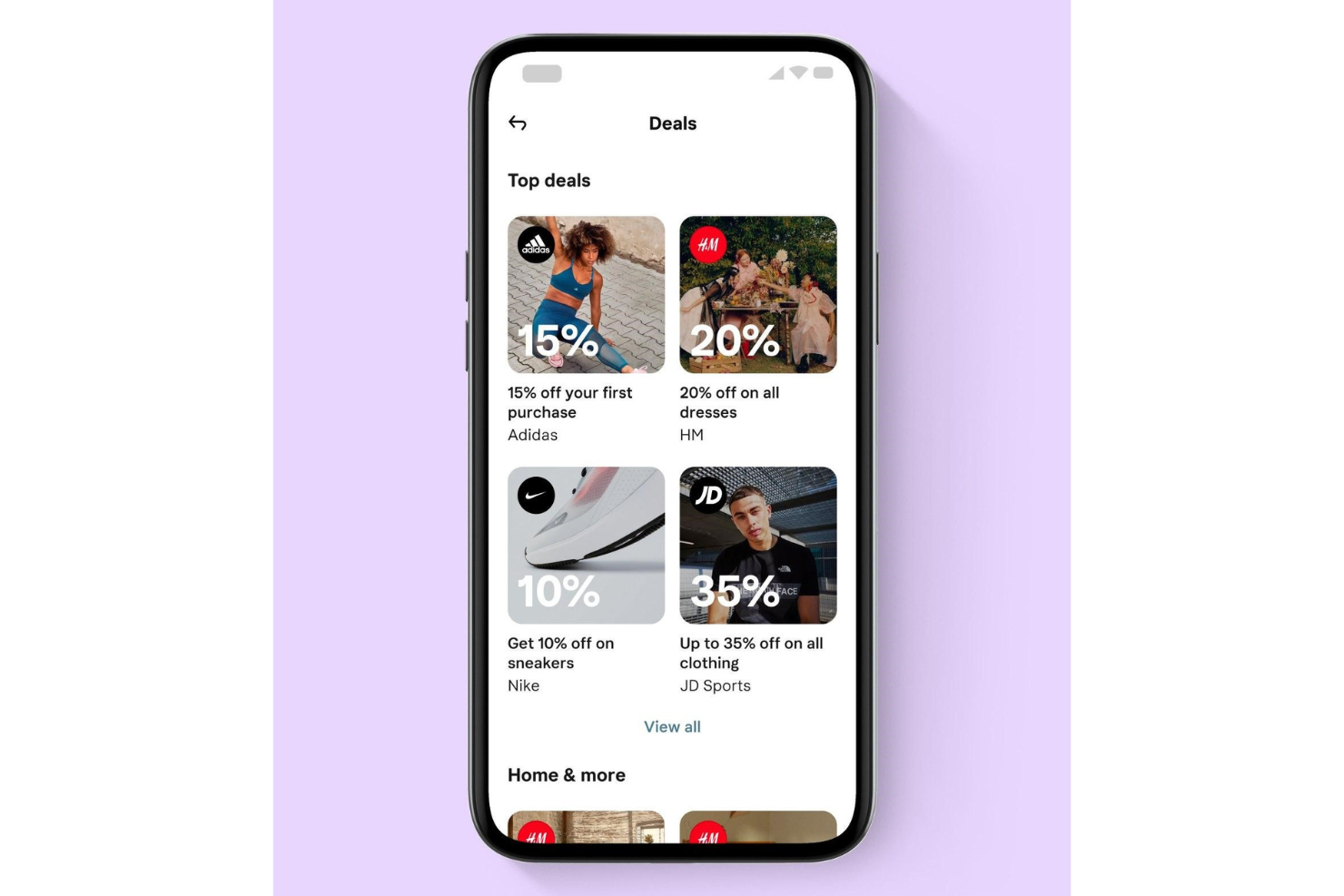

Klarna offers various BNPL options that are an excellent fit for fashion and luxury brands.

Why I picked Klarna: The platform is a popular choice for younger generations who typically shop with many fashion and luxury brands. This is because of Klarna’s Pay in 30 Days financing option, which allows your customers to try your items for free, keep what they like, and return what they don’t want within 30 days. It will enable you to provide a low-pressure option to your customers and encourage them to complete their orders.

Klarna also allows you to offer express checkout options on your product pages, which means you can create a one-click checkout experience. But keep in mind that when using this option, there’s an additional fee to your business. It might be worth it to decrease the effort it takes your customers to finish their purchase by reducing the time it takes them to change their minds.

Klarna Standout Features and Integrations

Features include zero-fraud liability, upfront payment, global solutions, seller protection, automatic updates, advertisement solutions, product search, order management, reporting tools, data analytics, and a merchant portal.

Integrations include LogiCommerce, Desktop.com, Shopaccino, PremierCashier, Happy Returns, Cloud Funnels, 29 Next, Elixir, SendOwl, Centra, BetterCommerce, and Adyen.

Klarna offers custom pricing upon request.

Pros and cons

Pros:

- No loan limitations.

- Multiple checkout options.

- Well recognized.

Cons:

- Poor customer service.

- High late fees for customers.

PayPal’s “Pay-in-Four” BNPL platform provides merchants who already use PayPal Pay with capabilities to give customers alternative payment options.

Why I picked PayPal’s “Pay-in-Four”: The PayPal platform is the most popular, secure payment system, and they brought their capabilities to the BNPL atmosphere. They have a level of trust worldwide that can help you turn potential, unconvinced individuals into paying customers. Merchants who already accept PayPal as a payment option for customers can easily implement the Pay-in-Four system.

PayPal’s “Pay-in-Four” platform can scale with any business and help you provide various financing options to your customers. All you have to do is add a Pay Later button as another payment option on your checkout system. Afterwards, customers with an existing PayPal account can apply for the Pay-in-Four financing if their purchase is between $30 and $1,500.

PayPal’s “Pay-in-Four” Standout Features and Integrations

Features include business insights, reporting, automatic updates, debit and credit card processing, POS system, recurring payment, purchase protection, invoice management, and online checkout.

Integrations include BigCommerce, Wix, WooCommerce, GoDaddy, Adobe, Shift4Shop, XCart, Miva, Volusion, OpenCart, Cart.com, and Vortx.

PayPal’s “Pay-in-Four” is a free add-on for current PayPal merchants. When using the platform, you’ll only pay the regular 3.49% + $0.49/transaction.

Pros and cons

Pros:

- Simple organization.

- Easy to use.

- No additional costs.

Cons:

- High customer interest rates.

- Takes customers off your website.

Affirm helps your business provide flexible payment options wherever your customers shop for your products.

Why I picked Affirm: The platform is beneficial for ecommerce, in-store, and telesales transactions. They are Amazon’s choice for BNPL solutions. Affirm enables businesses to integrate buy-now-pay-later options for customers, no matter where they’re buying. You can use Affirm to show your customers flexible payment terms throughout your ecommerce site, including every product page and checkout, to make it easy for them to buy.

Affirm gives retailers complete control over the minimum amount customers spend to qualify for installments. You can choose whether to offer customers a 0% interest loan financing, where to show Affirm’s payment messaging, and how long your customers have to make payments. The platform also has a tool called Adaptive Checkout. This unique solution can update your customer’s loan repayment options when they add items to their cart, allowing them to see their purchase amount in personalized installment payments throughout your site.

Affirm Standout Features and Integrations

Features include business portal, credit card processing, ACH payment processing, activity dashboard, mobile payments, billing and invoicing, mobile app, and real-time analytics.

Integrations include Wix, Shopify, WooCommerce, Magento, BigCommerce, OpenCart, 3dcart, NetSuite SuiteCommerce, AmeriCommerce, Volusion, Web Shop Manager, PlanetScale, and Lightspeed eCommerce.

Affirm offers custom pricing upon request.

Pros and cons

Pros:

- Intuitive dashboard.

- Large customer purchase limits.

- No customer late fees.

Cons:

- Only works in the USA.

- Competition might get better rates.

Zip Co is a convenient option for businesses because customers can use it anywhere in the world if they use an Amex, Discover, or Visa credit card.

Why I picked Zip Co: Formerly Quadpay, Zip provides you with an opportunity to accept payments from customers anywhere in the world, as long as your business accepts payments from Amex, Discover, or Visa. The platform also has a community of customers that you can tap your business into to drive more traffic to your site. This combination of a global community and the ability to accept their payments means your business can enjoy a high average order value.

Zip Co lets your business put your customers first by providing convenient installments that won’t affect their credit scores. Zip Co lets your customers control their repayment schedule and set up weekly, biweekly, or monthly payments. When customers choose to make payments on a purchase, your business will get paid the same day from the vendor.

Zip Co Standout Features and Integrations

Features include order management, customer data management, merchant portal, reconciliation management, community marketplace, website widget, refund processing, and credit card processing.

Integrations include Salesforce, Shopify, WooCommerce, Magento, BigCommerce, Oracle Commerce, Workarea, and CartHook. Zip Co also provides an API to connect the platform to your current systems.

Zip Co offers custom pricing upon request.

Pros and cons

Pros:

- Responsive platform.

- Increases AOV.

- Easy to navigate.

Cons:

- No platform demo.

- No reporting.

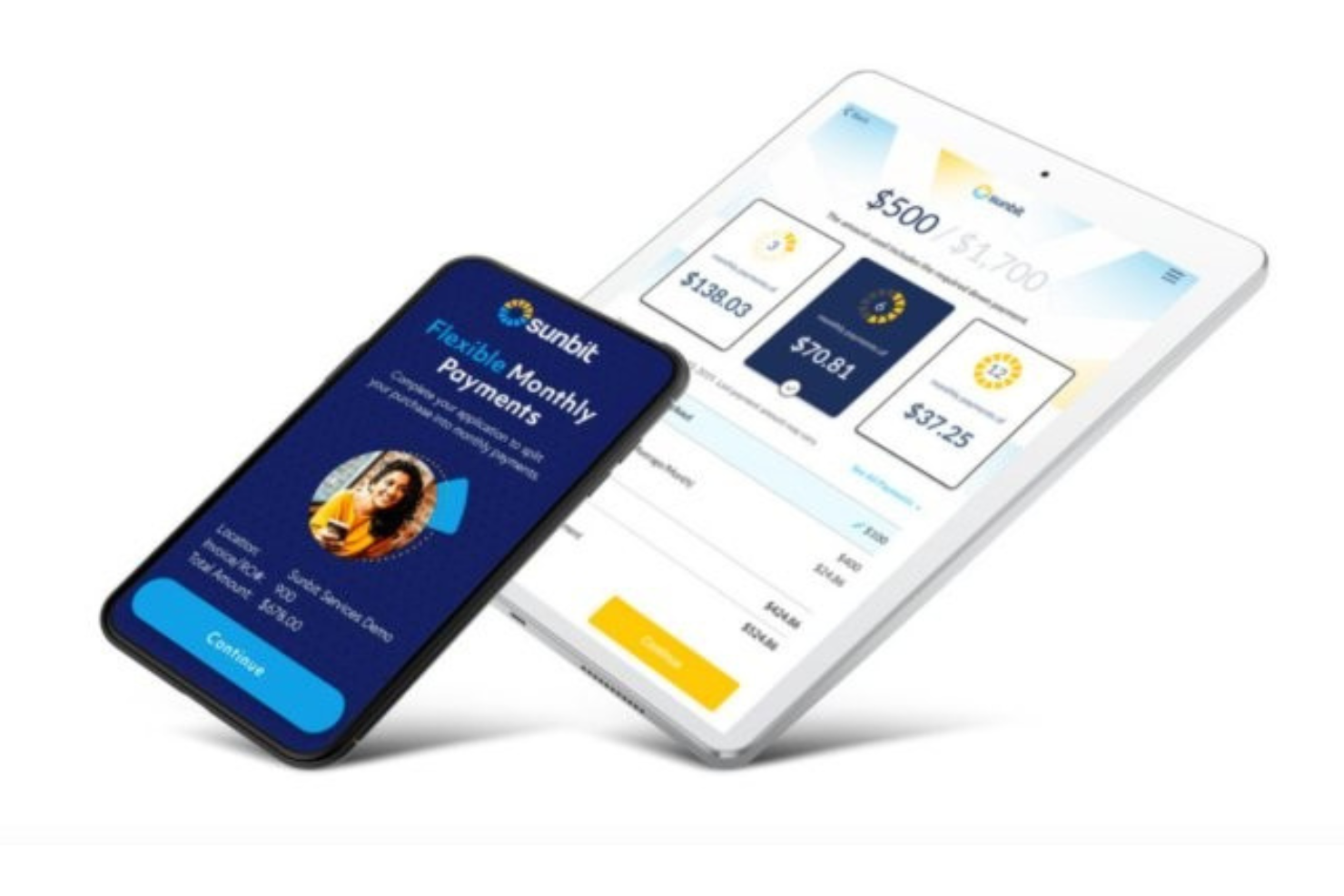

Sunbit helps you break down payments of your essential services for customers.

Why I picked Sunbit: Unlike other platforms that focus on merchants selling nonessential items, Sunbit sets itself apart by enabling businesses to offer installment options for in-person services, such as car repairs, eye doctor appointments, or veterinary care. It helps you soften the financial blow of your essential services for your customers. But, where it really shines is your business will now have a competitive because you can offer services to customers who might not have good credit.

Sunbit helps businesses that provide essential services to their customers and make them more affordable. With this platform, you can enable customers to pay for more of your services, up to $10,000, with a 3-to-12-month installment duration.

Sunbit Standout Features

Features include high approval rates, a quick application process, a partner success team, digital marketing resources, and actionable insights.

Sunbit offers custom pricing upon request. Sunbit offers a free demo.

Pros and cons

Pros:

- Excellent omnichannel solution.

- Caters to in-person businesses.

- Easy to use.

Cons:

- Requires a down payment.

- Must apply to discover costs.

Wisetack enables businesses to give customers transparent payment options for subscription-based products and services.

Why I picked Wisetack: The platform plugs into your current website and checkout process to enable your business to give customers payment installment options for services like subscription boxes or streaming services. Wisetack BNPL (Buy Now, Pay Later) is a financing solution that allows ecommerce businesses to offer their customers the option to pay for their purchases in installments instead of a lump sum payment. By integrating Wisetack BNPL into their ecommerce platform, businesses can offer their customers the flexibility to pay over time and potentially increase customer loyalty and sales.

Wisetack BNPL also offers various benefits to the businesses themselves, including reduced cart abandonment and improved cash flow, as customers are more likely to complete their purchase when given the option to pay in installments. Additionally, Wisetack BNPL provides businesses with valuable insights into their customers’ spending habits, helping them make informed decisions about inventory, marketing, and other business operations. Overall, Wisetack BNPL can be a valuable tool for ecommerce businesses looking to increase sales, retain customers, and improve their overall financial health.

Wisetack Standout Features and Integrations

Features include consumer financing, fast customer approvals, debit and credit card processing, and immediate payments.

Integrations include an API that integrates with your current systems.

Wisetack offers custom pricing upon request. Wisetack doesn’t have any free trial information.

Pros and cons

Pros:

- Payment term controls.

- Easy integrations.

- Excellent coordination with the vendor.

Cons:

- Must wait to receive funds.

- Fees can be high.

Afterpay provides a credit limit for your customers to make purchases on your ecommerce store and provides rewards for responsible spending.

Why I picked Afterpay: The platform sets sensible and transparent initial spending credit limits for those new to using Afterpay when buying products. This initial limit can increase when customers make their payments on time. The vendor also provides tips to help customers spend responsibly.

Afterpay works for retailers with online storefronts and in-store purchasing options. It has a simple, built-in integration with Square, which makes it easy to offer BNPL options from a Square POS system. You can also order a marketing kit from Afterpay to help you let your customers know you accept Afterpay as a payment option.

Afterpay Standout Features and Integrations

Features include ACH payment processing, fraud detection, electronic payments, data security, mobile payments, credit card processing, subscription billing, and transaction history.

Integrations include Ecwid, CS-Cart, Shopify, Wix, WooCommerce, Synder, Magento, BigCommerce, Cloud Funnels, Propeller, BridgerPay, and Salesforce Commerce Cloud.

Afterpay offers custom pricing upon request.

Pros and cons

Pros:

- Excellent support for merchants.

- No customer credit checks.

- Easy to use.

Cons:

- High interest on late payments.

- Some retailers can be denied.

Humm is a BNPL platform that helps customers break up significantly large purchases.

Why I picked Humm: As it says on the Humm website, this BNPL helps your customers buy “big things.” They help break down any purchase up to $30,000! Your customers can spread these payments out over five or ten payments every two weeks or up to 60 months for more significant purchases.

Humm guarantees to settle their payment upfront with your business the next business day. This can be significant if you’re a smaller business that relies on these payments. Also, if a customer returns an item to your store, Humm will return their fee on the items.

Humm Standout Features and Integrations

Features include flexible repayments, soft credit checks, and online and in-store purchase processing.

Integrations include Salesforce, Shopify, WooCommerce, Magento, Striven POS, PrestaShop, OpenCart, Kitomba, Retail Directions, Shopify Plus, Intershop, and eStar.

Humm offers custom pricing upon request.

Pros and cons

Pros:

- Simple sign-up process.

- Direct REST API.

- Customers can make large purchases.

Cons:

- High customer fees.

- Customer support needs work.

Uplift enables businesses to offer payment transactions within the travel industry.

Why I picked Uplift: If your ecommerce business operates in the travel industry, Uplift can help you reach more customers by offering installment options. You can provide transaction payments for totals as large as $25,000 with terms between six weeks to 24 months. Every transaction happens directly in your purchase workflow, so there’s no need to redirect the customer to another webpage to make a payment.

Uplift allows you to offer your customers a simple way to book travel plans immediately and make payments over time. They also don’t charge any late fees or pre-payment penalties, allowing your customers to book more trips while you reap the benefits. Thanks to the Uplift platform, your customers can even gift their family and friends a trip through your website.

Uplift Standout Features and Integrations

Features include fast approval process, installment loans, payment processing, and an API.

Integrations include an API that allows you to connect the platform to your current systems.

Uplift offers custom pricing upon request.

Pros and cons

Pros:

- No fees ever.

- Increases flight bookings.

- Straightforward application process for customers.

Cons:

- Issues with customer refunds.

- Poor customer service.

Related Ecommerce Software Reviews

If you still haven't found what you're looking for here, check out these related ecommerce tools that we've tested and evaluated.

- Ecommerce Platforms

- Inventory Management Software

- Payment Processing Software

- Shopping Cart Solutions

- Order Management Systems

- Warehouse Management Software

Our Selection Criteria for BNPL Platforms

Choosing the right BNPL platform is a critical step for ecommerce businesses. It’s not just about offering installment payments—it's about finding a solution that enhances customer experience, integrates smoothly, and drives real business results.

Core functionality (25% of total weighting score)

These are the essential features every BNPL platform needs to provide:

- Seamless integration with both online and physical stores.

- Instant credit approval to ensure a fast and frictionless checkout process.

- Flexible payment plans that cater to different customer needs.

- Transparent fee structures, so there are no hidden costs for either merchants or consumers.

- Secure and compliant transaction processing, meeting industry standards for protecting sensitive data.

Additional standout features (25% of total weighting score)

Platforms that bring extra value through innovative features stand out:

- Customizable payment options that let you adjust plans based on consumer behavior or seasonal trends.

- Integration with loyalty and rewards programs to boost customer retention.

- I test these features by simulating real-world scenarios to assess their execution and impact.

Usability (10% of total weighting score)

Usability is crucial for both merchants and customers:

- The platform should have an intuitive interface that simplifies the checkout process.

- Clean, user-friendly design that balances powerful functionality with ease of use.

Onboarding (10% of total weighting score)

Quick and seamless onboarding is essential:

- The platform should provide detailed guides, tutorials, and chatbot assistance to make setup easy.

- Smooth onboarding helps merchants integrate the system quickly, and consumers can start using it without confusion.

Customer support (10% of total weighting score)

Great customer support is non-negotiable:

- Fast response times and multiple support channels (live chat, email, phone) are critical.

- Knowledgeable support teams who can effectively resolve issues.

Value for money (10% of total weighting score)

The pricing should reflect the platform's value:

- Transparent pricing with no hidden fees for merchants or consumers.

- Flexible plans that scale with your business as it grows.

Customer reviews (10% of total weighting score)

User feedback can reveal a lot about the platform:

- High satisfaction rates based on ease of use, reliability, and support.

- Positive feedback highlighting business impact, such as higher average order values and improved customer retention.

When weighing BNPL platforms, these criteria help you find a solution that fits your business needs while adding measurable value.

What is a Buy Now, Pay Later Platform?

A buy now, pay later (BNPL) platform lets your customers break up their purchase into smaller, often interest-free payments, while you get paid up front—no waiting, no awkward conversations about credit cards or budgets.

It gives shoppers the flexibility they want and helps you avoid abandoned carts.

BNPL is especially popular with younger and budget-conscious buyers, and it’s gaining traction in areas like travel, healthcare, and education.

By offering BNPL, you show your customers you understand their needs and are ready to meet them where they are.

How to Choose the Best BNPL Platform

BNPL isn’t one-size-fits-all. The best platform for your store depends on your business model, tech stack, customer base—and how much you value things like global reach or responsible lending. Here's how to narrow it down.

| Step | What to do | Why it matters |

|---|---|---|

| 1. Define the real pain point | Are you solving cart abandonment, boosting AOV, or just giving buyers flexibility? Nail the “why.” | Keeps you focused and avoids shiny-feature syndrome. |

| 2. Know who’s using it | Is this just for your ecommerce team, or do support, finance, and in-store staff need access too? | Influences your UI needs, onboarding process, and user seats. |

| 3. Check your stack | Confirm the platform integrates with your POS, CRM, ERP, and ecommerce platform. | No one wants to rip-and-replace—or Frankenstein a stack that doesn’t talk. |

| 4. Think local + global | Need global coverage? Look for platforms with regional availability, multi-currency support, and localized compliance. | Not all BNPLs are everywhere. Zip covers more countries than Affirm, for instance. |

| 5. Look under the hood | Ask about soft vs. hard credit checks, automated approvals, and customization options. | Impacts UX and conversion rates. Also helps you avoid regulatory snags. |

| 6. Match your brand values | Want a provider that gives a damn? Look for social impact initiatives, ethical lending caps, and transparent fee structures. | Your customers care. So should your checkout. |

| 7. Run the numbers | Consider transaction fees, any fixed monthly costs, and what you’re getting in return (like co-marketing). | Low-fee providers may skimp on support or reach. Make it pencil. |

| 8. Define success now | Know how you’ll measure success—more conversions, bigger carts, faster checkout? | Set benchmarks early so you don’t end up with buyer’s remorse later. |

Trends in BNPL Platforms for 2026

BNPL is growing up—and fast. But the loudest trends aren’t always the most important. Here’s what savvy ecommerce operators should actually be watching in 2026:

- Funding rounds are creating feature bloat. BNPL giants are flush with VC cash—and it shows. Many are prioritizing splashy partnerships and flashy dashboards over actual checkout performance. Merchants need to cut through the noise and test what actually moves conversions.

- Platforms are going niche, not broad. Instead of trying to be everything to everyone, newer BNPLs are carving out lanes—like Sunbit in essential services or Wisetack in subscriptions. Picking a generalist may mean missing out on features tailored to your vertical.

- Ethical lending is now a competitive edge. Younger shoppers don’t just want payment flexibility—they want to feel good about using it. Providers like Afterpay are baking in guardrails (like soft caps and education) that signal responsibility without punishing the buyer.

- Localization is replacing global expansion. The smartest BNPL players aren’t just launching in new countries—they’re adapting to them. That means region-specific UX, local language support, and payment plans that reflect cultural norms, not just exchange rates.

- BNPL marketplaces are the new affiliate channel. Klarna, Zip, and others are pushing curated marketplaces to drive traffic to merchants using their platforms. For brands, that means free exposure—but also increased dependence on third-party ecosystems.

- Regulatory pressure is reshaping the product. In markets like the UK and EU, regulation is forcing BNPL providers to simplify language, cap fees, and make risks more transparent. For ecommerce brands, that means fewer surprises—but also less room to customize terms.

- The best providers are prioritizing B2B next. BNPL for business purchases—think wholesale, SaaS subscriptions, or SMB procurement—is on the rise. If your customers aren’t end consumers, this next wave could be your sweet spot.

- Creditworthiness is becoming dynamic and real-time. Traditional FICO scores are giving way to real-time, AI-powered risk assessments based on behavior, not just history. That means more approvals—and fewer defaults—if you pick a smart provider.

Key Features of BNPL Platforms

A good BNPL platform does more than split payments—it should drive conversions, reduce friction, and align with your brand’s values. Here’s what to look for:

- Instant credit approval. Customers can get approved on the spot with soft credit checks, making the checkout flow fast and low-friction.

- Flexible payment plans. Most BNPL services offer multiple options—like 4 interest-free payments or extended financing up to 60 months.

- Seamless platform integration. Top providers offer plug-and-play support for Shopify, Magento, POS systems, and even custom stacks via API.

- Global readiness. Leading platforms offer multi-currency support, local payment methods, and regulatory compliance by region.

- Ethical and responsible lending. Look for spending caps, late fee transparency, and built-in education tools that support smarter consumer finance.

- Mobile-optimized experiences. Mobile-first design and dedicated apps make it easy for shoppers to apply, manage payments, and buy again.

- Transparent merchant fees. You should know exactly what you’re paying per transaction—and what you’re getting for it.

- Automatic payments and reminders. Platforms automate deductions and send smart nudges to help reduce missed payments (and bad debt).

- Customer insights and analytics. Get data on buyer behavior, repayment patterns, and AOV impact—then use it to iterate your funnel.

- Co-branded marketing tools. Some platforms (like Klarna or Afterpay) offer merchant toolkits, co-marketing campaigns, and marketplace placement.

Top Benefits of BNPL Platforms

BNPL platforms are performance tools. They improve conversions, unlock new customer segments, and support smarter, more flexible checkout experiences. Here's what else:

- Lift in cart size and conversion rates. Splitting payments reduces sticker shock and increases purchase confidence, especially on high-ticket items.

- Upfront payments for merchants. You get paid right away. The BNPL provider handles the collection risk, not you.

- Access to underbanked and younger consumers. These platforms serve buyers without traditional credit cards or strong credit scores—helping you reach new audiences.

- Cross-border scaling made easier. BNPL platforms with global coverage handle compliance, currency, and regional quirks so you don’t have to.

- Better post-purchase sentiment. Customers appreciate low-friction, interest-free options—leading to more positive experiences and higher retention.

- Built-in tools for financial health. Some providers include payment reminders, caps, and budgeting features to keep consumers in control.

- Smarter approvals through real-time data. AI-based risk assessments expand approvals while limiting defaults, even for new buyers.

- More marketing reach. Klarna, Zip, and others offer built-in marketplaces, co-branding, and campaigns that send traffic back to your site.

Cost & Pricing for BNPL Platforms

BNPL platforms have varying pricing structures depending on the provider and your business needs.

Most platforms charge a percentage-based transaction fee, with some also incorporating additional fees for smaller merchants or low-volume accounts.

Here’s a breakdown of current BNPL pricing trends and a comparison of some popular platforms:

| Platform | Transaction Fee | Interest Rate (Consumer) | Best For |

|---|---|---|---|

| Sezzle | 6% + $0.30 per transaction | 0% for "Pay in 4" | Best for helping customers build credit, especially younger consumers looking to establish credit history. |

| Klarna | 3.29% to 5.99% + $0.30 per transaction | 0% for "Pay in 4" and "Pay in 30"; 19.99% for longer terms | Ideal for fashion and luxury brands due to its strong consumer base and marketplace integration. |

| PayPal Pay Later | 1.9%-3.49% + $0.49 per transaction | 0% for "Pay in 4"; 9.99%-35.99% for monthly payments | Best for businesses already using PayPal as a payment gateway. |

| Uplift | 2-4% per transaction | 0% interest; custom terms up to 24 months | Best for businesses in the travel industry, enabling large bookings with flexible repayment. |

| Zip (formerly Quadpay) | 4-5% per transaction | 0% for "Pay in 4" | Best for global payments, especially merchants looking to serve international customers. |

| Humm | 3-6% per transaction | 0% for installments; custom plans up to 60 months | Best for large purchases (up to $30,000) across industries like furniture or high-end goods. |

| Afterpay | 4-6% + $0.30 per transaction | 0% for "Pay in 4" | Best for retailers targeting younger, budget-conscious consumers with responsible spending limits. |

Key considerations:

- Transaction fees: Most platforms, such as Sezzle, Afterpay, and Zip, charge 4-6% per transaction. Uplift's fees tend to be lower at 2-4%, especially for travel-related purchases.

- Consumer interest rates: Interest-free options are common for short-term plans, but longer-term options can carry interest rates as high as 36%, depending on the platform and the consumer's credit.

- Best for: Each platform caters to specific types of businesses. For example, Sezzle is great for younger consumers building credit, while Uplift is perfect for high-ticket items in industries like travel and luxury goods.

When selecting a BNPL provider, balance the transaction fees and additional costs against the platform’s features and how well they fit your target audience.

BNPL Platforms FAQs

You’ve read a lot at this point (or else you’ve scanned a lot). Either way, we guessed at some lingering questions you may have, then endeavored to answer them for your edification.

What are the most popular BNPL providers?

The biggest names in BNPL include Afterpay, Klarna, Affirm, PayPal Pay Later, and Zip. These platforms excel with flexible payment plans, strong integrations, and customer trust.

Regional players like Clearpay (UK) and Sezzle (US) are also growing rapidly. Klarna leads in fashion and luxury, while Affirm is known for high-ticket purchases like electronics or furniture. Emerging players like Splitit focus on offering installment plans directly through credit cards without new credit lines.

What happens if a customer misses a payment on a BNPL plan?

Most BNPL platforms charge late fees if a customer misses a payment, but the policies vary:

- Afterpay charges $10 per missed payment, capped at 25% of the order value.

- Klarna charges late fees after a grace period, but the amount depends on the region.

- Affirm doesn’t charge late fees but reports missed payments to credit bureaus, which could impact the customer’s credit score.

Merchants can mitigate missed payments by clearly communicating repayment terms upfront and offering reminders through email or SMS. This ensures a smoother customer experience and maintains loyalty.

How can BNPL improve my customer conversion rates?

BNPL can significantly boost your conversion rates and average order value. By giving customers the option to pay in installments, you reduce the sticker shock for larger purchases. Customers are more likely to buy when they don’t have to pay the full amount upfront—leading to fewer abandoned carts and increased revenue. Many merchants see a jump in conversions, sometimes up to 20-30%, after adding BNPL options.

Can I negotiate lower transaction fees with BNPL providers?

Yes, you can negotiate lower transaction fees—especially if your business processes high transaction volumes. To strengthen your position:

- Show evidence of your sales volume and consistency.

- Highlight how your offerings align with the BNPL provider’s target industries.

- Explore bundling marketing fees or co-promotions for better overall terms.

If you’re driving significant revenue through BNPL, don’t hesitate to negotiate for better margins.

What are the hidden costs of offering BNPL?

While BNPL can increase sales, be aware of hidden costs:

- Transaction fees: Typically 4-6%, which can impact margins.

- Marketing fees: Platforms like Klarna charge extra to feature your brand in their marketplace.

- Customer dissatisfaction: Late fees may create negative experiences, reducing loyalty.

To offset these costs, track ROI from BNPL sales closely, negotiate transaction fees, and ensure clear communication about repayment terms to customers.

How do BNPL platforms handle refunds?

Refund policies vary by platform but generally involve merchants issuing refunds directly to the BNPL provider. The provider then adjusts the customer’s payment schedule or issues a refund for completed payments. Merchants should understand their BNPL partner’s refund policies to avoid delays or customer confusion.

What types of businesses benefit most from BNPL?

BNPL is particularly effective for industries with high-ticket or discretionary purchases, such as electronics, fashion, furniture, travel, and healthcare. It can also work well for businesses targeting younger or credit-averse demographics.

Additional Ecommerce Payment Software Reviews

If you are looking for BNPL software, you might be interested in these related software reviews, as well. They all focus on ecommerce finances, payments, or tax management.

- Point-of-Sale (POS) Software

- Mobile Payment Solutions

- Ecommerce Sales Tax Software

- Ecommerce Fraud Prevention Software

What's Next?

If you're in the process of researching buy now, pay later platforms, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.