Lean and Mean Stock Machines: Managing inventory across multiple warehouses requires strategic planning to avoid overstocking while meeting demand. Efficient systems and communication are key to maintaining a lean inventory without sacrificing service levels.

The Art of Just-in-Time Bliss: Implementing a just-in-time inventory system helps reduce excess stock. Regular reviews and technology adoption can streamline procurement processes, aligning inventory closely with real-time demand.

Warehouse Harmony is the Goal: Coordination between warehouses ensures optimal inventory distribution. Utilizing data analytics tools can improve visibility and decision-making to achieve a synchronized supply chain.

Less is More, Even in Storage: Emphasizing minimalism in inventory levels can increase efficiency. Regular audits and performance metrics help identify surplus and adjust storage strategies accordingly.

Tech Tools to the Rescue: Leverage technology like automated inventory systems to enhance tracking accuracy and reduce human error. These innovations assist in maintaining lean operations across geographically dispersed warehouses.

Maintaining a lean inventory seems impossible when you’re operating multiple warehouses.

Sure, inventory management software can tell you how much stock any warehouse needs, but is that the most optimal inventory level for your business as a whole?

That’s where multi-echelon inventory optimization (MEIO) comes in.

It’s a network-wide inventory optimization approach that considers every node in your supply chain, from factories to fulfillment centers to storefronts.

In this guide, we look at what MEIO is, how it works, the types of models available, and how to implement it without losing your mind and margins.

What is Multi-Echelon Inventory Optimization (MEIO)?

MEIO optimizes inventory levels across supply chain points (echelons)—not just one node—to reduce costs and minimize stockout risk.

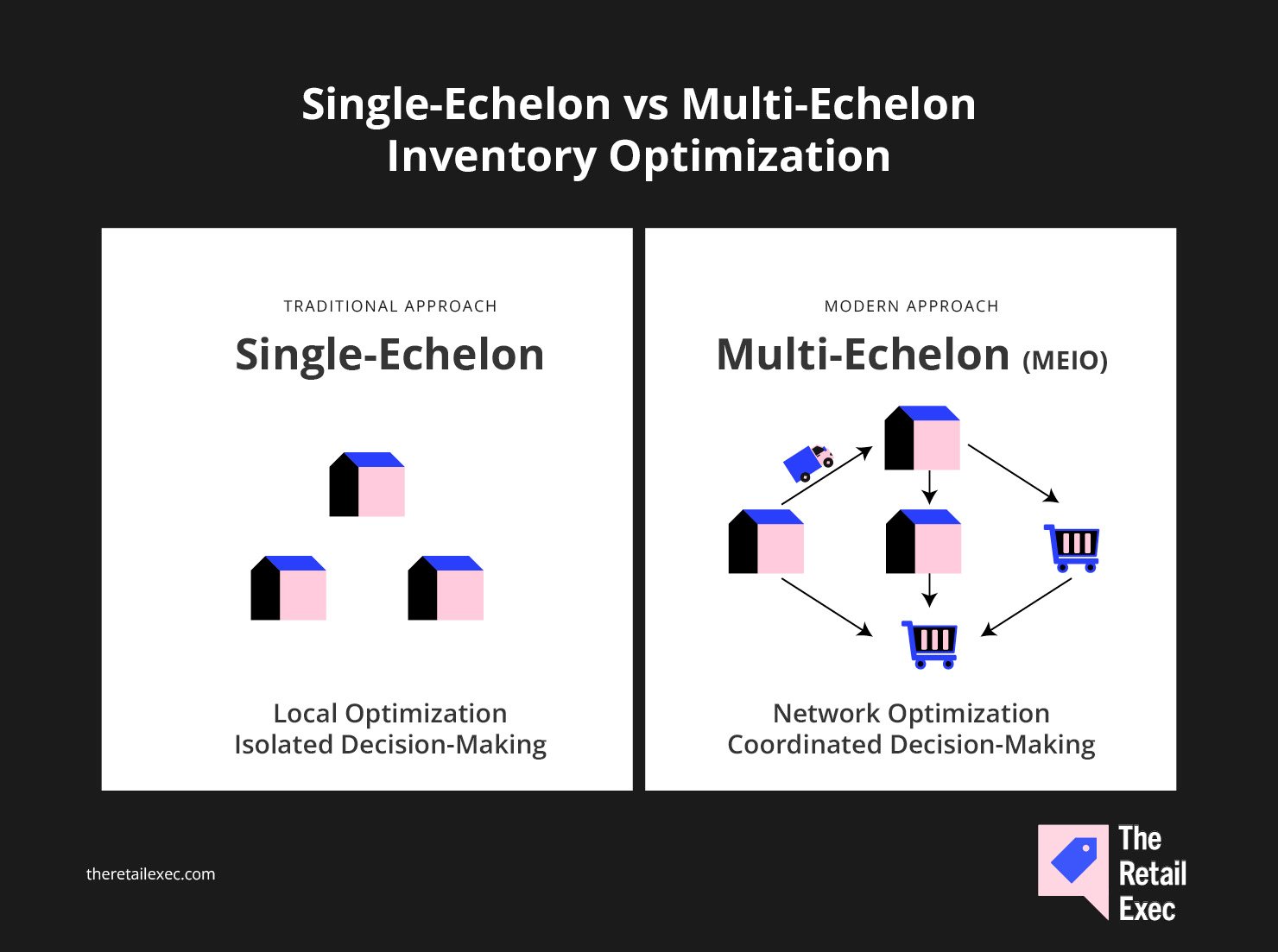

Single-echelon inventory management optimizes inventory at a specific location. Every location has one goal—avoid stockouts without overstocking.

That’s how most retail businesses manage inventory even today. It’s easier, but it translates to higher carrying costs if you operate multiple warehouses.

MEIO, on the other hand, looks at the big picture. Instead of optimizing each level in isolation, it syncs inventory levels across the entire network.

How MEIO works

MEIO can get math-heavy with concepts like demand propagation and cost propagation. But the payoff can be phenomenal. We’ll skip the calculations to keep things simple—we’ll help you understand MEIO as a concept and how it works.

Meet Adam, your trusty supply chain manager.

Adam manages a vast network of warehouses, and he’s trying to free up some capital tied up in inventory. So far, he’s been unsuccessful.

Adam calls Charles, who runs the warehouse in California—the last stop of the supply chain.

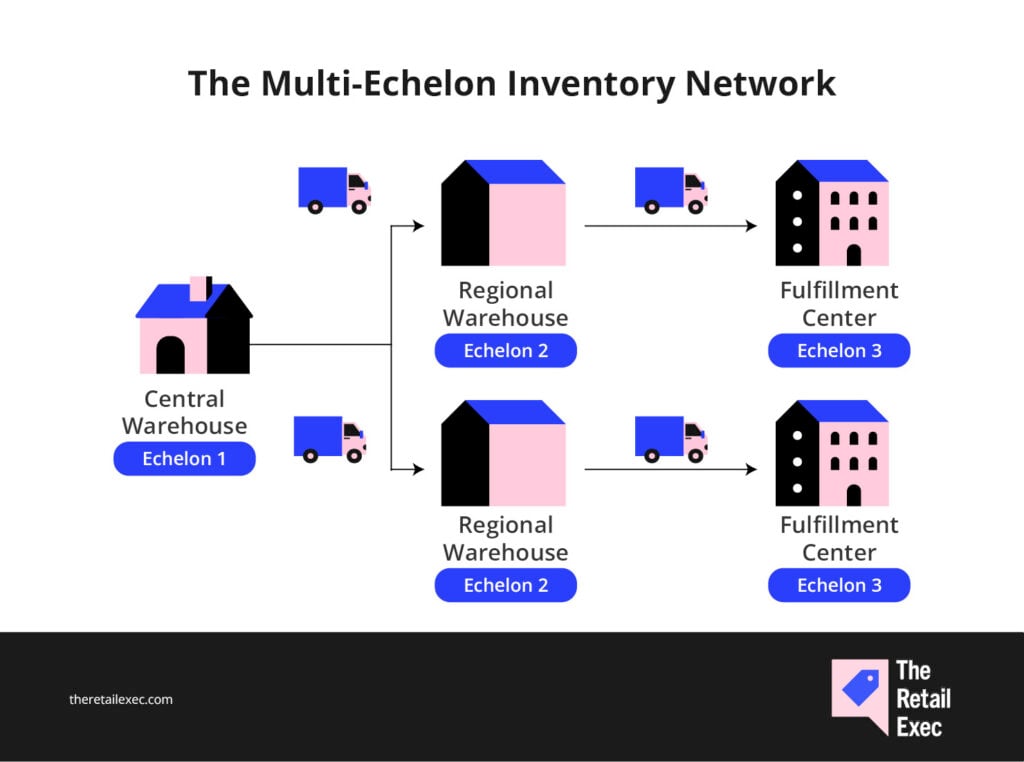

Whenever Charles needs inventory, he places an order with the regional warehouse, which in turn receives inventory from a central warehouse.

Here’s what Adam’s supply chain network looks like:

All locations use inventory management software to minimize carrying costs while holding adequate inventory to meet demand. Each location optimizes inventory independently based on data and recommendations from the software.

However, Adam thinks there’s room to further reduce costs.

That’s where multi-echelon inventory optimization comes in, which treats each location as an echelon and optimizes inventory across the network collectively.

With MEIO, your overall inventory levels reduce because you’re able to maintain safety stock levels at the network level.

This translates to lower carrying costs without compromising service levels.

MEIO is designed to answer various complex questions. Running a few complex calculations can help you answer questions like:

- Where in the supply chain should the safety stock be stored?

- How much inventory should each node (or echelon) carry?

- What’s the best way to balance service levels and costs across the network?

Fortunately, you don’t need a math degree to optimize inventory. MEIO software can test all possible configurations, considering factors like storage costs and capacity limits across all locations.

The result? Lower overall inventory levels across the network through optimized allocation across locations.

Key Components of MEIO

Now that you know the process, let’s look at the components involved in MEIO:

- Demand forecasting. MEIO doesn’t just look at overall customer demand. It forecasts demand at every node because your regional warehouse doesn’t need the same forecast as your flagship store. Forecasting helps minimize the risk of the bullwhip effect* and keeps things tidy across the board.

*What is the bullwhip effect?

The bullwhip effect is when small changes in consumer demand cause large distortions in inventory orders as you move up the supply chain.

Imagine a customer buys one extra pack of toilet paper.

The retailer sees that tiny bump and thinks, “Huh, demand’s going up.” They order two extra packs this time. The distributor sees the bigger order and orders five extra packs.

As a result, the manufacturer ramps up production like it’s the apocalypse.

- Inventory allocation. In plain vanilla inventory management, once inventory lands somewhere, it stays there. MEIO changes that, with stock flowing between echelons based on real-time demand shifts. Initial allocations follow the demand forecast, but changes as forecasts change materially over time.

- Information availability and communication. All stakeholders must have a panoramic view of critical data, including inventory positions, demand forecasts, lead times, and replenishment cycles at every echelon.

- Data and analytics. Data is the most critical component of a successful MEIO strategy. Along with data, you also need an advanced algorithm that can crunch large data sets, provide critical insights, and help you find that elusive sweet spot where costs are low, service is high, and everyone sleeps better at night.

Types of MEIO Models

There are various types of MEIO models.

Before you choose one, let’s look at how they vary in terms of how they handle uncertainty (deterministic vs. stochastic), how decisions are distributed (centralized vs. decentralized), and how much complexity your business can realistically handle.

Deterministic models

Deterministic models assume the world is predictable and orderly.

Unfortunately, that’s rarely how the world works. But it’s still a usable model when you have rock-solid data and minimal variability in the supply chain and business environment.

Let’s take a soda company, for example. The company knows people want more soda during summer, and it knows when the trucks from the bottling plant arrive.

The best approach here? Don’t complicate things.

The company’s fixed network of retailers ensures stable, seasonal demand, while there’s little to no variability in lead times from the bottling plant, which makes supply predictable.

In this scenario, a deterministic model is the perfect fit.

Stochastic models

Stochastic models factor in the chaos using probability distributions to reflect reality.

They’re better suited for supply chains where demand variability, lead time fluctuations, and supply chain hiccups cause frequent problems.

If you often find yourself planning more for the forecast to go wrong than actually forecasting, a stochastic model is more suitable.

Suppose you’re a global electronics retailer that sells high-demand, frequently out-of-stock items like gaming consoles across multiple countries.

Your product’s demand swings like a pendulum, and shipping delays are almost inevitable.

That’s where you’ll need to use probability distributions to account for demand and lead time variability across warehouses and fulfillment centers.

Using a stochastic model, you’ll be able to find an expected value of stock levels to maintain at each node to avoid stockout risks. Of course, the software will do the calculations for you. You just need to plan execution.

Hybrid models

Hybrid models are a blend of deterministic and stochastic approaches.

Stable segments of the supply chain use a deterministic approach while high-variability segments use a stochastic model.

While it sounds like the best of both worlds, remember that a hybrid model still requires careful tuning and can be tricky to maintain across complex networks.

Fashion companies often use a hybrid model. Items like jeans and basics have stable demand, while trendy items are more unpredictable.

A fashion company might consider using deterministic planning for basics and proven bestsellers and stochastic modeling for new, seasonal, or high-variability items.

Centralized vs decentralized systems

Centralized systems are a no-fuss approach to managing inventory.

It’s a “one brain rules all” approach where a centralized model controls inventory decisions across the entire supply chain network.

If you’re a large company with a strong data infrastructure and need tight, global control, centralized systems might be the way to go.

Decentralized systems allow every node to make its own decision. It’s inventory anarchy—or autonomy, depending on your perspective.

A decentralized system is ideal for companies dealing with fragmented supply chains or when each echelon in your network has vastly different needs, and you can’t afford centralized control.

Benefits of Multi-Echelon Inventory Optimization

Let’s get straight into the benefits of this lovely acronym. By implementing MEIO, you can:

- Reduce inventory costs. MEIO minimizes inventory costs by optimizing the entire company’s inventory instead of just node-by-node optimization. MEIO helped unlock Procter & Gamble's $1.5 billion cash savings in 2009—without sacrificing service levels.

The true value is better collaboration and supply chain resilience overall.

When raw material suppliers, manufacturers, distributors, and retailers work to optimize the entire supply chain, end-to-end performance improves.

Retailers can run leaner, knowing inventory is held and be ready to respond to sales trends when distributors and suppliers can see and react to real-time POS trends and inventory levels.

- Improve fill rates and customer satisfaction. MEIO optimizes inventory placement across every node, which ensures products are exactly where they need to be when customers want them. The result? Fewer stockouts, faster fulfillment, and happier customers.

While maintaining minimal inventory may cause leaders to worry about a drop in service levels, reality is quite the opposite. Businesses typically improve service levels through MEIO.

Take HCL’s case study (download required) for example.

A North American beverage company using MEIO with HCL achieved 98% service levels for the company in a multi-echelon environment.

- Shorten lead times. MEIO intelligently positions inventory across the network to minimize lead times. It also prevents individual nodes from panic-ordering independently by coordinating replenishment across the network. Strategic inventory positioning and smooth order flow collectively help reduce lead times.

- Improve forecasting accuracy. MEIO models aggregate and reconcile demand data across all echelons, creating a single, unified forecast that reflects reality more accurately. It’s not about predicting the exact number of units you’ll sell in a given week. It’s more about factoring in uncertainty (using a stochastic model, for example) to predict a range of what might happen.

How to Implement MEIO in Your Business

Yes, the MEIO model you choose is important. However, any model is unhelpful if you do it wrong. Here’s how to set yourself up for a successful MEIO rollout.

Start with a full inventory and supply chain audit

Start with an inventory and supply chain audit to understand what you’re working with.

Examine the following to get a sense of how they vary by location and channel:

- Stock levels: How much inventory does each location hold currently and on average?

- Replenishment policies: What are the triggers for replenishment and terms agreed upon with suppliers?

- Safety stock rules: How much inventory is held as safety stock for each SKU?

- SKU-level performance: What SKU is frequently out of stock and which ones are overstocked?

That’s just scratching the surface, though.

The next step is to dig deeper. Revisit historical demand data, actual vs forecasted sales, supplier lead times, and stockout events.

Look for patterns like an SKU that’s always understocked in one location but overstocked elsewhere, or a product with a three-week lead time that gets reordered every three days.

You'll have a strong foundation for implementing MEIO when you’ve identified the problems you need to solve.

Align internal teams and set clear optimization goals

MEIO involves a cross-functional transformation. It requires all departments—supply chain, finance, operations, and IT—to play nice.

This means getting everyone aligned on what “optimization” actually means for your business.

As Barry, the supply chain lead at Crisp, explains:

The foundation of MEIO starts with data and strategic alignment across all supply chain partners.

Data, metrics, and analytics need to be consistent across organizations to provide the single source of truth

Start by defining clear, measurable goals. Get answers to questions like:

- What service levels do you want to hit, and where?

- How much inventory do you want to pull out of the system, and over what time frame?

- What trade-offs are acceptable between cost and availability?

Getting these answers requires input from multiple teams, so collaboration is key.

“With the close collaboration and integration required for MEIO, every partner needs to be playing from the same sheet of music,” explains Barry.

Choose the right technology stack

Let’s get one thing clear: spreadsheets won’t cut it. You need to build a tech stack that supports MEIO.

At the bare minimum, you must be able to track inventory in real time and access historical inventory data.

Legacy ERP systems are no good. You need a cloud-based solution that integrates with other systems in your stack.

If you’re looking for a modern ERP, here are the top 10 ERPs on the market today:

Inventory management software is another critical component in your tech stack. It lets you track inventory and draw meaningful insights from historical data. When selecting solutions, explore retail planning software options that integrate well with MEIO systems.

If you don’t use an inventory management system or are unsatisfied with your current one, check out these top inventory management systems:

And, of course, you can find a precision tool for the job by looking for the best inventory optimization solutions on the market:

You can always add more tools to your tech stack, such as a warehouse and order management system and an AI-powered analytics tool to analyze inventory data.

No matter the type of system, prioritize tools that integrate easily with internal systems, such as your ERP and inventory management system.

This ensures frictionless data exchange and makes life easier when you want to automate inventory management.

Scalability and an easy-to-use interface are also critical.

Sure, you might be optimizing a regional network today, but tomorrow, it could turn into a global ecosystem with hundreds of nodes. The platform you choose should be able to adapt to your growing needs.

There’s also plenty to lose by choosing a platform with a steep learning curve. Software is supposed to simplify the job at hand, and if it feels too hard to use, your adoption rate will turn out abysmal.

Clean and standardize your data

Start with the essentials—historical demand, supplier lead times, inventory turnover, and SKU-level performance data.

Then clean house. This involves:

- Standardizing formats. Dates, units, currencies, what have you.

- Removing duplicates. You don’t need that file named “SKU_123_final_v2_FINAL.csv.”

- Validating inputs. Are those 300-day lead times a typo that’s supposed to be 30 days?

MEIO models rely on structured, reliable data to simulate scenarios and recommend the optimum inventory level for each node.

If your data is garbage, your outputs will be equally trashy, and no algorithm can fix that.

Run a pilot project with limited SKUs or regions

Once your MEIO system munches on clean data, it will tell you the best way to allocate SKUs across the network.

But before you go all in, start small:

- Choose one or a few SKUs or regions to test your model: Pick a mix of SKUs that reflect demand pattern and your fulfillment strategy for a given region and test your model’s effectiveness.

- Validate the model’s assumptions: See if the model’s logic holds true under real-world constraints, like actual lead times, demand variability, and current service levels.

- Run some stress tests: Simulate scenarios like demand spikes, supplier delays, or inventory constraints to see how the model responds and where it breaks.

- Identify potential risks: Look for breakdowns in data flow, communication, or decision-making that might prevent full-scale implementation.

This helps tune the model’s parameters, clean up process gaps, and build confidence with stakeholders, who may not be sold on investing in “optimization” until they see results.

A successful pilot also gives you internal case study material. This can help improve and speed up buy-in and full-scale implementation.

Define and track key performance indicators (KPIs)

If you can’t measure it, you can’t improve it. And you definitely can’t prove to your CFO that MEIO is worth the money. That’s why you need to track KPIs.

Focus on metrics that matter the most to you and your leaders. Here are some examples:

- Service levels (fill rate): Are you able to fill orders without overstocking?

- Inventory turnover: Is inventory moving as quickly, or collecting dust in the warehouse?

- Stockout frequency: How frequently do you have to tell your customers, “Sorry, we’re out of stock”?

- Holding costs: How much does it cost you to store inventory, on average, in the warehouse?

- Forecast accuracy: Are your inventory forecasts reasonably accurate or wildly distant from reality?

The KPIs help you track the impact of MEIO on your supply chain.

You should see fewer stockouts and lower storage costs. Once you see these results, share them with your leaders to prove it’s worth the investment.

If they give you the green light, scale MEIO across your supply chain.

Scale implementation across the entire network

There’s no one way to scale implementation.

If your network is small, you can start implementation across the entire network at once or focus on the next set of high-impact SKUs or regions, then build from there.

The implementation steps are the same—just applied to new SKUs and regions.

What’s more critical at this point for successful implementation is managing the human element of the process. Be sure to:

- Train your teams across functions to understand MEIO. Make sure that supply chain planners, inventory managers, and store managers know how to interpret MEIO recommendations and use them in daily decision-making.

- Invest in change management. Take time to build resources that make the transition easier for your team. Develop clear documentation, assign internal champions, and offer proactive support.

- Keep stakeholders in the loop. Regularly communicate results and upcoming changes to both leaders and frontline teams. Transparency is critical to building trust and maintaining momentum as you scale.

Build a continuous improvement loop

After the model is live, build a review cadence into your operations—monthly or quarterly works well for most businesses.

Reviews tell you what’s working, what’s drifting, and where the model needs recalibration.

They also surface external shifts—like new sales trends, changes in supplier behavior or lead times, or performance dips at specific nodes.

All this information feeds your strategy for adjusting your MEIO model to keep it up-to-date.

Common Challenges in Implementing MEIO (& How to Solve Them)

MEIO is a promising concept, but implementation isn’t a cakewalk.

Between legacy tech, messy data, and humans being, well, human, there are several potholes on the road to successful implementation.

We walk you through potential inventory challenges below so you’re better prepared:

Poor data quality

Inconsistent demand history, lead time data, and mislabeled SKUs are silent saboteurs of MEIO. If your data’s unreliable, your optimization model will be too.

For example, if a fast-moving SKU is mislabeled as a slow-seller, the model might understock it, leading to stockouts.

How to fix it:

- Clean and standardize data before the build. Use ETL tools to quickly clean, transform, and standardize data across sources.

- Bring in outside help. For significant cleaning, a data consultant’s fee costs less than fixing dirty data post-implementation.

Weak supplier coordination

MEIO requires upstream and downstream visibility, which requires cooperation from suppliers.

How to fix it:

- Work with existing suppliers. See if they’re open to supporting for your MEIO initiative.

- Consider finding new suppliers. Prefer suppliers who are open to coordinating with you on data sharing. Of course, whenever you onboard new suppliers in the future, outline expectations, data-sharing protocols, and tech integrations.

Legacy systems and siloed tech

If you’re using the same ERP you were using in 2010 or rely on an inventory app that’s duct-taped to Excel, you will likely face challenges when implementing MEIO.

How to fix it:

- Start with patching systems. While there’s no easy fix to legacy systems, you can start small with cloud-based MEIO solutions that can sit on top of your existing stack—many offer APIs or connectors to patch into your data without a full rip-and-replace.

- Upgrade to modern systems if legacy systems don’t play nice with newer systems. Though highly effort-intensive, the best approach is to replace legacy systems with cloud-based systems that are compatible with all modern systems.

Organizational silos and change resistance

Conflicting priorities can quickly throw MEIO implementation off track.

You need everyone—ops, finance, IT, logistics—to align on priorities because:

- The ops team wants to focus on reducing stockouts

- Finance wants to minimize inventory costs

- IT wants system stability, and

- Sales wants product availability

All goals can be achieved through successful MEIO, but when a team talks past another team or operates in a silo, MEIO implementation stalls.

For example, let’s say the supply chain manager built an MEIO model that recommends lowering safety stock levels in several distribution centers.

The team didn’t loop in sales early enough, so when the inventory for a few slower-moving SKUs was reduced, sales started flagging “lost sales” and escalated complaints from field reps.

See the problem?

To avoid this, make sure you:

- Bring all stakeholders to the table early. Involve them when determining the goals and understanding the MEIO model’s logic. That way, they’re invested in the outcomes, not just reacting to them.

- Frame MEIO as a revenue enabler, not just another supply chain project. If you pitch it as “just another ops tool,” good luck getting finance or execs to care. Show them how it can drive revenue and unlock cash flow, and you’ll get their attention.

- Highlight early wins to build momentum. Don’t wait for the full rollout to show results. After the pilot, show small wins, like a 10% cut in safe stock or an increase in full rates. Turn those into internal case studies and circulate them.

MEIO: A Complex But Effective Inventory Management Technique

MEIO is a game-changer for inventory-heavy businesses.

Optimizing inventory holistically across your supply chain helps reduce waste, improve service levels, shorten lead times, and ultimately improve profitability.

But make no mistake: you need more than an MEIO model to succeed.

You need functional alignment, clean data, and a technology stack that supports your efforts. Build a tech stack where all systems are cloud-native, integrate with other tools in your stack, and preferably are powered by AI.

Looking for more tips? Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.

MEIO FAQs

Before we sign off, here’s the lingering questions you might have, along with the answers that complete them.

How do I know if my ecommerce business is ready for MEIO?

There are no telltale signs that a business is ready for MEIO, but if you’re scaling fast, juggling multiple fulfillment points, and tired of reactive inventory firefighting, you’re probably ready for MEIO.

Can MEIO work with a 3PL or fulfillment partner?

MEIO can and should work with a 3PL or fulfillment partner. In fact, if you’re outsourcing any part of your warehousing or distribution, MEIO can be an excellent way to gain visibility and start optimizing across your entire network, including the parts you don’t own.

How long does it typically take to see results from MEIO?

The short answer is it depends. If your pilot goes well, you’ll see improvements in fill rates, and stockouts will reduce over the next three to six months. After scaling to additional nodes or product lines, measurable reductions in carrying costs will show up within six to 12 months.

Is MEIO overkill for smaller ecommerce brands with only a few SKUs or channels?

Sometimes, but not always. If you’re a lean business with fewer than 50 SKUs, one or two fulfillment locations, and predictable demand patterns, MEIO might feel like bringing a bazooka to a knife fight. You’ll spend more on implementation, data prep, and software than the ROI justifies.