The Top Instant Approval, High-Risk Merchant Account Services

Let’s see the handy shortlist here at the top. These are the best instant approval merchant account services for instant approval, each with their specialties:

If you run a high-risk business, you already know that getting a merchant account is never as “instant” as promised.

Approval can feel like a waiting game—weeks spent on hold, endless questions about your business model, and the looming threat of higher fees just for operating in a riskier category.

Most payment processors treat high-risk industries like a hot potato.

If you’re in CBD, credit repair, nutraceuticals, adult, or anything the banks don’t love, you’ll hit roadblocks: rejections, rolling reserves, or a flat-out refusal to even review your application. That’s why instant approval high-risk merchant account services matter.

This guide cuts through the noise. I reviewed the leading providers for instant approval merchant accounts—looking at how fast they move, how well they handle fraud, what support you actually get, and how clear their pricing is (because surprise fees are nobody’s idea of fun).

I’m not an insider on the payments side, but I’ve spent years working in retail and ecommerce—long enough to know what keeps business owners up at night. If you need payment processing you can actually rely on, you’re in the right place.

Why Trust Our Software Reviews

Comparing the Best High-Risk Merchant Account Instant Approval, Side-by-Side

OK, let’s see how these options stack up on pricing, trial info, and specialties so you know what’s what.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for automated chargeback resolution | Free plan available | Pricing available upon request | Website | |

| 2 | Best for quick approval times | Free consultation available | Pricing upon request | Website | |

| 3 | Best for fast approval times | Free consultation available | From $0.30/transaction | Website | |

| 4 | Best for small businesses | Free consultation available | Pricing upon request | Website | |

| 5 | Best for firearms and tactical gear businesses | Free consultation available | Pricing upon request | Website | |

| 6 | Best for chargeback protection | Free consultation available | Pricing upon request | Website | |

| 7 | Best for ecommerce businesses | Demo account available | Pricing upon request | Website | |

| 8 | Best for travel and hospitality | Free consultation available | Pricing upon request | Website | |

| 9 | Best for diverse payment options | No free trial | From $9.95/mo | Website | |

| 10 | Best for multi-currency processing | No free trial | Pricing upon request | Website | |

| 11 | Best for data security compliance | Not available | Pricing upon request | Website | |

| 12 | Best for discreet billing and compliance | No free trial | Pricing upon request | Website | |

| 13 | Best for international clients | Trial offers available | Pricing upon request | Website | |

| 14 | Best for U.S. clients | Free consultation available | Pricing upon request | Website |

The Best High-Risk Instant Approval Merchant Account Provider Reviews

Below you’ll find my take on each high-risk instant approval merchant account provider that made the shortlist.

I’ve focused on what actually sets them apart—where they fit best, what they handle well, and what to watch out for—so you can quickly zero in on a service that won’t slow you down.

Chargeflow is a chargeback management platform for high-risk ecommerce and subscription merchants.

It automates dispute recovery and prevention across online and mobile transactions so you can reduce chargeback costs and recover lost revenue quickly.

Why I picked Chargeflow: Chargeflow stands out for its automated, data-driven approach. Its AI-powered system builds personalized evidence packages and submits disputes on your behalf, boosting win rates while freeing your team from manual processes.

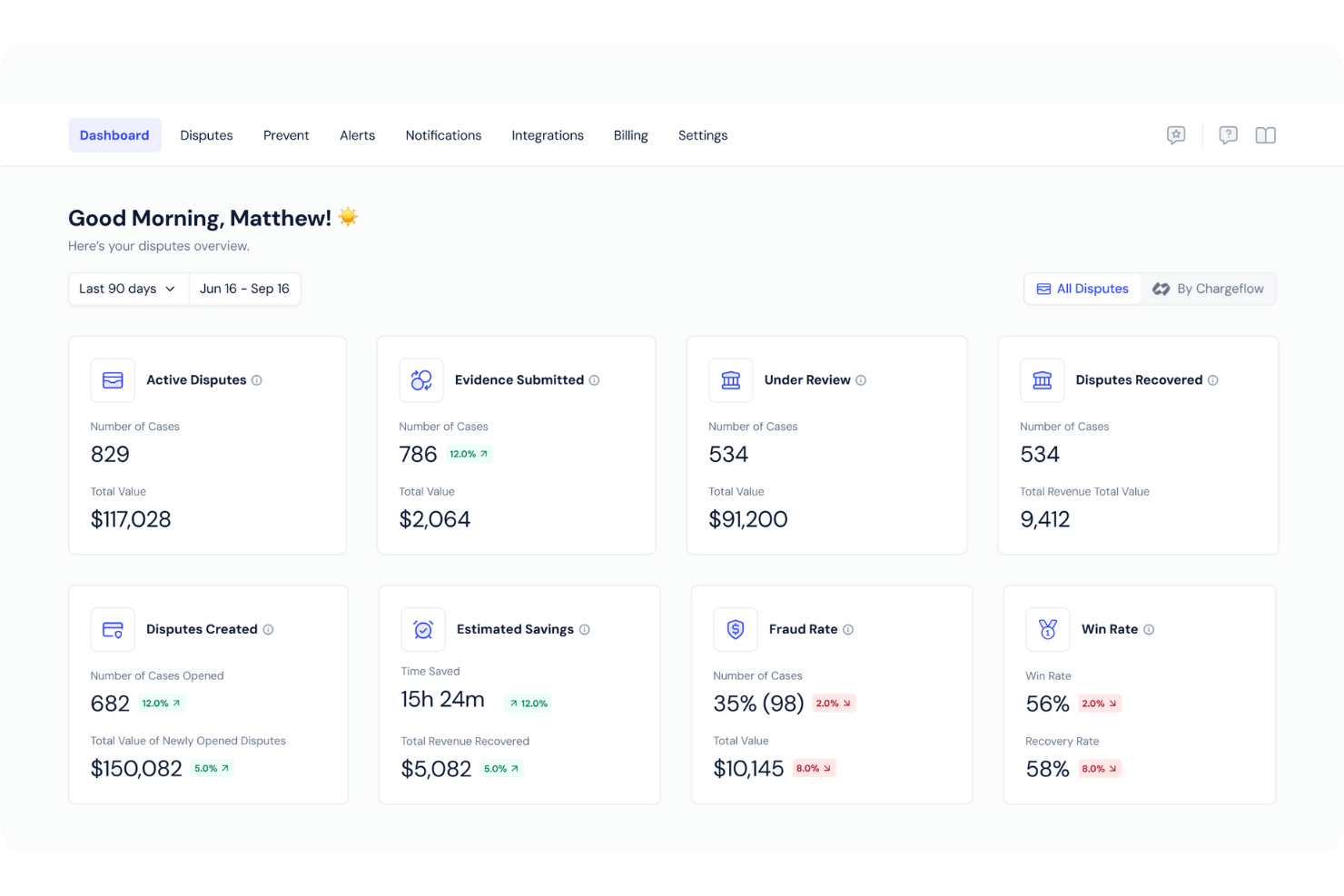

Real-time alerts prevent up to 90% of chargebacks, which keeps your chargeback ratio in the safe zone and helps you avoid account freezes or higher processing fees. With a unified dashboard and advanced analytics, you see dispute trends, recovery success and weak points across all payment processors, giving you the clarity to improve operations.

Another major advantage is breadth of integrations and scalability. Chargeflow connects to over 100 payment gateways and ecommerce platforms, making it easy to plug into your existing tech stack.

Its success‑based pricing and modular solutions mean you can start with prevention or automation and expand as your business grows without heavy implementation or contracts.

Standout services: Chargeflow’s automation handles the entire dispute lifecycle — from gathering transaction data to generating AI‑built evidence and submitting it to banks—so nothing falls through the cracks.

The alerts module monitors transactions in real time and automatically issues refunds or order updates to stop disputes before they occur, preserving merchant account health. Its Insights dashboard consolidates data from every store and processor into one view, delivering actionable metrics on win rates, recovery amounts and dispute reasons to improve decisions.

Integrations: Supports Shopify, WooCommerce, BigCommerce, Magento, Wix, Webflow, Salesforce Commerce Cloud, Etsy, Stripe, PayPal, Adyen, Zendesk and 100+ other platforms.

Target industries: Ideal for high‑risk ecommerce brands, subscription businesses, SaaS providers, travel and multi‑store retailers that face frequent chargebacks.

Specialties: Chargeback prevention, automated dispute recovery, fraud detection, unified analytics and compliance management.

Pros and cons

Pros:

- Unified dashboard integrates data across 100+ platforms for actionable insights.

- Fully automated dispute management handles evidence creation and submission for higher win rates.

- Real-time alerts prevent up to 90% of chargebacks, safeguarding merchant account health.

Cons:

- Best for high-risk or high-volume merchants; may be overkill for small businesses.

- Lacks pre-transaction conversion optimization features; focus is on post-sale disputes.

Host Merchant Services offers a variety of payment processing solutions, catering mainly to businesses in need of quick and efficient merchant account approval. They focus on providing reliable payment services to small and medium-sized enterprises across various high-risk industries.

Why I picked Host Merchant Services: Host Merchant Services’ ability to provide rapid approval times is a key differentiator, ensuring your business can start processing payments without unnecessary delays. They offer integrated payment solutions that simplify the transaction process for your team. Additionally, their customer support is accessible, providing assistance whenever needed to keep your operations running smoothly.

Standout Services: Host Merchant Services offers integrated payment solutions that allow your business to handle multiple transaction types efficiently, enhancing operational flexibility. They also provide real-time analytics, giving your team valuable insights into transaction patterns and helping with strategic planning.

Target Industries: Ecommerce, retail, hospitality, health and wellness, and professional services.

Specialties: Quick approval times, integrated payment solutions, real-time analytics, customer support, and high-risk industries.

Pros and cons

Pros:

- Quick approval process

- Integrated payment options

- Real-time transaction analytics

Cons:

- Limited international services

- Setup may require assistance

Zen Payments offers high-risk credit card payment processing services, focusing on quick approvals and efficient payment solutions for high-risk industries. They primarily serve business owners requiring fast and reliable merchant account setups.

Why I picked Zen Payments: Zen Payments excels in providing fast approvals, which is vital for businesses needing immediate payment processing capabilities. Their services include same-day funding and support for major e-commerce platforms like Shopify and WooCommerce. This ensures your team can quickly set up and manage transactions efficiently, aligning with their USP of fast approval times.

Standout Services: Zen Payments offers same-day funding, providing your team with quick access to transaction funds, addressing cash flow challenges. They also provide a free processing terminal, which helps reduce initial costs for setting up your payment processing system.

Target Industries: Coaching, bad credit score repair, firearms, CBD, and tech support

Specialties: High-risk transactions, same-day approvals, ecommerce integration, fast funding, and competitive rates

Pros and cons

Pros:

- Specialized industry support

- Strong customer service

- Competitive transaction rates

Cons:

- Potential limitations for low-risk businesses

- May require underwriting approval

PaymentCloud offers customized payment solutions for high-risk merchant accounts, catering to industries like adult services and ecommerce. They focus on credit card processing, ACH payments, and fraud prevention, serving primarily small businesses with tailored support.

Why I picked Payment Cloud: PaymentCloud differentiates itself by providing specialized payment solutions that cater specifically to small business needs. Their services include personalized account management, which aligns with their USP of being best for small businesses. This approach ensures you receive tailored support and cost-saving analysis to help your team scale efficiently.

Standout Services: PaymentCloud offers fraud prevention tools that help your team mitigate online fraud risks effectively. They also provide business funding options like merchant cash advances, addressing your need for financial support when traditional loans are challenging to secure.

Target Industries: CBD, ecommerce, online gaming, and travel.

Specialties: ACH payments, fraud prevention, echeck processing, business funding, and mobile payments.

Pros and cons

Pros:

- Personalized account management

- Advanced fraud prevention tools

- Seamless ecommerce integration

Cons:

- May require underwriting approval

- Limited to high-risk industries

SOAR Payments specializes in providing high-risk merchant account services, focusing on secure transaction processing and risk management for businesses in regulated industries. They primarily serve clients in sectors like firearms and tactical gear, offering tailored solutions to meet specific business needs.

Why I picked SOAR Payments: SOAR Payments’ expertise in serving firearms and tactical gear businesses means they provide solutions that address the unique challenges of these industries. They offer risk management tools that help your team maintain compliance and mitigate potential issues. Additionally, their dedicated support ensures that you receive guidance tailored to your operational requirements.

Standout Services: SOAR Payments provides specialty industry support, ensuring your business receives guidance tailored to your specific industry needs. They also offer advanced fraud prevention tools to help protect your transactions from unauthorized activities, which is crucial for maintaining security in high-risk sectors.

Target Industries: Firearms, tactical gear, nutraceuticals, and tech support.

Specialties: Firearms industry support, risk management, fraud prevention, tailored solutions, and compliance assistance.

Pros and cons

Pros:

- Advanced fraud prevention tools

- Tailored risk management solutions

- Compliance assistance

Cons:

- Requires detailed documentation

- Not ideal for very small businesses

EMB offers high-risk merchant account services with a focus on effective payment processing and chargeback management. They serve businesses in high-risk sectors that require specialized solutions to handle complex transactions.

Why I picked EMB: EMB’s chargeback protection service makes them a standout for businesses that experience frequent disputes. They provide tools to help your team manage and minimize chargebacks, which is important for maintaining a stable cash flow. Additionally, their dedicated support ensures that you have the resources needed to tackle high-risk payment challenges efficiently.

Standout Services: EMB offers high-risk gateway integrations that allow your business to seamlessly accept payments from various sources, enhancing your transaction capabilities. They also provide ACH processing to facilitate direct bank transfers, helping your team manage recurring and large payment volumes effectively.

Target Industries: Travel, ecommerce, CBD, and nutraceuticals.

Specialties: Chargeback protection, high-risk gateway integration, ACH processing, fraud prevention, and dedicated support.

Pros and cons

Pros:

- Strong chargeback management

- High-risk gateway availability

- Effective ACH processing

Cons:

- Limited low-risk industry support

- Requires detailed compliance documentation

Easy Pay Direct provides payment processor solutions tailored for ecommerce business models, offering services like online credit card processing, recurring billing, and chargeback management. Their primary clients include online merchants, high-risk businesses, and enterprises requiring reliable payment gateways.

Why I picked Easy Pay Direct: Easy Pay Direct’s proprietary EPD Gateway allows you to manage multiple merchant bank accounts, reducing the risk of payment disruptions. Additionally, their transaction routing feature distributes transactions across various accounts, ensuring stability and continuity in your payment processing.

Standout Services: You can utilize their recurring billing system to automate subscription payments, simplifying revenue collection. Their chargeback mitigation tools help you address disputes efficiently, protecting your business from potential losses.

Target Industries: Ecommerce, high-risk businesses, information products, CBD and hemp, and enterprise-level companies.

Specialties: Online payment processing, high-risk merchant accounts, transaction routing, chargeback mitigation, and recurring billing.

Pros and cons

Pros:

- Multiple merchant account management

- Over 250 shopping cart integrations

- Proprietary payment gateway

Cons:

- Setup fees may apply

- Limited information on contract terms

Durango Merchant Services provides high-risk merchant account solutions tailored to support complex payment processing and risk management needs. They cater primarily to businesses in travel and hospitality, offering specialized services that address industry-specific challenges.

Why I picked Durango Merchant Services: Durango Merchant Services’ expertise in the travel and hospitality sectors allows them to offer tailored solutions that accommodate the unique payment needs of these industries. They provide tools to handle fluctuating transaction volumes effectively, ensuring your operations remain smooth. Additionally, their emphasis on risk management helps protect your business from fraud and chargebacks, which are common in these sectors.

Standout Services: Durango Merchant Services offers multi-currency processing to help your business accept payments from international clients effortlessly, enhancing your global reach. They also provide chargeback mitigation tools that aid in reducing disputes and maintaining a healthy cash flow, crucial for businesses dealing with frequent transactions.

Target Industries: Travel, hospitality, ecommerce, tech support, and health and wellness.

Specialties: Multi-currency processing, chargeback mitigation, high-risk payment solutions, fraud protection, and industry-specific support.

Pros and cons

Pros:

- Strong industry focus

- Effective chargeback tools

- Multi-currency processing available

Cons:

- Setup may require technical assistance

- Limited focus on low-risk industries

High Risk Pay is a specialized merchant account provider for high‑risk businesses like adult services, travel, and MLMs.

It lets you securely accept credit cards and ACH payments across in‑person, online, and mobile channels so you can focus on selling, not on being declined.

Why I picked High Risk Pay:

With a 99% approval rate and turnaround times measured in hours, this service gets you up and running while other processors are still thinking it over.

It welcomes merchants with less‑than‑perfect credit and takes care of the compliance headaches for industries banks usually shy away from.

I also like the built‑in chargeback prevention tools and next‑day funding—nothing drains momentum like fraud losses or cash stuck in limbo. There are no application or setup fees and its rates start at 1.79%, which is surprisingly reasonable for high‑risk processing.

Standout services: High Risk Pay offers ACH/eCheck processing, credit card acceptance, multi‑currency support, chargeback management, and a streamlined application process. Those perks matter when your daily grind involves watching for fraud and keeping cash flowing quickly.

Integrations: It connects with Wix, Shopify, PrestaShop, Magento, WordPress, OpenCart, and BigCommerce, making it easy to plug into your existing storefronts.

Target industries: Designed for adult, CBD, MLM, travel, subscription, and other high‑risk businesses that need reliable payment processing.

Specialties: High‑risk merchant accounts, fast approvals, chargeback protection, next‑day funding, diverse payment options.

Pros and cons

Pros:

- Next-day funding keeps your cash flow steady.

- Chargeback protection tools help reduce fraud and disputes.

- Fast approval within 24–48 hours helps you start accepting payments quickly.

Cons:

- Risk of account holds can disrupt business operations.

- Limited information on the website makes it hard to understand offerings.

SMB Global Payments is a high‑risk merchant account provider for ecommerce businesses with specialized payment needs.

It enables secure international credit card and ACH processing, covering online, in‑person, and mobile transactions so you can accept payments reliably without reserves.

Why I picked SMB Global Payments:

I like SMB Global Payments because they approve merchant accounts quickly, reducing downtime and freeing up cash flow. Their robust fraud monitoring and chargeback prevention help you stay compliant and reduce loss, while multi‑currency support and ACH processing expand your payment options.

The company’s custom solutions match your risk profile, giving you peace of mind. Free EMV equipment and recurring billing features add value, making it easier to operate both physical and online stores.

Standout services: SMB Global Payments offers tailored merchant accounts for high‑risk industries, real‑time fraud and chargeback protection, ACH and e‑check processing for recurring billing, multi‑currency acceptance, and dedicated support teams that guide you through underwriting and compliance. These services help reduce chargebacks, speed up settlement, and keep your business operating smoothly across channels.

Integrations: Integrates with NMI, Authorize.net, USA ePay, and major shopping cart and POS systems.

Target industries: Ideal for high‑risk ecommerce merchants, travel companies, e‑cigarette and CBD retailers, nutraceutical sellers, and subscription‑based businesses.

Specialties: Focus areas include high‑ticket transactions, recurring billing, multi‑currency payments, and chargeback mitigation.

Pros and cons

Pros:

- Multi-currency and ACH support helps you accept recurring and global payments.

- Real-time fraud and chargeback prevention safeguards your transactions.

- Quick approvals enable faster account setup and cash flow.

Cons:

- Limited transparency in services makes evaluation challenging.

- Primarily serves high-risk merchants, so low-risk businesses may not find a fit.

ECS Payments offers high-risk merchant account services, focusing on industries like auctions and CBD. They provide payment solutions that include credit card processing and online payment gateways, serving businesses in high-risk sectors.

Why I picked ECS Payments: ECS Payments differentiates itself by emphasizing data security compliance, crucial for businesses facing high chargeback risks. Their services include fraud detection protocols and secure online payment gateways. This ensures your team manages transactions safely and aligns with industry standards.

Standout Services: ECS Payments provides fraud detection protocols that help your team identify and mitigate transaction risks efficiently. They also offer mobile apps, allowing your team to manage payments on the go, which is essential for dynamic business environments.

Target Industries: Auctions, CBD, firearms, travel, and tech support.

Specialties: Fraud detection, online payment gateways, poor credit card processing, mobile apps, and recurring payments.

Pros and cons

Pros:

- Strong data security measures

- Supports various high-risk industries

- Mobile payment management

Cons:

- Limited to U.S. and territories

- Requires high-risk account setup

FastoPayments is a high‑risk payment gateway provider for merchants in sensitive industries.

It streamlines online and in‑person payments, covering card, ACH, crypto, and local methods so high‑risk businesses can process transactions securely and discreetly.

Why I picked FastoPayments:

Their deep expertise with high‑risk sectors means fewer rejected transactions and better chargeback management.

I like how they marry compliance and discreet billing with flexible payment options—supporting everything from adult entertainment to gaming. The dashboard also gives clear reporting and control over multiple merchant accounts, helping teams reconcile sales and manage risk.

Standout services: FastoPayments offers custom merchant account setup, recurring billing tools, tokenization for secure card‑on‑file storage, and corporate structuring guidance.

They also provide local payment methods, POS systems, bank‑account services, and chargeback management. These services reduce fraud, simplify back‑office operations, and keep transactions flowing across channels.

Integrations: Connects with major shopping carts, CRM systems, subscription platforms, and risk management tools.

Target industries: Ideal for high‑risk merchants in adult entertainment, dating, nutraceuticals, gaming, and other regulated niches.

Specialties: Discreet billing, high‑risk merchant accounts, compliance consulting, recurring payments, multi‑currency and crypto support, local payment methods.

Pros and cons

Pros:

- Offers multiple payment methods including local options and cryptocurrencies for flexibility.

- Onboarding team sets up accounts efficiently and helps businesses go live quickly.

- Support team responds quickly and resolves issues promptly.

Cons:

- Technical glitches occasionally affect stability or transaction processing.

- Integration sometimes suffers when acquiring banks change, causing disruptions.

Webpays offers high-risk payment processing solutions, focusing on industries like gaming and forex. They provide secure payment gateways and global merchant accounts, serving businesses that require international transaction capabilities.

Why I picked Webpays: Webpays excels in supporting international clients with its multi-currency payment options and global reach. Their services include real-time integration with platforms like Magento and WordPress, ensuring your team can efficiently manage transactions in different markets. With PCI-DSS certification, they provide high-level security, making them a reliable choice for businesses operating globally.

Standout Services: Webpays offers multi-currency support, allowing your team to process payments in various currencies, which is crucial for international business expansion. They also provide 24/7 customer assistance, ensuring your team receives timely support and dedicated account management for seamless operations.

Target Industries: Gaming, forex, ecommerce, travel, and tech support.

Specialties: Multi-currency payments, fraud prevention, payment gateway integration, 3D secure transactions, and dedicated account management.

Pros and cons

Pros:

- Multi-currency support

- Real-time integration

- Secure payment processing

Cons:

- Limited to high-risk industries

- Some services may incur fees

Freedom Processing offers payment technology and point-of-sale solutions tailored for high-risk industries. They serve businesses needing high-risk processing, mobile POS, and ecommerce plugins to manage transactions efficiently.

Why I picked Freedom Processing: Freedom Processing differentiates itself with a focus on U.S. clients, providing tailored solutions that include zero-fee processing and fast funding. Their commitment to transparency and ethical practices ensures your team benefits from clear pricing without hidden or higher fees. This makes them ideal for businesses looking to enhance profitability while managing secure transactions.

Standout Services: Freedom Processing offers zero-fee processing, allowing your team to mitigate transaction costs, which is crucial for maintaining profit margins. They also provide fast funding, enabling your team to access funds quickly, which is essential for businesses needing immediate cash flow.

Target Industries: High-risk industries, retail, ecommerce, hospitality, and healthcare.

Specialties: High-risk processing, zero-fee processing, mobile POS solutions, virtual terminals, and ecommerce plugins.

Pros and cons

Pros:

- Zero-fee processing options

- Fast funding availability

- Strong emphasis on transparency

Cons:

- Requires setup for specific solutions

- Some services may incur additional fees

Our Selection Criteria For High-Risk Merchant Account Instant Approval Providers

To make this list, a provider had to do more than talk a good game. Here’s exactly what I looked for—and how much each factor counted toward the final score.

Core functionality (25% of total score)

A provider’s basic job is to actually get you processing payments, safely and without drama.

- Card and ACH acceptance. Must support credit cards, debit cards, and ACH payments—even for “out-there” business models.

- Fraud and chargeback tools. Real prevention—not just a checkbox feature.

- Multi-currency and global reach. Handles cross-border sales for true ecommerce.

- Secure payment gateways. End-to-end encryption and PCI DSS compliance are non-negotiable.

Additional standout features (25% of total score)

Every provider claims to be “all-in-one.” I looked for real value-adds, not vaporware.

- High-risk industry specialization. Knows the real pain points of your vertical (CBD, adult, nutraceuticals, etc.).

- Customizable payment options. Adapts to your risk profile and workflow, not the other way around.

- Crypto acceptance and modern payment methods. For those not living in 2005.

- Zero-fee and rolling reserve structures. Favors transparency and predictable costs.

Usability (10% of total score)

If you can’t use it, you won’t.

- Clean dashboard. Intuitive interface, even for teams without a payments specialist.

- Integration with ecommerce and POS. Real plug-and-play with Shopify, WooCommerce, and major POS systems.

- No-bloat reporting. Actionable transaction and chargeback data—no endless CSV exports.

Onboarding (10% of total score)

Getting started shouldn’t feel like applying for a mortgage.

- Application and approval speed. Actual “instant approval” or close to it—no weeks-long limbo.

- Clear requirements. Tells you upfront what documentation you’ll need.

- Dedicated onboarding help. Human support, not a 50-page PDF.

Customer support (10% of total score)

When your money’s on the line, support can’t be optional.

- 24/7 live support. For when things break at midnight.

- Multiple channels. Phone, chat, and email—pick your poison.

- Industry knowledge. Reps who speak high-risk, not just scripted responses.

Value for money (10% of total score)

High-risk doesn’t have to mean high-fee—unless you let it.

- Transparent pricing. No surprises on your first statement.

- Flexible contracts. Avoids long lock-ins and hidden penalties.

- Volume and loyalty discounts. Rewards businesses that stick around.

Customer reviews (10% of total score)

Word on the street still matters.

- High satisfaction ratings. Real feedback from actual operators, not just a handful of cherry-picked testimonials.

- Service consistency. Minimal complaints about surprise account holds or fund freezes.

- Retention and trust. Providers with long-standing client relationships score higher.

What is a High-Risk Merchant Account Instant Approval Provider?

A high-risk merchant account instant approval provider is a payment processing company that specializes in approving and onboarding high-risk businesses—fast.

They’re built to handle industries banks usually avoid, like CBD, adult entertainment, credit repair, supplements, and more.

These providers cut through the usual red tape, offering payment processing solutions designed for high-risk transactions, higher chargeback rates, and complex business models.

Their main job: help you accept credit cards and other payments, often with same-day or next-day approval, plus tools to fight fraud and manage chargebacks.

If your business keeps getting turned away by “normal” payment processors, these are the firms you call. managing high chargeback rates and ensuring secure payment processing.

How to Choose Instant Approval High-Risk Merchant Account Services

Choosing a provider for instant approval high-risk merchant account services takes more than clicking the first “apply now” button you see. Use this table to break down the process and make your choice with eyes wide open:

| Step | What to do | Why it matters |

|---|---|---|

| 1. Pinpoint your pain points | List your deal-breakers: high chargeback rates, regulatory scrutiny, global sales, or industry bans. | Only a provider who actually solves your headaches is worth the extra fees. |

| 2. Demand true instant approval | Ask exactly how long their “instant” is, and what paperwork you’ll need for underwriting. | Avoid getting stuck in a days-long approval “review”—clarity up front saves time. |

| 3. Audit fees and contract traps | Request a full fee schedule, and flag hidden costs like rolling reserves, early termination, or support upcharges. | Prevent nasty surprises and lock-ins that drain your margins. |

| 4. Test real-world integration and support | Push for a real demo—run through your ecommerce flow, and call support after-hours. | If they flinch, their tech or service may not hold up when you need it most. |

| 5. Verify their track record | Check third-party reviews for payout delays, account holds, or surprise shutdowns—look for patterns, not marketing claims. | A bad reputation means your cash (or your business) could be at risk. |

Key Services to Look for in High-Risk Merchant Account Instant Approval Providers

Every provider promises the world, but you need services that make life easier for high-risk, high-volume, or regulated businesses.

Here’s what should actually matter when you’re comparing instant approval high-risk merchant account services:

- Real-time underwriting (not just “instant” in the marketing). You want a provider with a true instant approval process—automated, transparent, and designed for high-risk businesses. That means fewer manual reviews and faster access to credit card processing, even for adult entertainment, CBD, or nutraceuticals.

- Chargeback defense that works. Don’t settle for generic dispute tools. Look for payment processing solutions with automated alerts, deep chargeback analytics, and human backup to help you fight fraud and keep your merchant account alive.

- Rolling reserve transparency. If a payment processor is holding your cash as a rolling reserve, you need clear terms up front. How long, how much, and what it’ll take to reduce the reserve—no games, no moving targets.

- Support for “taboo” payment types. If your business handles high-risk transactions—crypto, ACH, cross-border, or emerging payment gateways—your merchant service provider should welcome that complexity and make it seamless, not a compliance headache.

- Customizable risk controls and reporting. The best high-risk merchant account providers let you set transaction limits, flag unusual activity, and pull real-time reports, so you can spot trends before they turn into problems.

- Seamless ecommerce and multichannel integrations. Whether you’re selling online, via mobile, or at a trade show, you want payment processing services that just work—with Shopify, WooCommerce, WordPress, or whatever else your stack includes.

- Industry-specific compliance and guidance. The right partner doesn’t just process payments—they help you stay compliant with PCI DSS, KYC, and any rules unique to your high-risk category. Expect proactive guidance, not generic warnings.

- Fast, predictable payouts (even for high volume or bad credit). Look for next-day or even same-day funding for high-risk merchants. You shouldn’t have to wait a week to access your own money, no matter what your business model or credit score.

Don’t waste time with providers who gloss over these details.

Benefits of Using Instant Approval High-Risk Merchant Account Services

Why bother with an instant approval high-risk merchant account provider? Here’s what you actually gain—beyond the basics.

- You start taking payments sooner. Fast approvals mean less downtime and fewer missed sales, even if your industry makes banks nervous.

- Less time wrestling with compliance. The right payment processors handle the heavy lifting on documentation, risk checks, and underwriting—so you can get approved with minimal back-and-forth.

- Built-in fraud and chargeback management. High-risk merchant account providers offer specialized tools to spot suspicious activity, reduce chargebacks, and keep your account in good standing.

- Global reach, without the roadblocks. Accept payments in multiple currencies and from high-risk regions, so your business can scale without outgrowing your merchant services.

- Support that actually shows up. When there’s a payout delay or sudden account freeze, you need real customer support—ideally, 24/7, with actual humans who know high-risk payment processing.

- Clarity on fees and reserves. You get upfront terms on rolling reserves, processing fees, and reserve release timelines—no more guessing what’ll hit your cash flow.

- Room to grow. The right high-risk payment processor adapts to your business model, whether your volume spikes, you expand to new categories, or your risk profile shifts.

Costs & Pricing Structures of High Risk Instant Approval Merchant Account Services

Here’s what real-world pricing looks like for high-risk merchant account services. Use these ranges to get your bearings—actual costs will vary by provider, industry, and volume.

| Plan type | Average price | Common features | Best for |

|---|---|---|---|

| Subscription | $10–$50/month | Monthly maintenance, support tiers, basic fraud tools | Consistent higher-risk sellers |

| Transaction-based | ~3.5%–4% + $0.25/transaction | Pay per sale, integrated fraud/chargeback tools | Variable or low-volume merchants |

| Tiered pricing | Varies (higher than standard) | Tiered rates (qualified/mid/non-qualified), bundled fees | Complex or highly regulated operations |

| Custom pricing | Negotiated per business | Tailored rates, rolling reserve terms, custom integrations | Unique or very high-risk business models |

Key factors that influence high‑risk merchant account pricing

Pricing isn’t just numbers—it reflects your risk, setup, and flexibility. Here’s what pushes costs up or down:

- Your industry and risk profile. CBD, adult, nutraceuticals, or anything flagged high risk? Expect higher rates and reserves.

- Processing volume and track record. Clean history and volume can get you a better deal.

- Rolling reserve policy. Typically a portion (5–15%) of funds held as a buffer. Less transparent terms mean more risk to your cash flow.

- Contract length and fees. Watch for auto-renewals, early termination penalties, and hidden costs.

- Support and integrations. 24/7, industry-aware support or complex integrations (multichannel, crypto) often carry a premium.

Understanding these levers helps you negotiate smarter and avoid surprises when funds hit your account—or don’t.

FAQs About High-Risk Merchant Account Instant Approval Services

Here are some answers to common questions about high risk merchant account instant approval:

Will “instant approval” really get my account live today?

Not usually. “Instant approval” means you get a fast preliminary decision—sometimes in minutes—but you’ll still need to complete underwriting before you can process payments. If your documents are ready and your business checks out, most providers can get you set up in 24–72 hours.

What will providers look for in my application?

Expect to provide business licenses, a valid ID, recent bank statements, processing history (if any), and details on your business model. High-risk processors are extra thorough—they want to see you’re legitimate and have processes for handling chargebacks and refunds.

How do rolling reserves actually work?

A rolling reserve is a percentage of your sales held back (usually 5–15%) for a set period (commonly 90–180 days) to cover potential chargebacks or fraud. Good providers tell you the terms up front, so ask for details in writing.

What happens if I get too many chargebacks?

Too many chargebacks can mean higher fees, a spike in your rolling reserve, or even account termination. Most high-risk payment processors have built-in alerts and chargeback mitigation tools, but if rates get too high, you might need to move fast to another provider.

Can I negotiate lower fees once I’ve proven myself?

Yes. If you keep your chargebacks low and grow your processing volume, many providers are open to lowering your rates or relaxing reserve requirements. Don’t be afraid to ask for a better deal after six months of clean history.

What should I do if my account is frozen or shut down?

First, get a straight answer from your provider about why it happened. You’ll need to resolve the issue—whether it’s too many chargebacks, compliance flags, or missing documents—before you can get unfrozen. Have a backup processor on speed dial just in case; downtime kills cash flow.

Get Approved, Get Paid, Get Moving

High-risk doesn’t mean high-hassle—if you pick the right merchant account provider. The instant approval services in this guide cut the red tape and help you accept payments with fewer surprises, faster approvals, and actual support when it matters.

Don’t let endless paperwork, slow payouts, or “we don’t serve your industry” emails block your revenue. Use the shortlist, check the fees, and get your high-risk business set up to win.

Retail never stands still—and neither should you. Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.