The Top 10 Subscription Management Software for Small Business

Let’s start with the leaderboard of our top picks for the best subscription management software for small businesses and why they are great:

Get free help from our project management software advisors to find your match.

Managing subscriptions at a small business is a special kind of juggling act—wrangling recurring billing, chasing renewals, and trying to keep churn from eating into your recurring revenue—all while making sure your subscriber experience doesn’t tank.

The right subscription management software can automate the heavy lifting, streamline your workflows, and give you real-time visibility into the metrics that actually matter.

I’ve spent more than a decade in retail and ecommerce—working alongside devs and marketers setting up subscription billing for ecommerce shops, I know the real pain points come from the day-to-day: failed payments, manual workarounds, and dashboards that don’t tell you what’s actually going on with your customers.

This guide is straight talk on the best subscription management platforms for small businesses—what they automate, how they handle recurring payments, what they do for retention, and where they fall short.

Whether your subscription business is SaaS, ecommerce, or services, you’ll find options here to help you optimize your billing process and keep your subscriber base growing.

Why Trust Our Software Reviews

We’ve been testing and reviewing retail and ecommerce software since 2021.

As retail experts ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different retail management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & check out our software review methodology.

Comparing the Best Subscription Management Software for Small Business Side-by-Side

Want the essentials at a glance? This chart lines up the top subscription management platforms for small businesses—pricing and what actually sets each apart. It’s the fast way to filter your shortlist.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for automated invoicing | Free demo available | From $229/month | Website | |

| 2 | Best for real-time reporting | Free demo available | From $99/month | Website | |

| 3 | Best for financial analytics | Free 30-day trial | From $599/month | Website | |

| 4 | Best for payment routing | Free demo available | Custom pricing upon request | Website | |

| 5 | Best for global sales | Free demo available | Pricing upon request | Website | |

| 6 | Best for multilingual support | 3-day free trial | From $29/month | Website | |

| 7 | Best for usage-based billing | Free plan available | From $45/month | Website | |

| 8 | Best for small retailers | Free demo available | From $29+/month | Website | |

| 9 | Best for flexible billing | 60-day free trial | From $49.99/month | Website | |

| 10 | Best for Shopify stores | 30-day free trial for new subscribers | From $99/month and a fee of 1.25% + $0.19/transaction | Website |

The 10 Best Subscription Management Software for Small Business, Reviewed

Here’s my straight-shooting review of the best subscription management systems for small businesses. What works, what doesn’t, and where each platform actually delivers.

ChargeOver is a subscription management software tailored for businesses that need efficient billing and invoicing solutions. It's ideal for small to medium-sized companies looking to automate recurring billing tasks and manage customer subscriptions effortlessly.

Why I picked ChargeOver: ChargeOver excels in automated invoicing, making it a great choice for businesses that want to reduce manual billing tasks. The software offers customizable invoice templates, allowing you to maintain a professional look consistent with your brand.

Its Automatic payment reminders help you stay on top of collections without the hassle. ChargeOver also supports multiple payment methods, giving your customers flexibility in how they pay.

Standout features & integrations:

Features include detailed reporting tools to gain insights into your billing data, robust support for multi-currency transactions, and flexible dunning management to handle failed payments efficiently. These features help you manage your billing operations smoothly.

Integrations include QuickBooks, Xero, PayPal, Stripe, Authorize.Net, Braintree, Mailchimp, Salesforce, FreshBooks, and Zapier.

Pros and cons

Pros:

- Multi-currency transaction support

- Automatic payment reminders

- Customizable invoice templates

Cons:

- Limited advanced reporting features

- Initial setup can be complex

SubscriptionFlow is a subscription management platform aimed at businesses that need detailed oversight of their recurring revenue streams. It caters to companies looking to automate billing processes and gain insights through real-time data analytics.

Why I picked SubscriptionFlow: SubscriptionFlow offers real-time reporting, which is crucial for businesses that need up-to-the-minute financial data. The platform provides comprehensive dashboards that allow you to track key metrics and performance indicators.

It also supports automated billing, reducing the manual workload for your team. With its customizable reporting tools, you can tailor insights to fit your specific business needs.

Standout features & integrations:

Features include automated dunning management to minimize revenue loss from failed payments. You can also set up multi-tier pricing to cater to different customer segments. The platform offers advanced analytics tools to help you understand customer behavior and optimize your offerings.

Integrations include Stripe, PayPal, QuickBooks, Xero, Salesforce, HubSpot, WooCommerce, Shopify, Mailchimp, and Zapier.

Pros and cons

Pros:

- Automated dunning management

- Customizable reporting tools

- Real-time financial data

Cons:

- Limited offline support

- Initial setup complexity

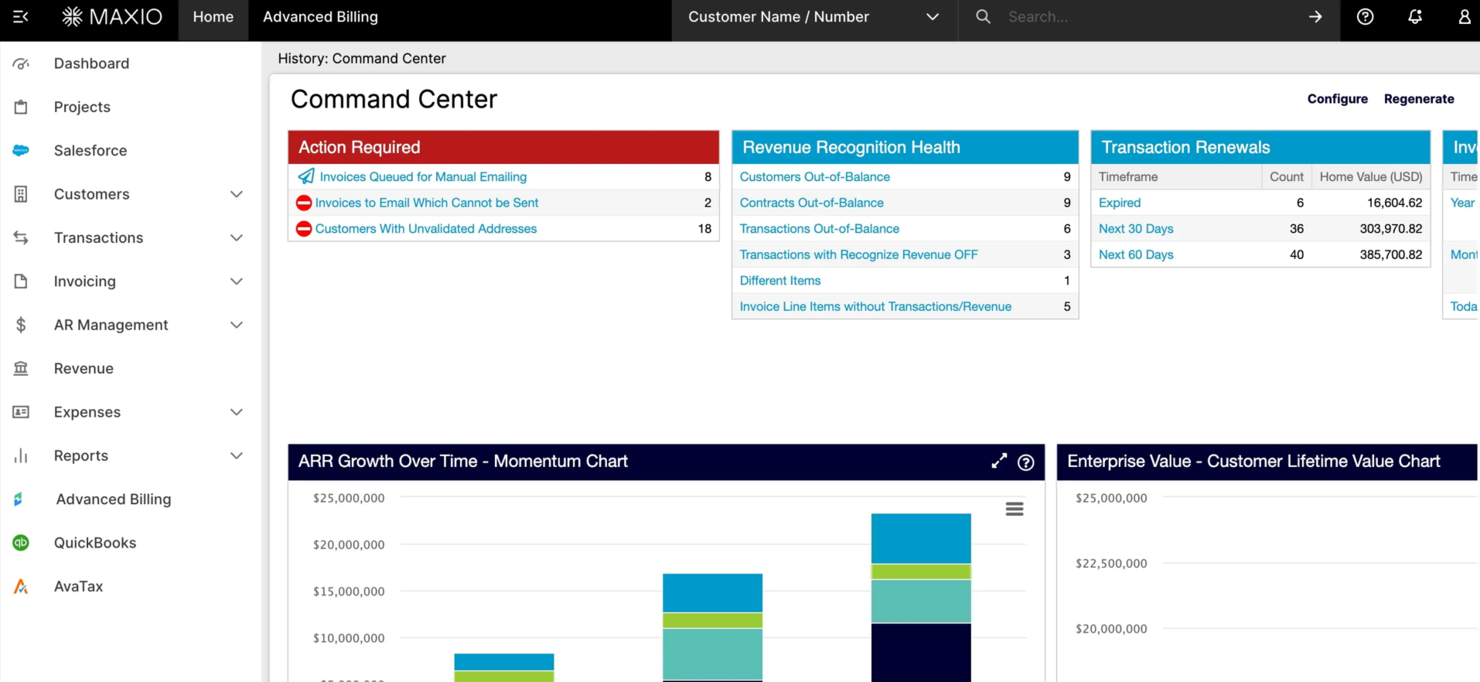

Maxio is a subscription management platform designed for B2B SaaS subscription businesses, offering billing software solutions and financial operations. It's ideal for finance teams looking to manage complex billing and subscription-based business models. The tool provides detailed financial insights and supports recurring invoicing.

Why I picked Maxio: Maxio excels in delivering financial analytics that help you make informed decisions about your business. Its standout features include advanced reporting tools and customizable dashboards that align with its USP of financial analytics.

You can easily track financial performance and compliance, making it a reliable choice for managing complex billing needs. The platform also supports multiple payment gateways, ensuring smooth transactions.

Standout features & integrations:

Features include product catalog management to avoid contract sprawl, tailored invoicing processes to suit business needs, and automated revenue recognition for compliance with GAAP and IFRS-15. These features allow you to manage multiple schedules and reallocations efficiently.

Integrations include HubSpot, Salesforce, NetSuite, QuickBooks, Xero, Stripe, PayPal, Braintree, Zuora, and Recurly.

Pros and cons

Pros:

- Supports multiple payment gateways

- Customizable dashboards

- Advanced reporting tools

Cons:

- Limited support for non-SaaS businesses

- May require technical knowledge

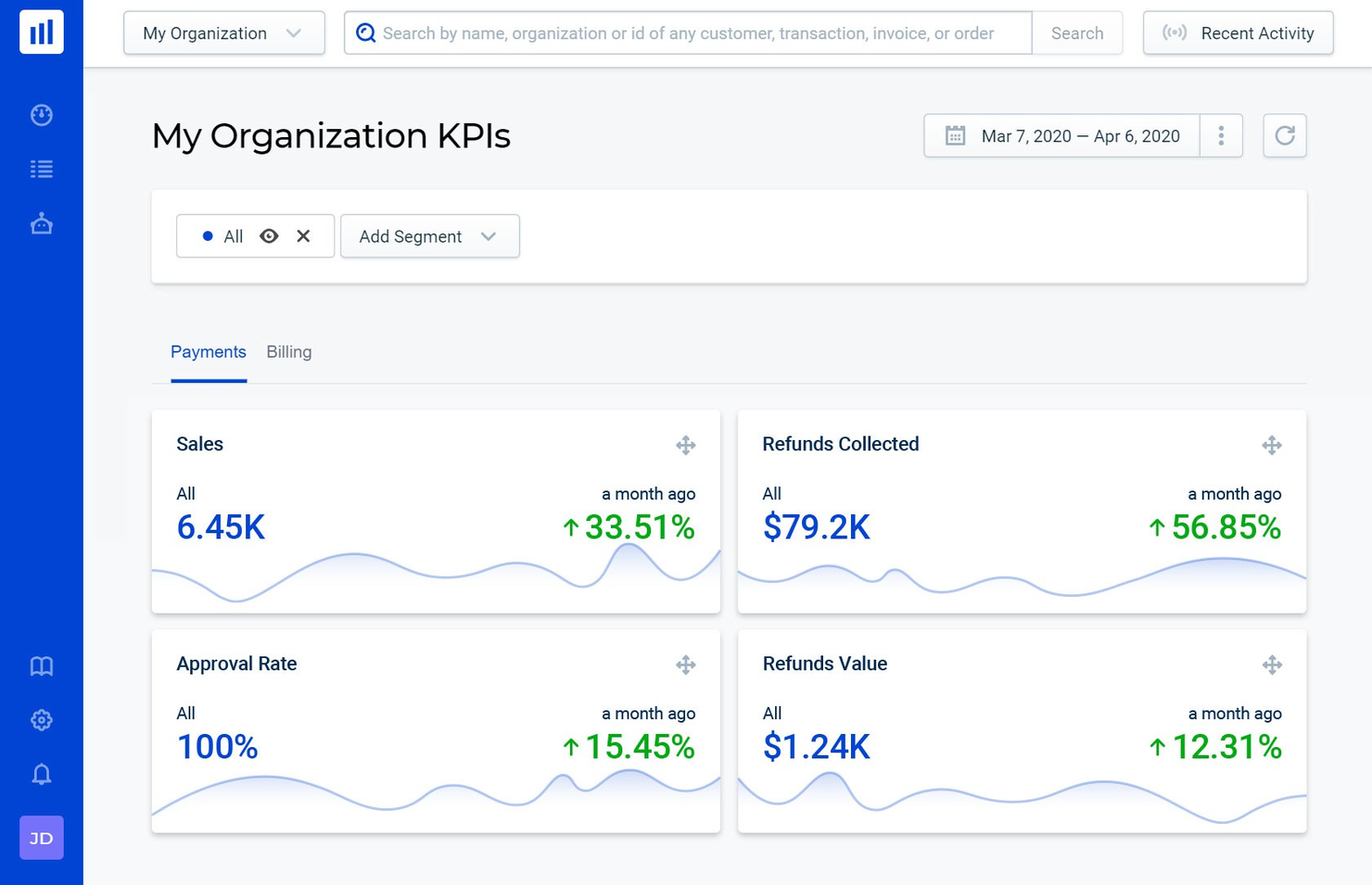

Rebilly is a billing and subscription management platform designed for businesses that need to optimize their payment processes. It's used by companies seeking to manage subscriptions, improve payment routing, and increase revenue.

Why I picked Rebilly: Rebilly excels in payment routing, which is essential for businesses looking to optimize transaction success rates. The platform offers intelligent routing features that help you direct payments through the most efficient paths.

With its comprehensive analytics, you can monitor transaction performance and make informed decisions. Rebilly also provides tools for managing subscriptions and automating billing, enhancing overall financial operations.

Standout features & integrations:

Features include customizable invoicing that lets you tailor billing documents to your brand. You can also set up automated dunning processes to recover failed payments. The platform offers advanced reporting tools to provide insights into customer behavior and financial trends.

Integrations include QuickBooks, Xero, Salesforce, HubSpot, Mailchimp, Stripe, PayPal, Authorize.Net, Braintree, and Zapier.

Pros and cons

Pros:

- Customizable invoicing options

- Comprehensive analytics

- Intelligent payment routing

Cons:

- Limited offline support

- Requires technical expertise

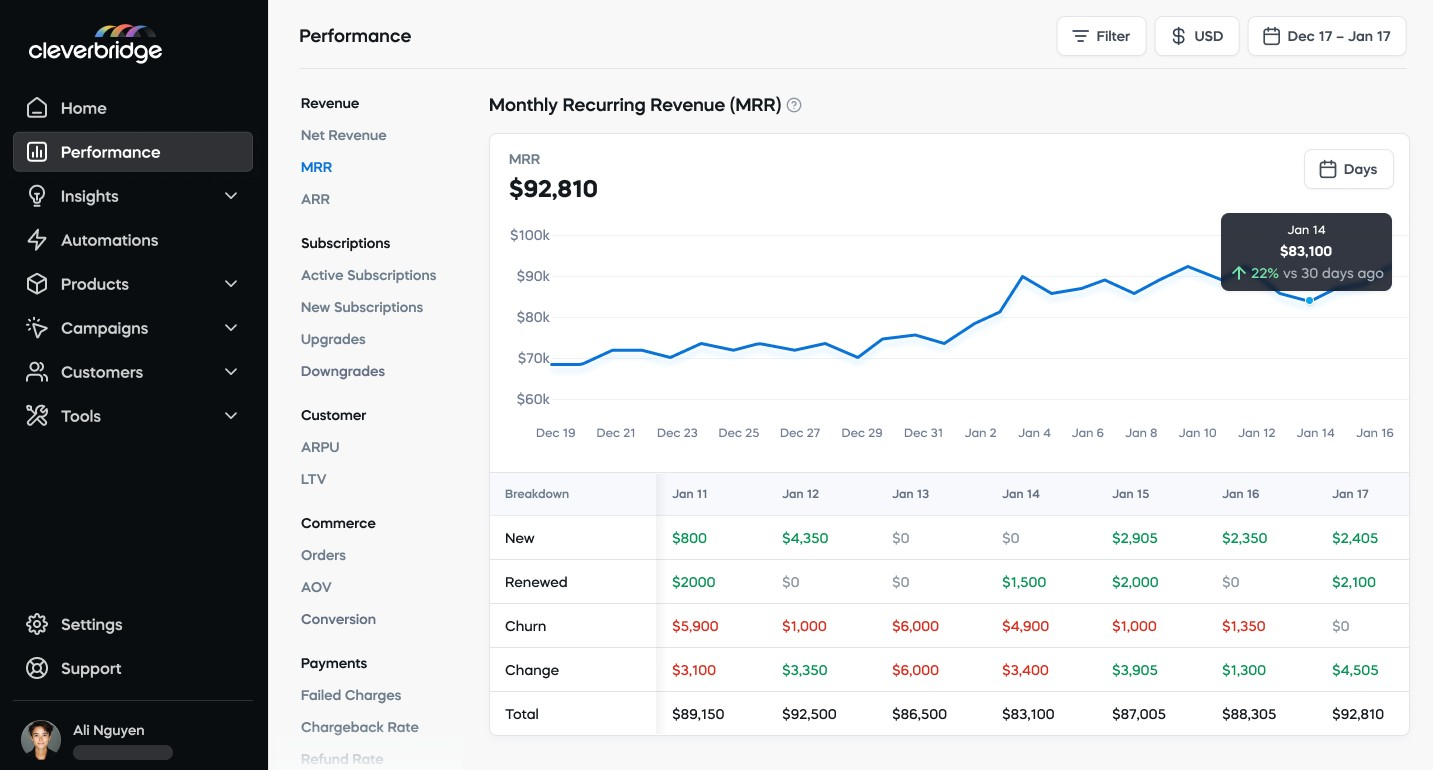

Cleverbridge is a subscription management platform tailored for businesses looking to expand their global sales reach. It serves companies aiming to manage subscriptions, handle international transactions, and enhance customer experiences across borders.

Why I picked Cleverbridge: Cleverbridge excels in supporting global sales, making it ideal for businesses aiming to extend their market internationally. It offers multiple currency support, which is crucial for handling transactions in different regions.

You can also set up localized payment methods, ensuring a smooth experience for international customers. With its tax management tools, Cleverbridge helps you navigate complex tax regulations across countries.

Standout features & integrations:

Features include customizable checkout pages that enhance the customer purchase journey. The platform provides comprehensive fraud prevention tools to secure transactions. You can also access detailed sales analytics to monitor global performance and adjust strategies accordingly.

Integrations include Salesforce, Microsoft Dynamics 365, SAP, NetSuite, Marketo, HubSpot, Mailchimp, Zendesk, Google Analytics, and Shopify.

Pros and cons

Pros:

- Detailed sales analytics

- Customizable checkout pages

- Comprehensive fraud prevention

Cons:

- Initial learning curve for new users

- Can be complex to configure

Twice Commerce is a subscription management software designed for businesses seeking to transition to recurring revenue models. It serves companies that need to manage subscriptions, rentals, and resales effectively across various sales channels.

Why I picked Twice Commerce: Twice Commerce excels in providing multilingual support, which is crucial for businesses operating in diverse markets. The software offers tools for managing subscriptions and rentals, making it adaptable to various industries.

With features like inventory management and order fulfillment, it helps streamline operations. Its user-friendly interface ensures a quick setup, allowing you to start managing subscriptions efficiently.

Standout features & integrations:

Features include tools for inventory optimization, which help you manage stock effectively. The software also supports online and offline selling, providing flexibility in how you reach customers. With a dynamic product catalog, you can easily update and manage your offerings.

Integrations include Shopify, WooCommerce, Zapier, QuickBooks, Xero, Stripe, PayPal, Mailchimp, Google Analytics, and Facebook.

Pros and cons

Pros:

- Dynamic product catalog

- Supports online and offline sales

- Effective inventory management

Cons:

- May need customization for large businesses

- Adjustment to subscription model needed

Billsby is a subscription management tool designed for businesses that need flexible billing options. It's especially suitable for companies offering services that vary in usage, allowing for accurate billing based on consumption.

Why I picked Billsby: Billsby excels in handling usage-based pricing billing, making it a strong choice for businesses with fluctuating service demands. It offers detailed metering capabilities, allowing you to track and bill customers accurately.

The tool offers flexible pricing models, allowing you to tailor your billing strategies to your business needs. Billsby also supports multiple currencies, enabling you to cater to international clients easily.

Standout features & integrations:

Features include advanced reporting tools that help you analyze customer behavior and revenue trends. You can also set up automated invoicing to streamline your billing process. The platform offers customizable customer portals that enable clients to manage their subscriptions easily.

Integrations include Stripe, PayPal, QuickBooks, Xero, Salesforce, HubSpot, WooCommerce, Shopify, Mailchimp, and Zapier.

Pros and cons

Pros:

- Customizable customer portals

- Detailed metering capabilities

- Handles fluctuating service demands

Cons:

- Limited advanced analytics

- Initial setup can be time-consuming

Square Subscriptions is a subscription management tool tailored for small retailers and various business types like food and beverage, beauty, and services. It enables businesses to manage billing and customer retention while enhancing cash flow management.

Why I picked Square Subscriptions: Square Subscriptions is ideal for small retailers due to its straightforward setup and integration with other Square products. It offers customizable billing models and automated transactions, allowing you to manage subscriptions efficiently.

You can create checkout links and share subscription options via social media or email. This makes it easy for your business to generate predictable revenue streams without monthly fees.

Standout features & integrations:

Features include flexible plan durations that let you tailor subscription plans to your business needs. The platform also provides easy management of subscriptions through the Square Dashboard, giving you control over your offerings. Automated transactions help ensure timely payments and reduce manual effort.

Integrations include Square Point of Sale, Square Invoices, Square Online, QuickBooks, Xero, Mailchimp, HubSpot, WooCommerce, Shopify, and Google Analytics.

Pros and cons

Pros:

- Easy sharing of subscription options

- Automated transactions

- Customizable billing models

Cons:

- Some features may require technical setup

- Scalability issues for bigger operations

Bold Subscriptions is a subscription management tool designed for ecommerce businesses, particularly those on Shopify. It helps merchants create and manage subscription services, focusing on flexible billing options and customer retention.

Why I picked Bold Subscriptions: Bold Subscriptions offers flexible billing, allowing you to customize how and when you bill your customers. The platform supports mixed cart checkout, letting customers purchase one-time and subscription products together.

You can also set up advanced discounting rules to incentivize subscriptions. With its intuitive setup, Bold Subscriptions makes it easy to launch and manage subscription services effectively.

Standout features & integrations:

Features include advanced analytics to track subscription performance and customer insights. You can also customize the customer portal to enhance user experience. The platform supports multiple languages and currencies, making it suitable for global businesses.

Integrations include Shopify, BigCommerce, WooCommerce, Zapier, HubSpot, Mailchimp, Google Analytics, Facebook, QuickBooks, and Xero.

Pros and cons

Pros:

- Customizable customer portal

- Advanced discounting rules

- Supports mixed cart checkout

Cons:

- May require customization for large stores

- Some features need technical expertise

Recharge is a subscription management platform tailored for ecommerce businesses, particularly those using Shopify. It helps merchants manage recurring billing, optimize customer retention, and enhance subscription experiences.

Why I picked Recharge: Recharge is perfect for Shopify stores looking to enhance their subscription services. It provides tools for managing recurring payments and offers customizable subscription options.

You can easily integrate it with your Shopify store to streamline the checkout process. Recharge also offers analytics that help you understand customer behavior and improve retention strategies.

Standout features & integrations:

Features include an intuitive dashboard that allows you to track subscriber data and revenue metrics. You can set up automatic notifications to keep customers informed about their subscriptions. Recharge also supports multiple payment gateways, providing flexibility in how customers can make payments.

Integrations include Shopify, BigCommerce, Stripe, PayPal, Klaviyo, Google Analytics, Facebook, Mailchimp, HubSpot, and QuickBooks.

Pros and cons

Pros:

- Supports multiple payment gateways

- Customizable subscription options

- Perfect for Shopify integration

Cons:

- Limited offline support

- Requires technical knowledge

Other Subscription Management Software for Small Business

Here are some additional subscription management software for small business options that didn’t make it onto my shortlist, but are still worth checking out:

- PayWhirl

For easy integration

- MoonClerk

For design customization

- Stax Bill

For high-volume invoicing

- Recurly

For churn reduction tools

- FastSpring

For global ecommerce

- Paddle

For SaaS companies

- Chargebee

For revenue recognition

- Zoho Billing

For multi-currency support

- Subbly

For subscription box businesses

- Zuora

For enterprise scalability

Our Selection Criteria For Subscription Management Software

When I evaluate subscription management software for small businesses, here’s what I actually look for—and what matters most if you want a system that works in the real world.

Core functionality (25% of total score)

You need the basics to be rock-solid. Here’s what I expect:

- Manage recurring billing without constant handholding.

- Handle multiple subscription plans and pricing models.

- Automate payment collection so you’re not chasing invoices.

- Provide a self-service portal for subscribers.

- Generate clear, actionable billing reports.

Additional standout features (25% of total score)

The best platforms go beyond the basics. I look for:

- Customizable billing cycles and flexible payment options.

- Advanced analytics and real-time reporting you’ll actually use.

- Multi-currency support for global or growing teams.

- CRM and accounting integrations that don’t break.

- Automated dunning management for failed payments and churn.

Usability (10% of total score)

If your team can’t figure it out, it won’t get used. I want:

- An intuitive, user-friendly interface.

- Easy navigation and minimal learning curve.

- Clean layout and design—no clutter.

- Responsive design for mobile or tablet access.

Onboarding (10% of total score)

Getting up and running shouldn’t be a slog. I check for:

- Useful training videos and interactive product tours.

- Prebuilt templates to speed up setup.

- Webinars or live support for onboarding.

- Chatbots or real help—not just a PDF manual.

Customer support (10% of total score)

When something breaks, you need a real answer fast. I look for:

- 24/7 support availability.

- Multiple support channels (chat, email, phone).

- Fast, knowledgeable responses.

- A searchable knowledge base.

- Personalized support if things get hairy.

Value for money (10% of total score)

You want ROI, not just another monthly bill. Here’s what matters:

- Competitive pricing and flexible plans.

- Features included—no nickel-and-diming.

- Transparent pricing structure.

- Real value for the cost.

Customer reviews (10% of total score)

I always check the crowd’s take. I look for:

- Consistent satisfaction ratings.

- Specific pros and cons mentioned by real users.

- Frequency of updates and improvements.

- Honest feedback on support and onboarding.

- User testimonials and case studies that aren’t just marketing fluff.

What is Subscription Management Software for Small Business?

Subscription management software for small business is a tool that lets you automate recurring billing, manage customer subscriptions, and handle payment collection—without the manual headaches.

It’s built for business owners and teams who need to streamline their subscription model, reduce churn, and keep recurring revenue on track.

The right platform gives you the dashboards, workflows, and customer self-service options to make subscription billing, renewals, and retention a lot less painful.

How to Choose Subscription Management Software for Small Business

Choosing the right subscription management software isn’t about chasing shiny features—it’s about finding a system that actually fits your business, your workflows, and your team’s real-world needs.

Here’s a quick, actionable checklist to help you cut through the noise and zero in on a solution that works for you:

| Step | What to do | Why it matters |

|---|---|---|

| Map your pain points | List out where your current billing, renewals, or subscriber management falls short. | Keeps you focused on solutions that solve real problems, not just nice-to-haves. |

| Prioritize must-haves | Decide which features are non-negotiable (automated billing, dunning, integrations, etc.). | Ensures your shortlist actually supports your business model and growth plans. |

| Test usability | Get hands-on with demos or free trials. Involve the team that will be using it. | Avoids surprises and makes sure your staff can actually use the platform day-to-day. |

| Check integration fit | Confirm it plays nice with your CRM, ecommerce, and accounting tools. | Saves you from manual work and data headaches down the line. |

| Compare total cost | Look beyond sticker price—factor in onboarding, support, and any transaction or upgrade fees. | Prevents budget surprises and helps you get real value for the spend. |

| Review support & onboarding | Evaluate response times, training resources, and support channels before you commit. | You’ll want help that’s actually helpful when things get messy. |

Features of Subscription Management Software for Small Business

Not all subscription management software is created equal. The right platform should do more than just process a payment—it should help you automate, optimize, and scale your subscription business without a ton of manual work.

Here’s what actually matters for small businesses:

- Automated billing. Automatically charge recurring payments so you’re not chasing invoices or dealing with late-night spreadsheets.

- Customer self-service portals. Let subscribers manage upgrades, downgrades, cancellations, and payment details on their own, cutting down on support tickets.

- Flexible payment options. Accept credit cards, ACH, one-time and recurring payments, and support different billing cycles to fit your business model.

- Customizable invoices. Make your invoices look like your brand, not a generic template, and tailor them for different subscription plans.

- Real-time reporting and dashboards. See churn, MRR, subscription renewals, and subscriber metrics at a glance—no more waiting for end-of-month surprises.

- Dunning management. Automatically follow up on failed payments with smart retries and notifications to recover revenue you’d otherwise lose.

- Integration with CRM, ecommerce, and accounting apps. Sync customer data and recurring revenue with the rest of your tech stack—no more double entry.

- Multi-currency and multilingual support. Bill international customers in their own language and currency without extra hassle.

- Robust security safeguards. Keep subscriber data safe with encryption, PCI compliance, and access controls.

- API and workflow automation. Build custom workflows or connect with other business tools as you grow, without outgrowing your software.

Benefits of Subscription Management Software for Small Business

If you’re still managing subscriptions with spreadsheets or duct-taped systems, you’re leaving money (and sanity) on the table.

Here’s what you really get when you use a subscription management solution that’s built for small business:

- Improved cash flow. Automated billing and payment collection mean you get paid on time, every time, without chasing customers.

- Reduced churn and better retention. Dunning management, self-service portals, and real-time notifications help keep subscribers around and cut down on failed payments.

- Time savings for your team. Automation handles the repetitive stuff—billing, renewals, upgrades, downgrades—so your staff can focus on growth, not admin.

- Stronger customer experience. Subscribers get control with user-friendly portals, flexible payment options, and clear communication at every step.

- Actionable insights and smarter decisions. Real-time dashboards and reporting give you the metrics you need—churn rate, recurring revenue, lifetime value—to actually run your subscription business, not just guess.

- Scalability as you grow. A good subscription management platform grows with you, handling more plans, more users, and more integrations without breaking a sweat.

- Better data security and compliance. Built-in safeguards keep customer data secure and help you stay compliant with PCI, GDPR, and other industry standards.

Costs & Pricing of Subscription Management Software for Small Business

Subscription management software pricing is anything but one-size-fits-all. You’ll see everything from “free forever” plans to four-figure monthly enterprise tiers, with plenty of fine print in between.

The real question isn’t just sticker price—it’s what you get for your money, and what could sneak up on your budget later.

Here’s a quick breakdown of typical plan types and what’s usually included:

| Plan type | Average price | Common features | Best for |

|---|---|---|---|

| Free plan | $0 | Basic billing, limited customer portals, basic reporting | Testing the waters, solo shops |

| Personal plan | $5–$25/user/month | Automated billing, customer portals, standard reporting | Small teams, simple needs |

| Business plan | $30–$75/user/month | Advanced analytics, customizable invoices, multi-currency support | Growing teams, more complexity |

| Enterprise plan | $100+/user/month | Full integrations, priority support, deep customization | High-volume, multi-location, or complex ops |

Additional cost considerations

Before you sign on the dotted line, watch for these common gotchas:

- Transaction fees. Some platforms take a cut of every payment—especially on lower-tier or “free” plans.

- Upgrade and add-on charges. Features like advanced workflows, extra integrations, or premium support may cost extra.

- Onboarding or setup fees. A few vendors charge to help you get started—ask up front.

- Overage fees. Exceed your subscriber, invoice, or transaction limits, and you might get hit with surprise charges.

- Support tiers. 24/7 or “white glove” support can sometimes cost more, especially on entry-level plans.

- API access. Some restrict API calls or integrations unless you’re on a higher plan.

Subscription Management Software for Small Business FAQs

Here are some answers to common questions about subscription management software for small businesses:

Can I migrate existing subscribers and billing data into new subscription management software?

Yes, most subscription management platforms offer import tools or onboarding support to help you migrate existing subscriber lists, subscription plans, and payment history.

Look for clear documentation, CSV import options, and dedicated migration support—especially if you’re moving from homegrown systems or another billing platform.

What’s the difference between subscription management software and regular billing or invoicing software?

Subscription management software is purpose-built for recurring billing, automated renewals, churn reduction, dunning management, and subscriber lifecycle management.

Standard billing or invoicing tools usually lack features like automated renewals, self-service portals, or real-time subscription metrics—leaving you with more manual work and less insight.

How does subscription management software help with upgrades, downgrades, and plan changes?

A good subscription management solution lets you automate plan upgrades, downgrades, and changes mid-cycle, without manual intervention.

Subscribers can often manage these changes themselves via a self-service portal, and the system automatically adjusts billing, proration, and notifications—keeping your team out of the weeds.

Can I use subscription management software with multiple payment gateways or currencies?

Yes, many top subscription management platforms support multiple payment gateways (like Stripe, PayPal, Authorize.Net) and multi-currency billing.

This is essential if you’re running an ecommerce or SaaS business with international subscribers or want flexibility in your payment processing setup.

What kind of reporting and analytics should I expect?

Look for real-time dashboards that show churn rate, MRR, renewals, failed payments, and customer lifetime value.

The best platforms let you customize reports, track subscriber cohorts, and export data to your accounting software or CRM—giving you actionable insights, not just data dumps.

How does subscription management software handle failed payments and reduce churn?

Leading platforms use automated dunning management: they’ll retry failed payments, send branded notifications, and let customers update payment details directly.

Smart dunning workflows help recover revenue, keep your churn rate down, and minimize manual follow-up for your team.

Don’t Let Your Revenue Go With the Flow

Subscription management shouldn’t feel like so hard.

The right software lets you automate the chaos, reduce churn, and keep your recurring revenue predictable—so you can focus on growing your business, not fixing billing fires.

Invest in a subscription management solution that actually works for your team, your subscribers, and your bottom line. Because in this game, you want more “recurring” and less “recurring nightmare.”

If you're in the process of researching subscription management software for small business, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.

Retail never stands still—and neither should you. Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.