Payment processing fees, chargebacks, and hidden costs can quietly drain your ecommerce margins if not closely monitored. Understanding these elements is crucial for maintaining healthy profit margins.

A dedicated merchant account allows businesses to negotiate pricing, implement advanced fraud prevention, and access detailed transaction reports, offering greater control over financial operations compared to one-size-fits-all solutions.

Keeping merchant accounts, payment gateways, and processors separate offers ecommerce businesses more flexibility for integration, negotiation, and switching providers compared to bundled solutions.

For international success, ensure your merchant account supports multi-currency transactions and diverse payment methods, addressing consumer expectations and avoiding lost sales due to payment barriers.

Understand flat-rate, tiered, and interchange-plus fee structures. Opt for transparency to avoid hidden costs and negotiate better terms, keeping your payment processing expenses under control.

Payment processing: the part of your ecommerce business that’s confusing by design—and quietly drains your margins if you’re not watching.

You think you’re getting a fair deal, but then processing fees, chargebacks, and random line items show up, eating away at your profit.

Every provider says the same thing: “low rates, fast setup, and 24/7 support.” Most deliver hidden fees, generic dashboards, and a support line that might as well be a suggestion box.

This guide is for you if you want:

- Clarity on real costs. Learn what you’re actually paying for every card swipe, ACH transfer, and digital wallet transaction.

- Better support. Cut through the tier-one nonsense and get direct access when you need it.

- Solid integrations. Make your ecommerce platform, POS, and shopping cart work together—no patch jobs required.

- Leverage in negotiation. Don’t settle for “one size fits all” pricing or “industry standard” transaction fees.

You’ll walk away knowing which ecommerce merchant account makes sense for your business, what features actually matter, and how to stop losing money to your own payment processor.

Let’s get into it.

What is an Ecommerce Merchant Account?

An ecommerce merchant account is a business bank account set up specifically to handle online payments from credit cards, debit cards, and other electronic payment methods.

When a customer checks out on your ecommerce website or in your brick-and-mortar store, the funds don’t go straight to your main bank account—they land here first, then get released after processing fees and compliance checks are cleared.

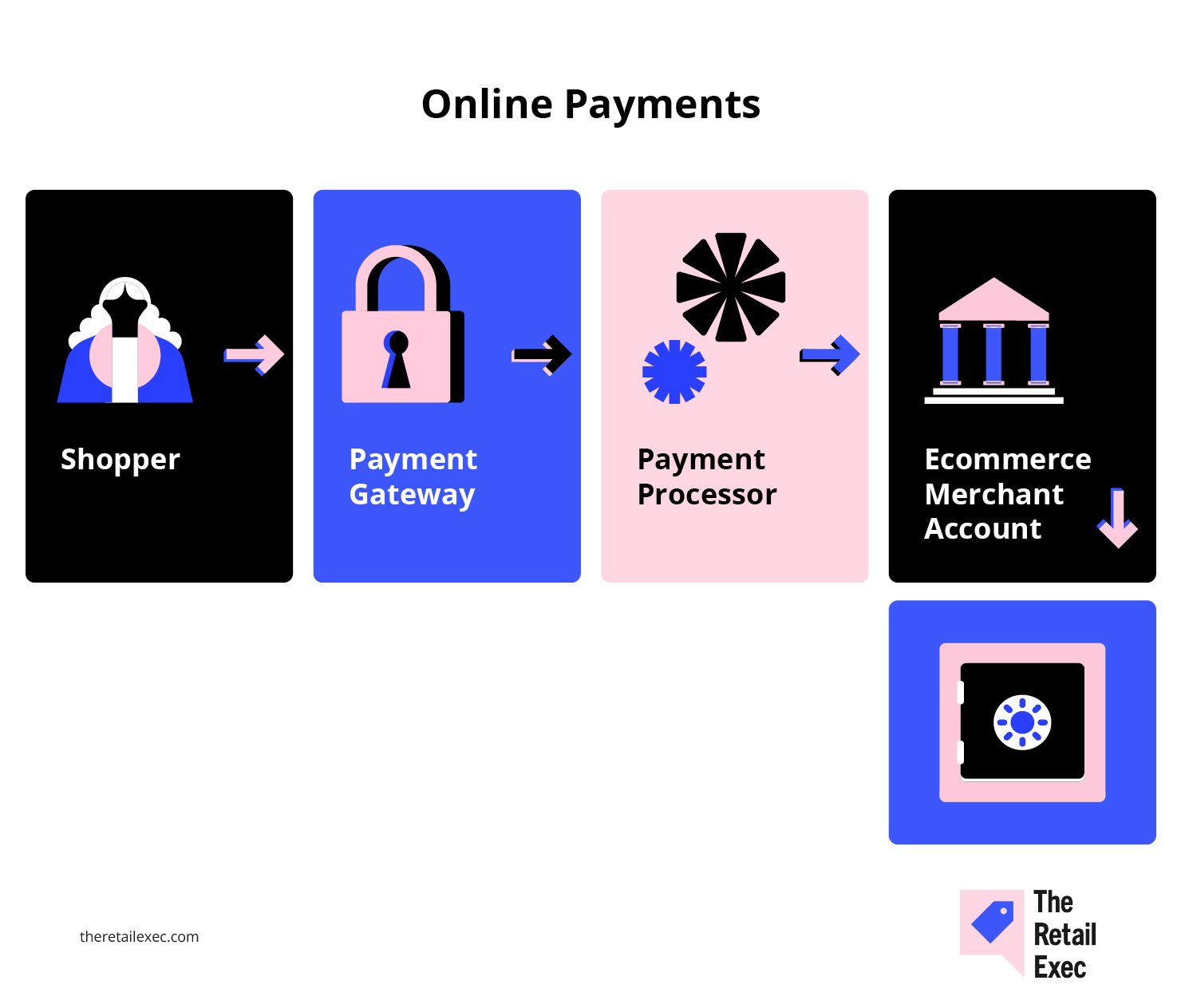

Here’s how it fits into the payment processing chain:

- Not a payment gateway. The gateway securely transmits your customer’s payment information from your shopping cart to the payment processor.

- Not the processor. The processor actually moves the money between banks and card networks like Visa, Mastercard, or ACH.

- It’s your control point. With a dedicated merchant account, you can negotiate your own pricing, use advanced fraud prevention, and track detailed reporting on every fee and transaction.

Jonathan Saluk, a merchant services consultant, puts it simply:

A dedicated merchant account gets you: lower fees, better fraud tools, dedicated support, funding reliability, and control over your business’s financial engine.

If you want leverage with your payment solutions, and you’re tired of feeling boxed in by all-in-one providers like PayPal or Stripe, owning your merchant account is the first step.

For businesses doing serious volume, it means more flexibility, more data, and—often—more money in your pocket.

Ready to learn more? Check out our primer on what is merchant payment processing for additional background.

Merchant account vs payment gateway vs processor

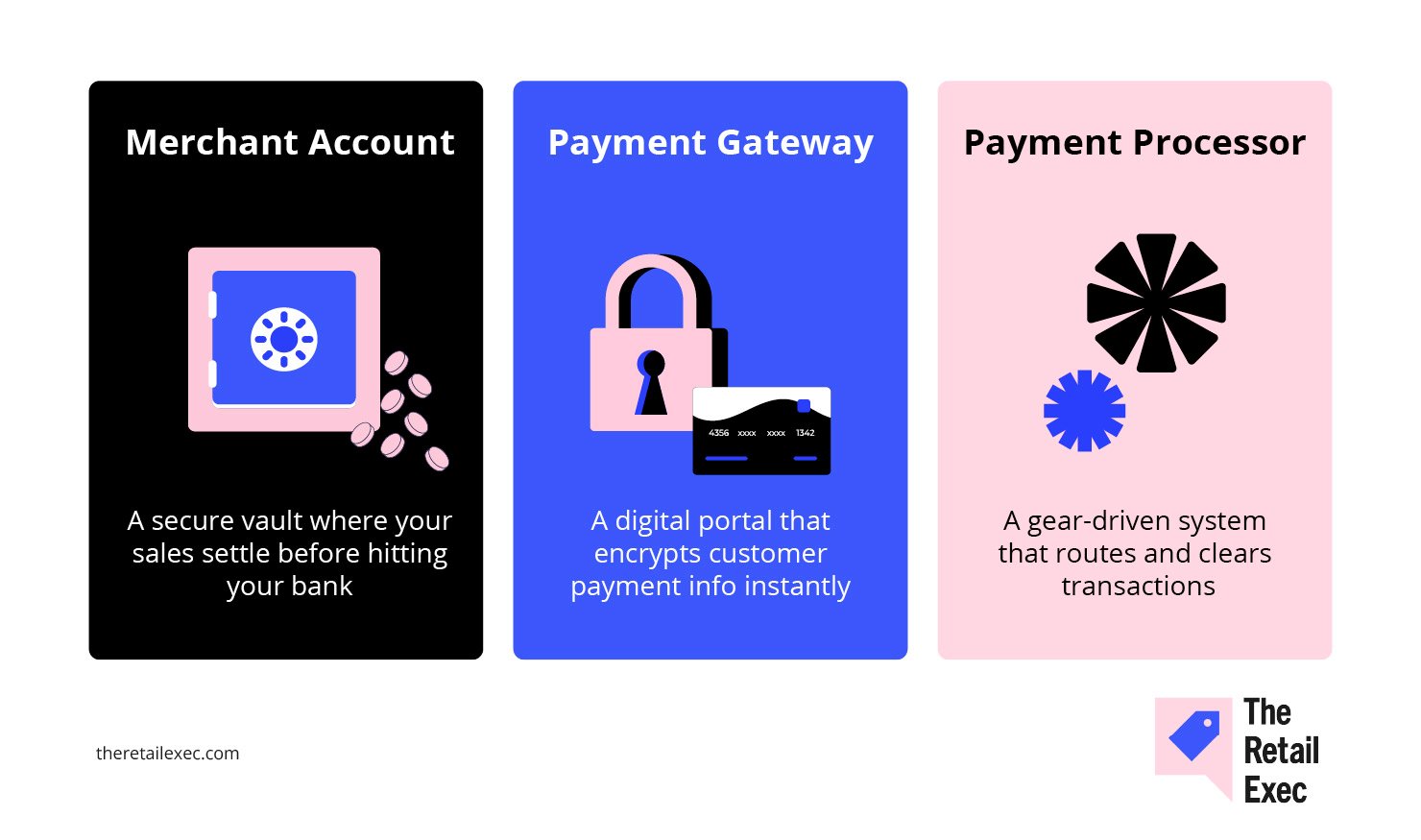

It’s easy to get lost in payment jargon, so let’s break down the three big pieces you’ll deal with in any ecommerce payment setup:

- Merchant account. This is the business bank account that holds funds from each sale before the money hits your primary account. It’s the step that lets you accept credit card payments, debit cards, ACH, and other electronic payments in your online store or at your point-of-sale.

- Payment gateway. This is the secure tech that moves your customer’s payment info from your checkout or shopping cart to the processor. Think of it as the connection between your ecommerce platform (like Shopify) and the processor’s systems. Popular gateways include Authorize.Net and, in some setups, Stripe.

- Payment processor. This is the company that actually runs the show behind the scenes—moving money between banks, managing settlements, handling Visa, Mastercard, and American Express networks, and dealing with transaction approvals and declines.

Why does this matter?

- Separation = flexibility. Keeping these roles separate gives you more freedom to swap out your payment gateway, choose different processors, or negotiate better pricing with each provider as your ecommerce business grows.

- Bundled solutions can be easier—but come with tradeoffs. Using an all-in-one service (like PayPal or Stripe) means less setup hassle, but often higher fees, less transparent reporting, and less leverage on support or custom integrations.

If you’re running a small business and want simplicity, a bundled solution might be fine.

If you care about cost, data, and control—especially as you scale your online business or expand to in-store payments—it’s worth keeping these roles separate.

Dive deeper into real-world examples of each role in our detailed breakdown of merchant account vs payment gateway.

Why your business needs a dedicated merchant account

Here’s the hard truth: sticking with generic, bundled payment solutions means you’ll always pay more and get less control.

If you want to run a serious ecommerce business—or scale your online store beyond side-hustle territory—a dedicated merchant account is the upgrade.

The actual advantages:

- Lower costs for real volume. According to ClearlyPayments, a business processing $1 million a year can cut its effective processing rate to around 2% with a dedicated account, compared to about 2.6% with an aggregator. That’s $6,000 a year back in your pocket just for switching.

- Better fraud prevention tools. Online sellers in the US and Europe reportedly spend close to 10% of revenue managing payment fraud (including losses and operational costs). With a dedicated merchant account, you unlock features like behavioral analysis, custom rule sets, and 3D Secure, which can reduce both fraud losses and false declines.

- Stronger support and more transparency. Aggregators treat you like another ticket in the queue. A dedicated provider offers real customer support, detailed reporting, and more insight into every line item on your statement—so you can actually optimize your payment flow and catch issues before they snowball.

- Control and flexibility. With a standalone merchant account, you’re not locked into one provider’s ecosystem. You can negotiate rates, switch out gateways, add payment methods like Apple Pay or ACH, and react fast if your business changes.

If you’re planning to scale your online store, open new locations, or experiment with new payment options, the extra flexibility and potential savings are real.

For anyone beyond the early small business stage, a dedicated merchant account isn’t just an upgrade—it’s protection for your margins and your sanity.

Pre-Selection Checklist

Before you apply for a merchant account, make sure you’re set up to pass underwriting with minimal headaches.

Here’s what every payment processor and merchant services provider is looking for:

- Registered business entity and federal tax ID. You need an LLC, corporation, or similar structure, plus your EIN from the IRS. No legal business, no merchant account.

- Dedicated business bank account. Mixing business and personal funds is a red flag for any provider. Have a separate account just for your ecommerce or retail business.

- 3–6 months of sales and payment data. Processors want proof you actually process payments: average ticket size, monthly volume, refund rates, and chargebacks. Pull statements from your previous payment service or platform (like Shopify, Stripe, or PayPal).

- A live website and refund policy. Your ecommerce website should be up and running, with a clear refund policy posted for customers and underwriters to review.

- PCI DSS compliance documentation. If you handle or store credit card data, you’ll need to show your PCI compliance certificate or self-assessment.

Get these ducks in a row, and you’ll breeze through most approval processes, whether you’re a new online business or scaling up your payments stack.

Key Features Every Retailer Should Prioritize

Picking the right merchant account features can directly boost your profits, streamline operations, and expand your reach. Below are the core features we’ll explore in detail:

Multi-currency and international support

Selling online means you’re competing for global wallets, not just local ones.

In the last year, 55% of online shoppers worldwide bought from a foreign ecommerce website. Even more telling: 92% of buyers want prices shown in their own currency, and 33% will ditch their cart if you force them to pay in USD.

Kai Wu, Chief Revenue Officer at Airwallex, puts it bluntly:

Ecommerce is more global than ever… With the global cross-border ecommerce market set to reach $7.9 trillion by 2030, it is critical for international merchants to solve consumer pain points and deliver the best possible customer experience in order to thrive in this competitive market

What should you look for in a merchant account provider?

- Automatic currency conversion and local settlement. Accept payments in any currency, get settled in your own bank account, and skip the surprise conversion fees.

- Support for regional payment methods. Go beyond Visa and Mastercard—think iDEAL, Alipay, and other local options that buyers trust.

- Clear international pricing. Cross-border fees and FX charges shouldn’t be a guessing game. Make your provider show you the math.

Dynamic currency conversion is a trap—demand true multi-currency pricing with transparent FX rates and localized payment methods like SEPA or iDEAL if you’re shipping globally

If you want international sales, build for international payments—or settle for local results.

Recurring billing and subscription tools

If your ecommerce business relies on memberships, subscriptions, or repeat orders, recurring billing isn’t optional—it’s the foundation of predictable revenue.

The numbers back it up: just a 5% improvement in customer retention can boost profits by up to 95%.

But here’s where most payment solutions fall short:

- Card updater and retry logic. Too many subscriptions fail because of expired cards. You want a merchant services provider that automatically updates cards and retries failed payments before you lose a customer for good.

At minimum, look for auto-retries on failed cards, dunning workflows, and secure card vaulting. Revenue recovery from failed payments is just as important as initial billing—especially for high-churn verticals. Also look for subscription and membership management plug-ins to your shopping cart—you may find better stand-alone solutions.

- Flexible subscription management. Look for features like customizable billing intervals, easy plan changes, and built-in dunning management to minimize involuntary churn.

- Integrations that save you time. Your merchant account should connect smoothly to your ecommerce platform, CRM, and accounting tools—whether you’re using Shopify, a custom API, or something in between.

Automated recurring billing isn’t just about convenience. It’s how you keep recurring revenue actually recurring.

Digital wallets and Buy Now, Pay Later options

Modern shoppers want payment options that match how they live—fast, flexible, and frictionless. If your checkout doesn't support wallets and buy now, pay later platforms, you're leaving serious money on the table.

- Wallets drive mobile conversions. Adding Apple Pay or Google Pay can boost mobile checkout rates by up to 62%. If your payment processor or ecommerce platform doesn’t support these out of the box, you’re making it too hard for shoppers to pay.

- BNPL increases completions. Buy Now, Pay Later isn’t just hype—providers report a 20–30% lift in cart completions after enabling it. Just be clear on the transaction fees and the real impact on your bottom line.

- Check the details. The best merchant account providers offer simple integrations, transparent BNPL pricing, and real-time approval metrics. Don’t settle for manual add-ons or buried support.

Silvija Martincevic, chief commercial officer at Affirm, tells it how it is:

Nearly half of consumers will only complete a purchase if a merchant offers a pay-over-time option at checkout…

This shows how important it is for retailers to offer customers payment flexibility that will not only increase conversion rates, but will also help to bring those customers back.

What this all means: If your payment stack can’t keep up with changing consumer expectations, you’ll lose them to the merchants who can.

Reporting & analytics

Want to know where your money’s going? Don’t count on your bank statement to tell the whole story. Detailed analytics aren’t a luxury for ecommerce businesses—they’re the difference between guessing and knowing.

Too many merchant account providers bury you in PDFs and call it “reporting.” What you need instead:

- Real-time dashboards showing your approval rates, declines, and transaction fees as they happen. Waiting for end-of-week or monthly summaries? You’re already behind.

- Deep filters and custom exports that let you zoom in on AMEX chargebacks, monitor how much you’re paying for debit card payments, or pinpoint which payment gateway is slow on the draw.

- Automated alerts for trouble—chargebacks, funding delays, weird volume spikes. Set thresholds so you get pinged when something’s actually off, not just when the marketing team wants to brag.

- Full transaction-level drill-down, including metadata, timestamps, and settlement details. This is how you win disputes, spot fraud patterns, or catch a processor “error” before it costs you real money.

If you’re stuck guessing why last month’s payout dropped or can’t explain sudden fee spikes to your accountant, your current provider isn’t giving you the analytics you need.

Demand more, or take your payment processing elsewhere.

Support & funding SLAs

There’s nothing like a payment problem to ruin your day—or your week—especially when you can’t get a straight answer from your merchant services provider. Support and funding speed should never be a guessing game.

What sets apart the good from the forgettable?

- Real support, on your schedule. Look for guaranteed response times: one hour or less for critical issues, and support channels beyond just email. If your online business processes payments 24/7, your provider should have humans on call 24/7—phone, chat, and email.

- Consistent settlement times. Industry standard is 1–3 business days for card transactions to hit your business bank account, but some providers can do same-day or even instant payouts (for a price). Slow or unpredictable funding delays your ability to order inventory, pay staff, or just sleep at night.

- Uptime guarantees. Don’t accept anything below 99% system uptime, but aim higher—99.9% or above. Downtime at checkout means lost sales, angry customers, and bad reviews.

- Chargeback and dispute help. Fast notification and access to dispute specialists can be the difference between eating a loss and keeping your cash.

Before you sign, stress-test their claims. Open support tickets at off-hours. Ask how they handle a failed payout or a fraud spike.

Providers that stumble here are likely to disappear when things go sideways.

High-risk merchant considerations

Selling CBD, supplements, travel, adult content, or anything else banks consider “high-risk?” Get ready for a different set of rules—and much higher costs.

What changes when you’re a high-risk merchant?

- Higher transaction fees. Expect to pay 3.5%–6.5% per card transaction, sometimes more. That’s the price for industries with higher fraud and chargeback rates.

- Monthly fees and rolling reserves. Monthly service charges usually land between $10 and $75. Processors may also hold back 5%–15% of your volume for 90–180 days as insurance against chargebacks.

- Steep chargeback penalties. Every disputed transaction can cost you $25–$50 on top of the refund.

- Extra scrutiny during underwriting. You’ll need airtight documentation—business formation papers, processing history, product/service descriptions, and sometimes even bank references. Be ready to explain everything.

Not all merchant account providers will touch high-risk merchants, and the ones that do vary wildly in their terms and service quality.

Top specialist providers like PaymentCloud, HighRiskPay, and National Processing can get you set up, but always compare not just rates, but also reserve release schedules and dispute support. Our comprehensive guide to ecommerce merchant services breaks down these providers in detail.

If you’re in a high-risk vertical, treat your payment stack as a business-critical asset—because for you, it absolutely is.

Understanding Fee Structures for Merchant Accounts

Nothing eats profits faster than bad pricing—or not knowing what you’re really paying. Every provider claims their pricing is simple. Spoiler: it rarely is.

There are three main pricing models you’ll see in merchant services:

Flat-rate pricing

This model charges one fixed percentage plus a flat fee for every card transaction—think 2.9% + $0.30 for credit card payments, no matter what.

It’s dead simple and easy to predict, but usually pricier for businesses processing high volumes or lots of in-person, debit card payments.

Tiered pricing

Here’s where things get murky.

Transactions get sorted into “qualified,” “mid-qualified,” or “non-qualified” buckets. You’ll see an advertised rate (“as low as 1.8%!”), but unless you live in the fine print, most of your sales will hit those higher, less favorable tiers.

Bottom line: Tiered pricing hides real costs and is almost never the best deal for established online stores.

Start with the effective rate—your total fees divided by total processed volume. Then inspect line items like non-qualified rates, cross-border fees, and monthly minimums.

Most importantly, check for the fully loaded landed cost—tariffs, processing, base cost, etc.

With the recent tariff and de minimis changes, these can catch you by surprise and quietly bleed margins if you’re not looking past the teaser rate.

Interchange-plus pricing

The gold standard for transparency. You pay the actual interchange fee set by the card networks (Visa, Mastercard, American Express) plus a fixed markup from your provider—e.g., interchange + 0.30% + $0.10.

Your statement spells out exactly where every penny goes, making it easier to negotiate and spot hidden charges.

Example cost comparison (based on $100 average ticket × 1,000 transactions):

| Pricing model | Rate example | Avg ticket × volume | Estimated fees |

|---|---|---|---|

| Flat-rate | 2.9% + $0.30 | $100 × 1,000 | (0.029×100×1,000) + (0.30×1,000) = $3,200 |

| Tiered (qualified) | 1.8% | $100 × 1,000 | (0.018×100×1,000) = $1,800 |

| Interchange-plus | interchange + 0.30% + $0.10 | $100 × 1,000 | ((0.021×100×1,000)+(0.003×100×1,000))+(0.10×1,000) = $2,500 |

How to use:

Replace the $100 × 1,000 with your own average ticket and monthly transaction count, then use the math in the last column to see your real fees under each model.

Pro tips:

- Flat-rate is for simplicity. Small business, low volume, want zero surprises? Go flat-rate.

- Tiered pricing benefits the processor. If it looks too good to be true, it probably is.

- Interchange-plus is for transparency. High-volume merchants can negotiate lower markups and avoid gotchas.

Before you sign, make every provider lay out every possible fee—monthly, per transaction, refunds, chargebacks, PCI compliance, statement fees, you name it. If they dodge or “can’t say,” run.

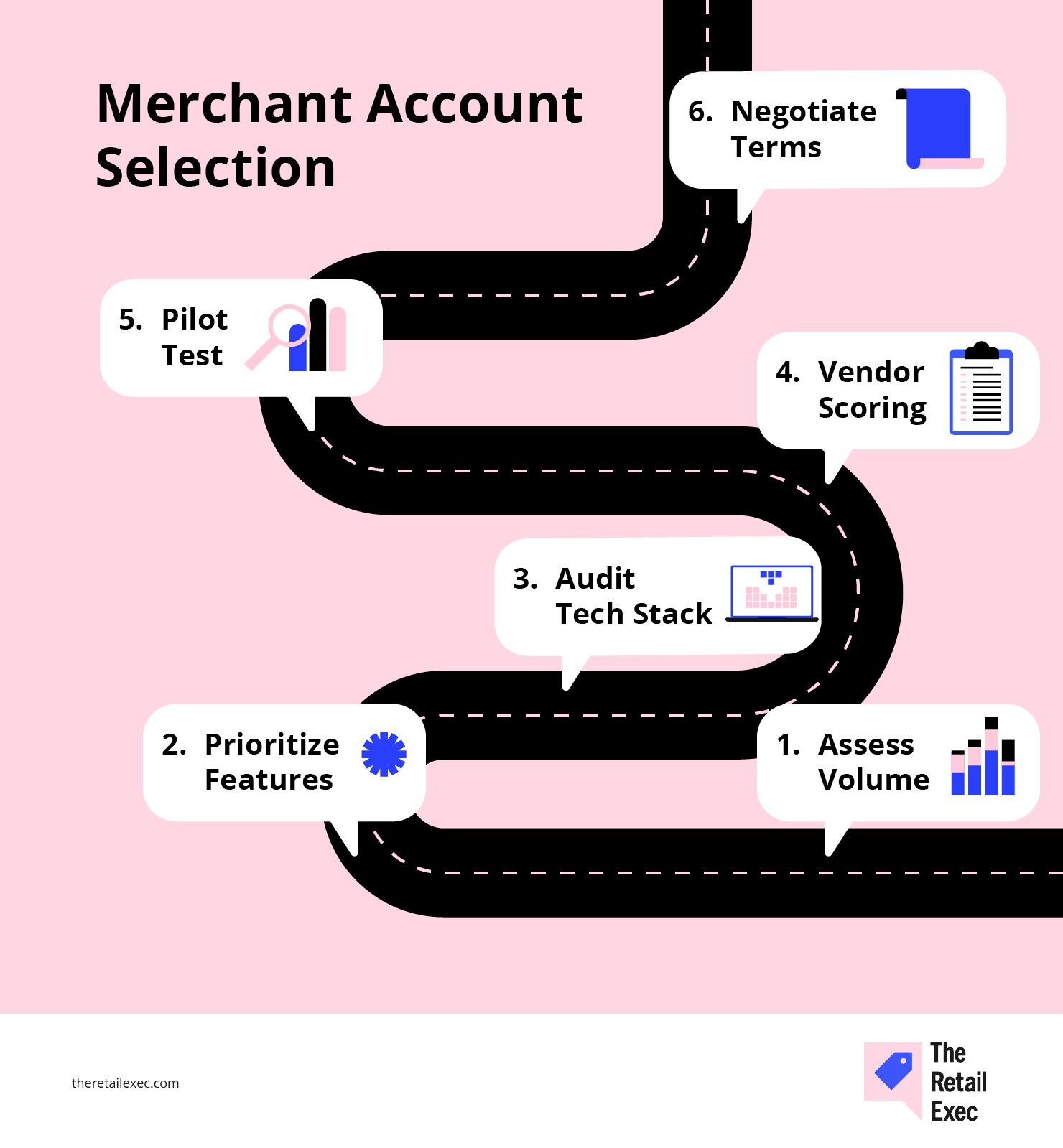

How to Choose Your Ecommerce Merchant Account

Picking the right merchant account can feel like navigating a maze blindfolded—so let’s rip that blindfold off with a six-step roadmap that covers everything from volume and features to tech stack and negotiation tactics.

Follow these steps in order, and you’ll transform what usually takes weeks of guesswork into a structured, data-driven process.

Each step builds on the last, ensuring you’ve covered risk, compliance, and real-world performance before signing on the dotted line.

By the end, you’ll have a clear scorecard comparing providers on fees, SLAs, fraud tools, and integrations—plus confidence that you’re not overpaying or missing key capabilities.

Step 1: Assess your transaction volume and payment mix

Start with the data, not the hype.

Pull your last 6–12 months of payment processing history—credit card, debit card, ACH, and anything else running through your checkout or point-of-sale. Break it down by:

- Monthly transaction count and average ticket size. Don’t let providers “bucket” you—show them your real numbers.

- Revenue by payment method. How much comes from Visa, Mastercard, American Express, Apple Pay, ACH, or other payment options?

- Seasonality or growth spikes. If you have peak months, flag them now. Providers want to see the full picture.

This isn’t busywork. You need these numbers to compare payment processor quotes apples to apples and to catch inflated “estimate-based” pricing.

If 40% of your sales are debit card payments or digital wallets, make that clear upfront.

The right merchant services provider should tailor their offer to your real mix—otherwise, you’ll be paying for the wrong things.

Step 2: Prioritize features and compliance requirements

Now that you know your payment mix, it’s time to get ruthless about what matters.

Don’t get dazzled by fancy dashboards—zero in on the features that actually impact your margins, operations, and compliance risks.

Build a simple matrix: list out must-haves on one side (like fraud prevention, recurring billing, or multi-currency support) and score each merchant account provider on a scale of 1–5 for each item.

Top criteria to consider:

- PCI DSS security. Only look at providers with PCI DSS Level 1 certification. Anything less, and you’re inviting trouble.

- Fraud prevention tools. Are you getting real-time alerts, customizable rules, and machine-learning filters—or just basic AVS checks?

- Payment flexibility. Does the provider support all your payment methods—credit card, debit card payments, ACH, wallets, Buy Now Pay Later—or are you forced into add-on fees?

- International and multi-currency support. Selling outside your own backyard? Prioritize providers with transparent cross-border pricing and built-in local payment rails.

- Integration simplicity. Ask about plugins for your ecommerce platform, API quality, and developer documentation. Bad integrations drain your team’s time (and patience).

- Reporting and analytics. Can you actually see what’s driving your processing fees and where your declines happen—or are you stuck with mystery numbers?

Verify if they’re PCI Level 1 compliant and whether they handle SAQ (Self-Assessment Questionnaire) scope reduction. If they push all PCI burden onto you, walk away.

The right features and compliance standards are how you future-proof your ecommerce business and avoid nasty surprises. Treat this step like a checklist, not a wish list—if a provider can’t score well on what you need now and in a year, cross them off.

For a head start, check out our best merchant account services to see top-rated providers in one place. Here’s a sneak peek at our top 10 picks:

Step 3: Audit your tech stack and integration needs

Now it’s time to map every piece of your commerce ecosystem—because one bad connection can turn payments into a full-time job.

- Inventory your tools. List your ecommerce platform (Shopify, WooCommerce, BigCommerce, custom build), POS, CRM, ERP, and any third-party app that touches online payments or customer data.

- Check integration methods. Does your preferred merchant account provider offer a direct plugin for your ecommerce store, or will you need to build a custom API connection? Native integrations save your dev team a ton of hours.

- Identify pain points. Any part of your current stack causing errors, failed transactions, or accounting headaches? Flag it. The right payment processing solutions should eliminate these—not add to them.

- Assess developer resources. Get time estimates for any integration work. Sometimes a “cheaper” provider costs you more if your team spends weeks fighting their API.

Bring this info to every vendor conversation.

If a merchant account provider can’t connect cleanly to your most important systems, or expects you to “just build it,” that’s a red flag.

You need payment solutions that keep your ecommerce business running—not ones that create new problems.

To save you the trial-and-error, we’ve rounded up the best ecommerce payment processors for integration and reliability. These picks are based on real-world fit, not just marketing claims:

Step 4: Create and use a vendor scoring checklist

Now that you’ve mapped your needs and your stack, don’t trust your gut or get blinded by the slickest sales pitch. Put every merchant account provider through the same scoring gauntlet.

Build a simple spreadsheet.

I use a 1-5 scale across three buckets: total cost, integration friction, and support responsiveness. Any account scoring under 12/15 isn’t worth the headache.

List each vendor as a row and your most important criteria as columns—think: processing fees, support SLAs, feature set, integration effort, fraud tools, and more. Assign weights to what matters most for your business.

Here’s how to do it:

| Criterion | Weight | Provider A score (× weight) | Provider B score (× weight) |

|---|---|---|---|

| Fees | 30% | 4 (1.2) | 3 (0.9) |

| Support SLAs | 20% | 5 (1.0) | 4 (0.8) |

| Feature set | 25% | 3 (0.75) | 5 (1.25) |

| Integration effort | 15% | 2 (0.3) | 4 (0.6) |

| Fraud & security | 10% | 4 (0.4) | 3 (0.3) |

| Total weighted score | 100% | 4.65 | 3.85 |

Multiply each provider’s score (1–5) by the weight of each criterion, then add them up. Highest total wins.

If a provider tanks on something critical—like integrations or customer support—ask if they can improve or move on. Adjust weights as you learn more; this isn’t set in stone.

Stop making decisions on gut feel or because a logo looks good on your site. Numbers don’t lie.

Step 5: Run a pilot test

Don’t trust the demo—run a real-world test drive before you sign.

- Set up test accounts with your top picks and push them hard: refunds, voids, partial captures, error codes. Don’t just swipe a card and call it done.

- Process 50–100 transactions per provider if you can. That’s how you catch the weird stuff: timeouts, webhook failures, surprise settlement times.

- Simulate customer flows. Have your team request refunds, track how long the money takes to hit a card, and monitor the full chargeback cycle.

- Log every issue. Weird fee recap? Dashboard numbers don’t match deposits? APIs flake out at scale? Write it all down.

- Gather feedback from every angle—finance, ops, dev, support. Score the severity, and send your bug list back to the provider. Push them for fixes or explanations.

Simulate edge cases like partial refunds, split shipments, or multiple declines in a single session. These are where most systems break.

Also, test across real devices and IPs—many bugs don’t show up in sanitized test environments.

One brand we worked with discovered that its mobile checkout failed on certain Android devices due to a date-picker bug during subscription sign-ups—something no one saw in QA because they were only testing on Chrome desktop.

Most problems hide in plain sight until you’re moving real money, not just watching a vendor walk through a canned PowerPoint.

Step 6: Negotiate final terms

You’ve got the data, pilot results, and scorecard—now use them to squeeze more value out of every provider.

- Leverage your volume. If you can commit to a monthly or annual minimum, ask for a tiered discount on processing fees or a better interchange-plus markup. Most providers have wiggle room—but only if you push.

Monthly volume commitments and chargeback ratios are the biggest levers. Ask for interchange-plus pricing with zero basis points markup if you’re processing at scale.

- Bundle smart. Need fraud prevention, chargeback management, or multi-currency support? Bundle them in your negotiation. You’ll often pay less for packages than à la carte.

- Play the contract length game. Longer contracts can get you lower rates, but don’t get trapped—insist on an early-exit clause or a cap on rate increases.

- Get implementation perks. Ask for a free month of sandbox access, waived setup fees, or dedicated dev support. Non-rate perks save cash and headaches.

- Double-check the fine print. Scrutinize reserve release schedules, refund and chargeback fee structures, SLA penalties, and anything “subject to change.”

When everything matches your needs, lock it in. If not, keep the conversation going—or walk away. Remember, the only deal worth signing is the one that fits your business, not theirs.

Common Pitfalls and How to Avoid Them

Even experienced operators trip up when choosing a merchant account. Here are the biggest traps—plus how to sidestep them before they burn you.

- Ignoring hidden fees. Sneaky batch, statement, or PCI compliance fees can quietly eat your margins.

Quick fix: Scrub real statements and force providers to spell out every single fee—before you sign.

- Skipping the test run. Trusting the sales demo means you miss integration headaches, failed payments, and weak support.

Quick fix: Run at least 50–100 transactions in a real-world pilot. Refunds, declines, edge cases—find the flaws before your customers do.

- Chasing low headline rates. The cheapest rate on paper won’t matter if you’re losing revenue to downtime, poor fraud tools, or slow support.

Quick fix: Use your vendor scoring checklist to balance fees against real performance and features.

- Planning for today, not tomorrow. The right provider for your current volume might choke if you scale up or go global.

Quick fix: Project your 12-month growth and vet providers’ ability to handle new payment methods, regions, and volumes.

- Signing long contracts without exit options. A multi-year term may save a few bucks—until your needs change and you’re stuck.

Quick fix: Always negotiate early-exit clauses and rate caps tied to your processing volume.

Avoid these pitfalls, and you’ll navigate the merchant account maze with confidence—turning what feels like a minefield into a clear, strategic advantage.

Check Out Time

Choosing the right ecommerce merchant account isn’t about chasing the lowest rate or getting wowed by a slick dashboard.

It’s about stacking the odds in your favor—understanding your payment flow, fee structure, and integration needs so you control the costs, not your provider.

Run the numbers. Stress-test your options. Negotiate like it actually matters—because it does.

The wrong account drains your profits and patience; the right one frees up cash and keeps you focused on growing your business.

Don’t let payments be the silent leak in your operation. Audit your setup regularly, watch for new payment trends, and never get too comfortable. Retail—and payment tech—never sit still.

Retail never stands still—and neither should you. Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.

Ecommerce Merchant Account FAQs

Now’s that time where we come up with questions you may be asking the screen right now, then we answer them to the best of our ability.

What qualifies me for interchange-plus pricing?

Interchange-plus pricing is typically available to merchants processing at least $50K–$100K per month with a clean chargeback history and solid underwriting documentation.

To qualify, be ready to share 6–12 months of processing statements, demonstrate low dispute rates, and provide proof of your business entity, EIN, and PCI compliance.

Hitting those thresholds lets you pay raw interchange costs plus a small markup—so you only pay a bit above what card networks charge.

Which documents are required for application?

At a minimum, you’ll need your business formation paperwork (articles of incorporation or LLC documents), federal tax ID (EIN), a voided business-account check, and a government-issued ID (driver’s license or passport).

Processors will also ask for 3–6 months of processing statements to assess your volume and chargeback profile. High-risk or high-volume merchants may need to supply PCI DSS attestation, product/service descriptions, and bank reference letters.

How can I test fraud prevention tools before committing?

Most providers offer sandbox environments where you can simulate both normal and high-risk transactions. Create test cases that trigger AVS mismatches, rapid-fire declines, or velocity checks, then evaluate how rules fire and alerts surface in the dashboard.

Adjust thresholds and retry settings to find the sweet spot between blocking fraud and avoiding false declines, then review logs and webhook data to ensure accuracy before going live.

Can I switch from flat-rate to interchange-plus later?

Yes—many gateways and aggregators let you start on a flat-rate plan and migrate to interchange-plus once you meet volume or risk criteria.

When negotiating your initial agreement, confirm migration terms: ensure there are no hidden setup fees, that your historical data will carry over, and that you understand any notice periods or contract changes required for the switch.

What’s the best way to monitor ongoing performance?

Set up real-time alerts for key metrics—approval rates dipping below 95%, chargeback ratios exceeding 0.5%, or funding delays beyond your SLA.

Schedule monthly or quarterly reviews of your weighted scoring matrix (fees paid, support response times, feature usage) to catch creeping costs or service gaps. Regular audits of statements and decline logs will help you spot anomalies before they snowball.

How long does the approval and funding process usually take?

Underwriting timelines vary by provider and risk profile. Standard merchant accounts often get approved in 3–5 business days once your application is complete, with funds settling in your bank 1–3 days after transaction date.

High-risk applications can take 2–4 weeks for approval and may require larger rolling reserves, so plan accordingly and have interim payment plans in place to avoid cash-flow gaps.