Best Shopify Payments Alternatives

Let’s see the leaderboard! Here are our picks for the best Shopify Payments alternatives and what they’re good at:

Running a Shopify store means you don’t have time for payment headaches—but Shopify Payments can still hit you with high transaction fees, limited payment methods, or roadblocks if you’re selling across borders.

If you’re tired of payouts getting delayed, fraud protection that feels flimsy, or checkout options that don’t match your customers’ expectations, it’s time to look at alternatives.

I’ve been in the trenches—managing inventory, warehouses, international sales, and ecommerce marketing—so I know how the wrong payment processor can drag down your checkout process and your bottom line.

The right one gives you flexibility, better conversion rates, and a sense of control over your payment processing.

This guide cuts through the noise and breaks down the best Shopify Payments alternatives: what they cost, how they handle credit cards and digital wallets, what their fraud protection looks like, and whether their customer support is actually useful.

Why Trust Our Software Reviews

We’ve been testing and reviewing retail management software since 2021. As retail operators ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different retail management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & check out our software review methodology.

Comparing the Best Shopify Payments Alternatives, Side-by-Side

Need the TL;DR on the best payment gateways? Here’s a quick comparison of pricing, trial details, and use cases for each Shopify Payments alternative—so you can spot the right fit for your online store without slogging through endless small print.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for flexible payment options | Free plan available | From $49/month + transaction fees | Website | |

| 2 | Best for payment customization | Free demo available | From $15/month | Website | |

| 3 | Best for omnichannel integration | Not available | Pricing upon request | Website | |

| 4 | Best for global tax compliance | Free demo available | From 3.5% + $0.35/transaction | Website | |

| 5 | Best for AI-driven fraud protection | Free demo available | Pricing available upon request | Website | |

| 6 | Best for payment customization | Free plan available | From $29.95/year | Website | |

| 7 | Best for AI-driven fraud protection | Free test account available | Pricing upon request | Website | |

| 8 | Best for Canadian businesses | Free demo available | Pricing available upon request | Website | |

| 9 | Best for payment customization | Free demo available | From 2.90% + $0.30/successful card transaction | Website | |

| 10 | Best for large‑scale enterprise processing | Free demo available | Pricing available upon request | Website |

The 10 Best Shopify Payments Alternatives, Reviewed

Here’s where we get into the details. Below, you’ll find my hands-on breakdowns of each payment provider’s standout features, pricing, integrations, and support—so you know exactly what you’re getting before you commit.

Square is a payment and point-of-sale (POS) platform designed for small and medium-sized businesses across industries like retail, food and beverage, and professional services. It combines payment processing, hardware, and business management tools to help you accept payments online and in person.

Why it’s a good Shopify Payments alternative: I picked Square because it offers a broader mix of hardware and software tools that let you accept payments anywhere—whether you’re in-store, online, or on the move. For small businesses, the ability to get started with free POS software and then expand into add-ons like inventory tracking and customer management makes it especially appealing. Also, Square’s focus on customer engagement—through features like digital receipts and loyalty programs—can help you keep customers returning without needing extra tools.

Standout features & integrations:

Features include team management for staff scheduling and payroll, cash flow management for monitoring your finances, and multiple hardware options such as Square Register and Square Terminal for handling sales in different environments.

Integrations include QuickBooks Online, Mailchimp, WooCommerce, Shopify, Wix, Google Sheets, Gmail, Zoho CRM, Slack, Asana, MailerLite, and Pipedrive.

Pros and Cons

Pros:

- Strong analytics and reporting

- Free POS system included

- Wide variety of POS hardware

Cons:

- Limited marketplace integrations

- Higher fees for large sellers

New Product Updates from Square

Square Introduces Neighborhoods on Cash App

Square launches Neighborhoods on Cash App, offering businesses access to over 57 million active accounts, direct marketing, neighborhood rewards, and a 1% processing fee. For more information, visit Square's official site.

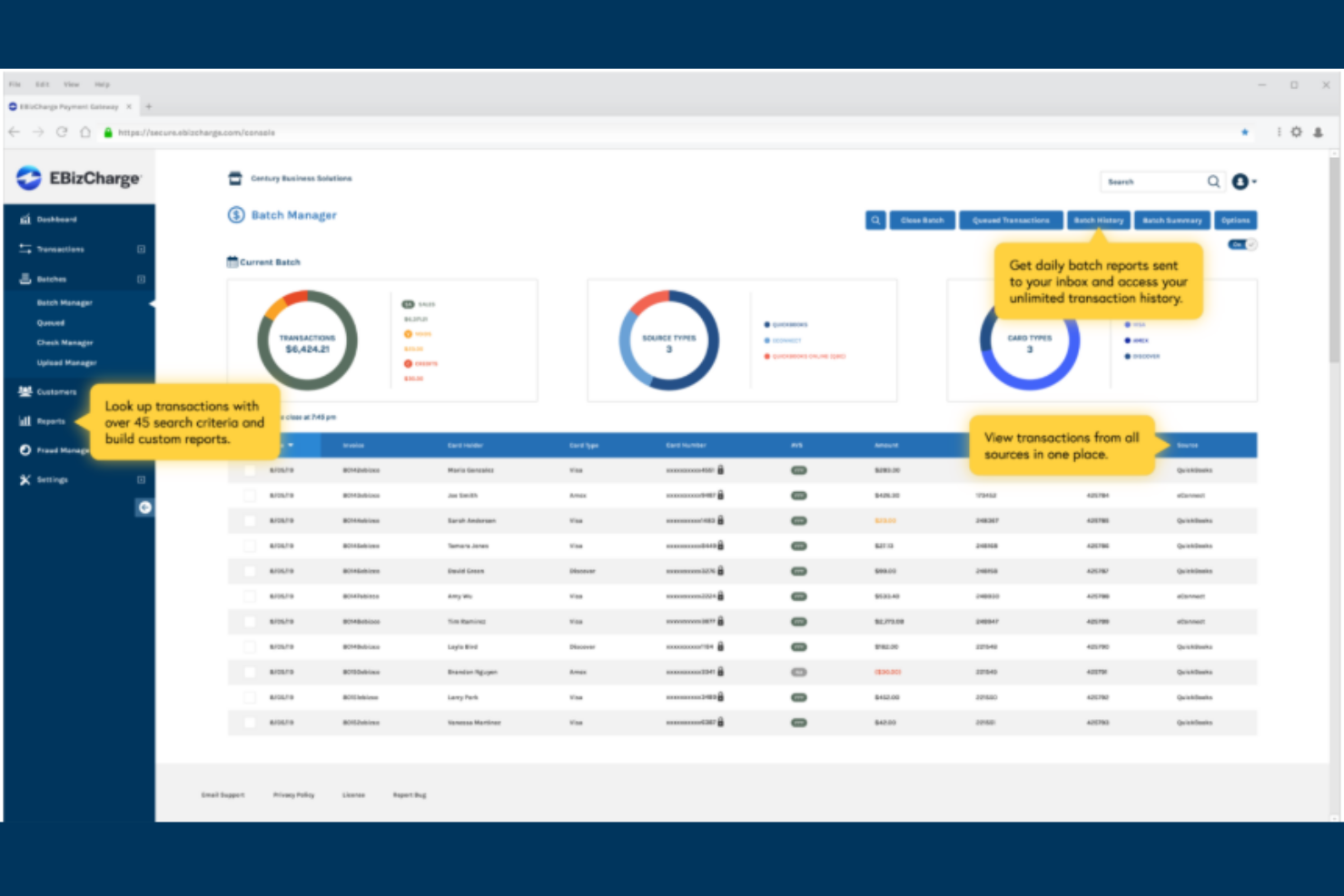

EBizCharge is a payment processing solution designed for businesses across various industries, including automotive, healthcare, and education. It offers services like credit card and eCheck processing, fraud prevention, and accounts receivable automation.

Why it's a good Shopify Payments alternative: EBizCharge provides a high level of payment customization, enabling your team to tailor payment options to fit specific business needs. Features like email payment links and a self-service customer payment portal enhance the payment experience for your customers. The platform's focus on security with tokenization and encryption ensures your transactions are safe. Additionally, advanced reporting tools help you streamline your accounting tasks.

Standout features & integrations:

Features include mobile payment capabilities, allowing your team to process payments on the go. The platform also offers recurring billing to automate regular payments, saving you time. EBizCharge's advanced reporting tools provide insights into your payment processes, helping you make informed decisions.

Integrations include QuickBooks, Microsoft Dynamics, Sage, SAP, Acumatica, NetSuite, Zoho, FreshBooks, Xero, and Intacct.

Pros and Cons

Pros:

- Suitable for various industries

- Advanced reporting capabilities

- Supports mobile payments

- Strong security features

Cons:

- Occasional delays in customer support

- Complex feature set for beginners

- May require technical setup

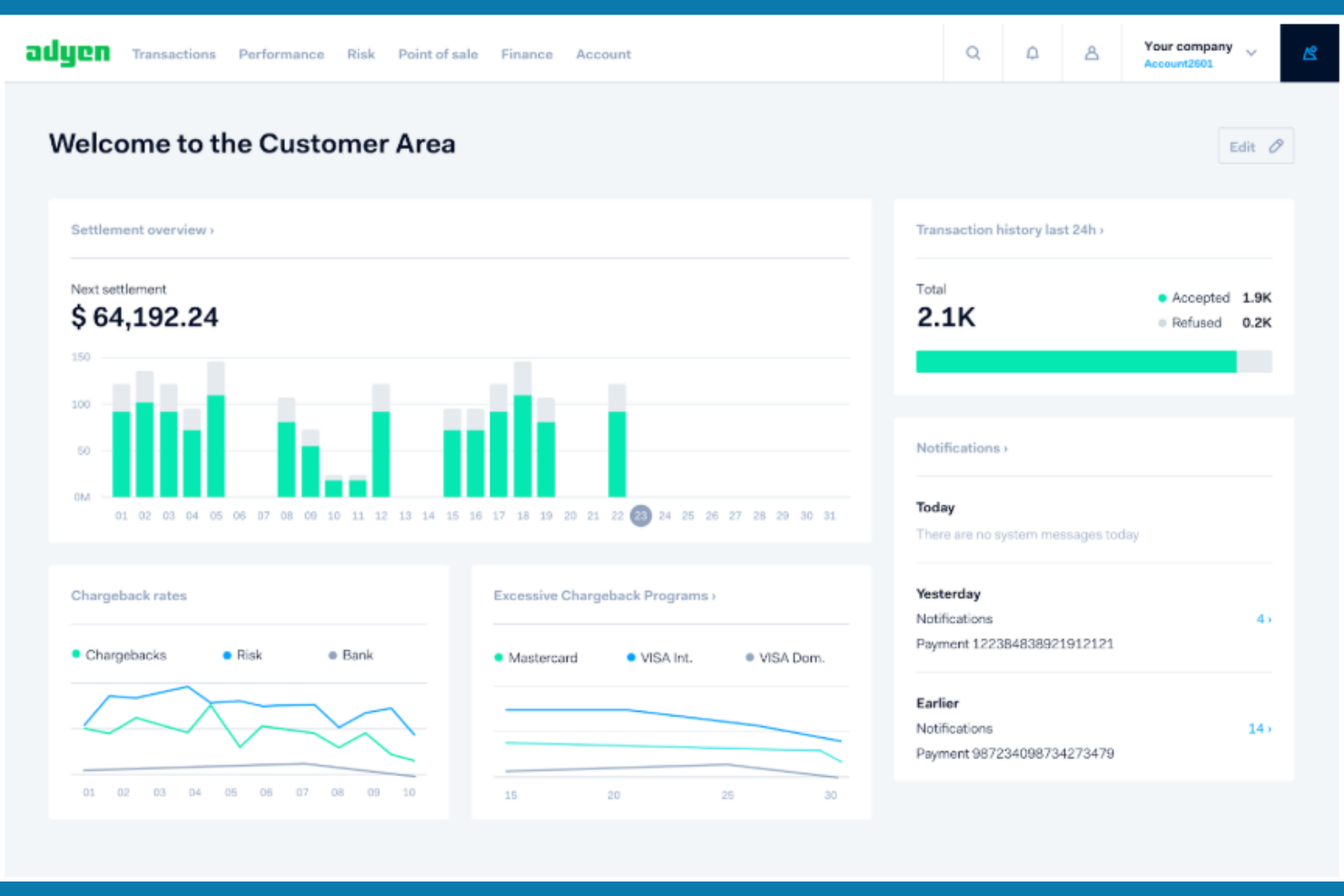

Adyen is a payment platform that caters to businesses of all sizes, providing solutions for online, mobile, and in-person payments. It supports a wide range of payment methods and currencies, making it ideal for global businesses looking to unify their payment processes.

Why it's a good Shopify Payments alternative: Adyen offers sophisticated omnichannel integration, allowing your team to manage payments across various channels seamlessly. With features like real-time data insights and risk management, you can optimize your payment strategies and reduce fraud. The platform supports a wide array of payment methods, enhancing your ability to cater to diverse customer preferences. Additionally, its global reach ensures you can operate in multiple regions without hassle.

Standout features & integrations:

Features include real-time data analytics, providing insights to help you make informed business decisions. The platform's risk management tools ensure secure transactions and reduce the likelihood of fraud. Adyen also offers scalable solutions, allowing your business to grow without changing payment providers.

Integrations include Shopify, WooCommerce, Magento, BigCommerce, Salesforce, QuickBooks, NetSuite, SAP, Xero, and Oracle.

Pros and Cons

Pros:

- Scalable for business growth

- Effective risk management tools

- Provides real-time data insights

- Strong global presence

Cons:

- Customer support may vary by region

- Limited support for small businesses

- Requires technical knowledge

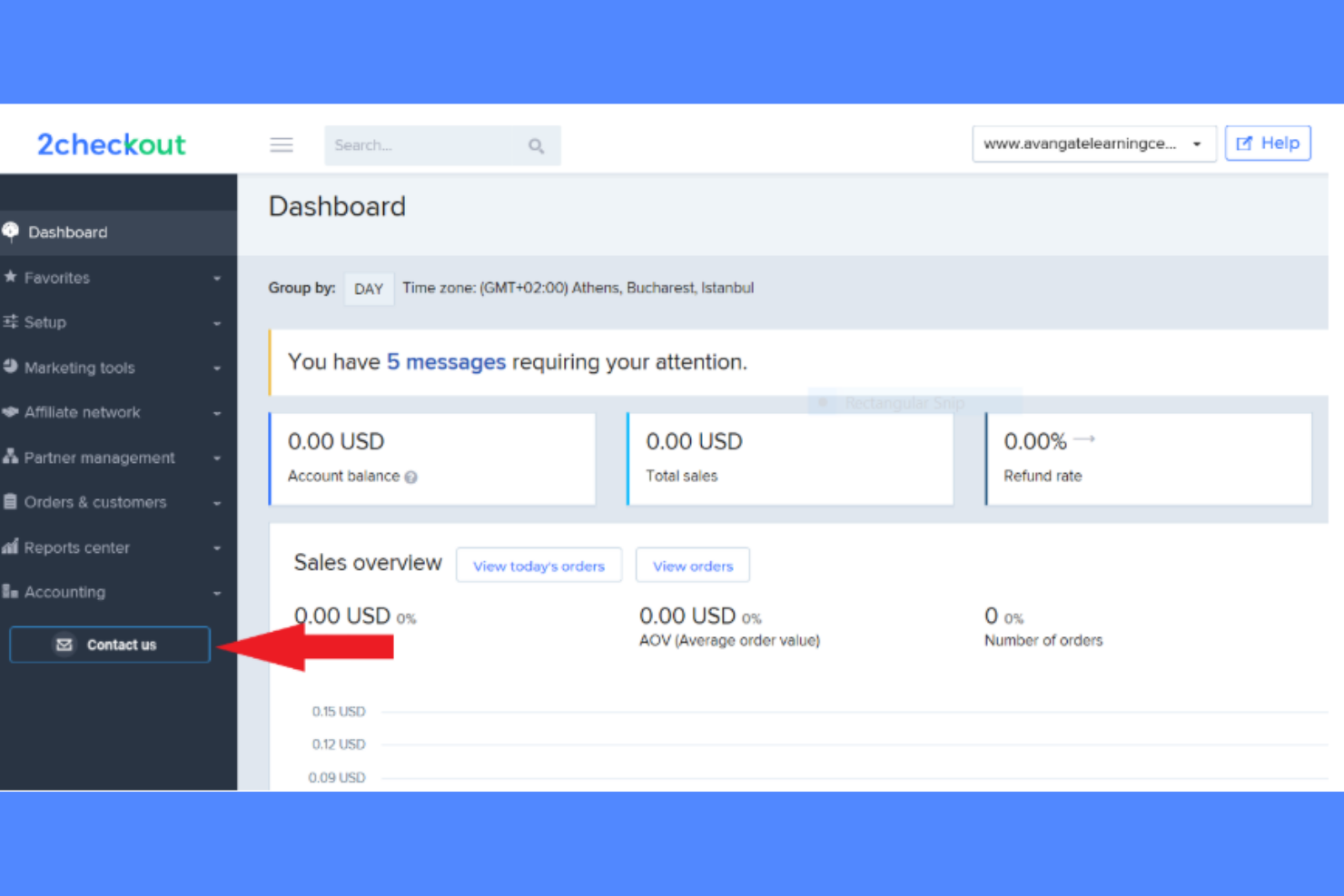

2Checkout (Verifone) is an online payment processing platform that serves businesses of all sizes, especially those operating in international markets. It helps manage global payments, subscription billing, and risk management for both B2B and B2C commerce.

Why it's a good Shopify Payments alternative: With its focus on global tax compliance, 2Checkout (Verifone) offers features like automated tax calculations, VAT management, and compliance with international regulations. These capabilities help your team handle complex cross-border transactions more efficiently than Shopify Payments. The platform's ability to support multiple currencies and localized buying experiences enhances its value for businesses looking to expand globally.

Standout features & integrations:

Features include automated tax calculations, VAT management, and compliance with international regulations. You can also benefit from subscription billing, which helps manage recurring payments. The platform's risk management tools protect your business from fraud.

Integrations include Shopify, WooCommerce, Magento, PrestaShop, OpenCart, BigCommerce, X-Cart, WHMCS, Ecwid, and 3dcart.

Pros and Cons

Pros:

- Localized buying experiences

- Provides risk management tools

- Automated tax calculations

- Supports global transactions

Cons:

- Customer service response time

- Requires technical knowledge

- Occasional delayed payouts

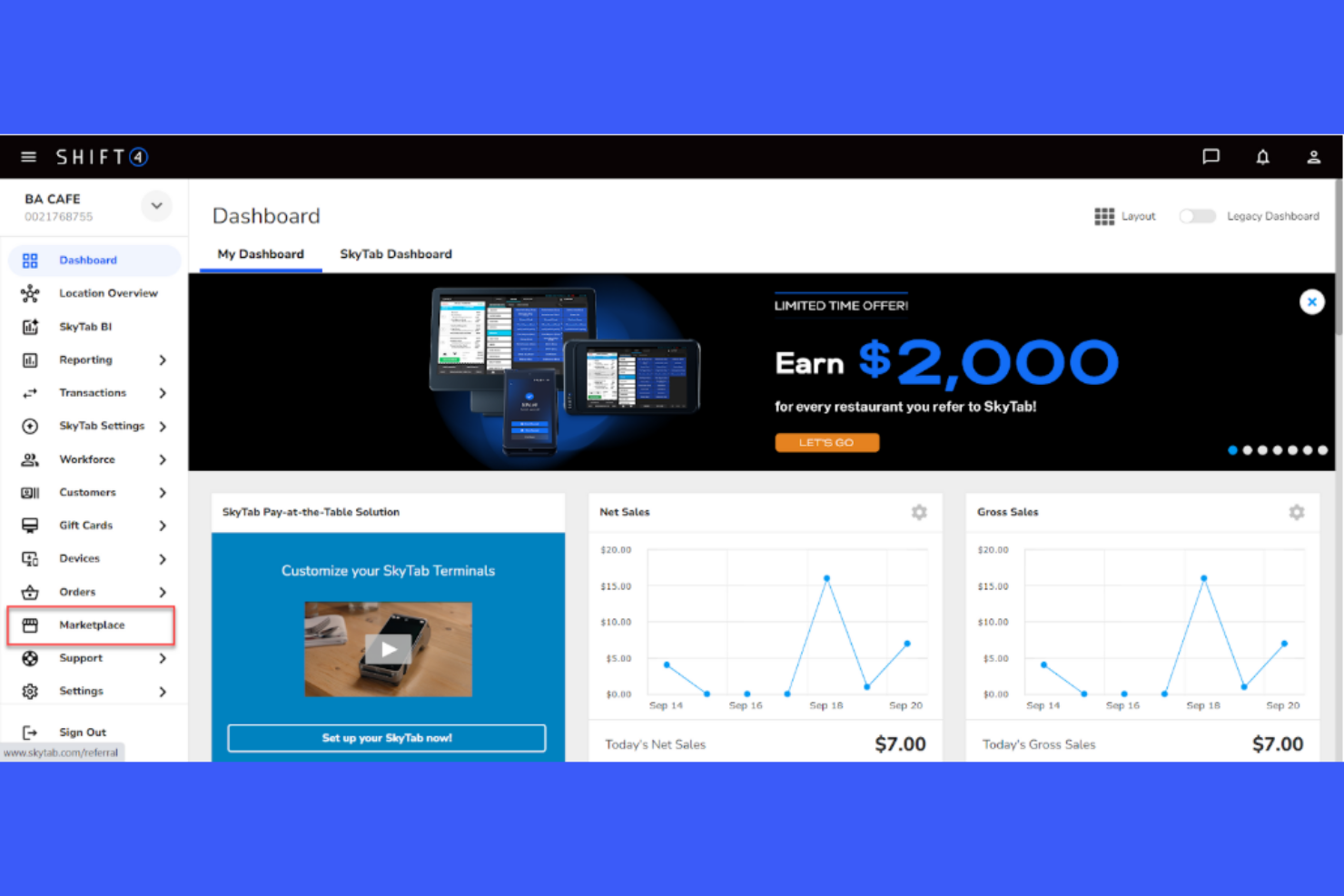

Shift4 is a payment processing platform that provides end-to-end payment solutions for a variety of industries, including hospitality, retail, and ecommerce. It supports in-store, online, and mobile payments, helping businesses manage transactions efficiently.

Why it's a good Shopify Payments alternative: Shift4's AI-driven fraud protection helps your team secure transactions and reduce the risk of fraud. It offers features like end-to-end encryption and tokenization to protect sensitive data. The platform's ability to handle multiple payment types makes it versatile for different business needs. Additionally, Shift4's advanced reporting tools give you insights into your payment processes, aiding in better decision-making.

Standout features & integrations:

Features include contactless payment options, which cater to the growing demand for touch-free transactions. The platform's mobile payment capabilities enable your team to process payments on the go. Shift4 also offers customizable gift card solutions, which can enhance your customer loyalty programs.

Integrations include Shopify, WooCommerce, Magento, BigCommerce, Salesforce, QuickBooks, NetSuite, SAP, Xero, and Oracle.

Pros and Cons

Pros:

- Customizable gift card solutions

- Offers end-to-end encryption

- Supports multiple payment types

- Strong AI-driven fraud protection

Cons:

- Occasional delays in customer support

- Limited support for small businesses

- Complex setup process

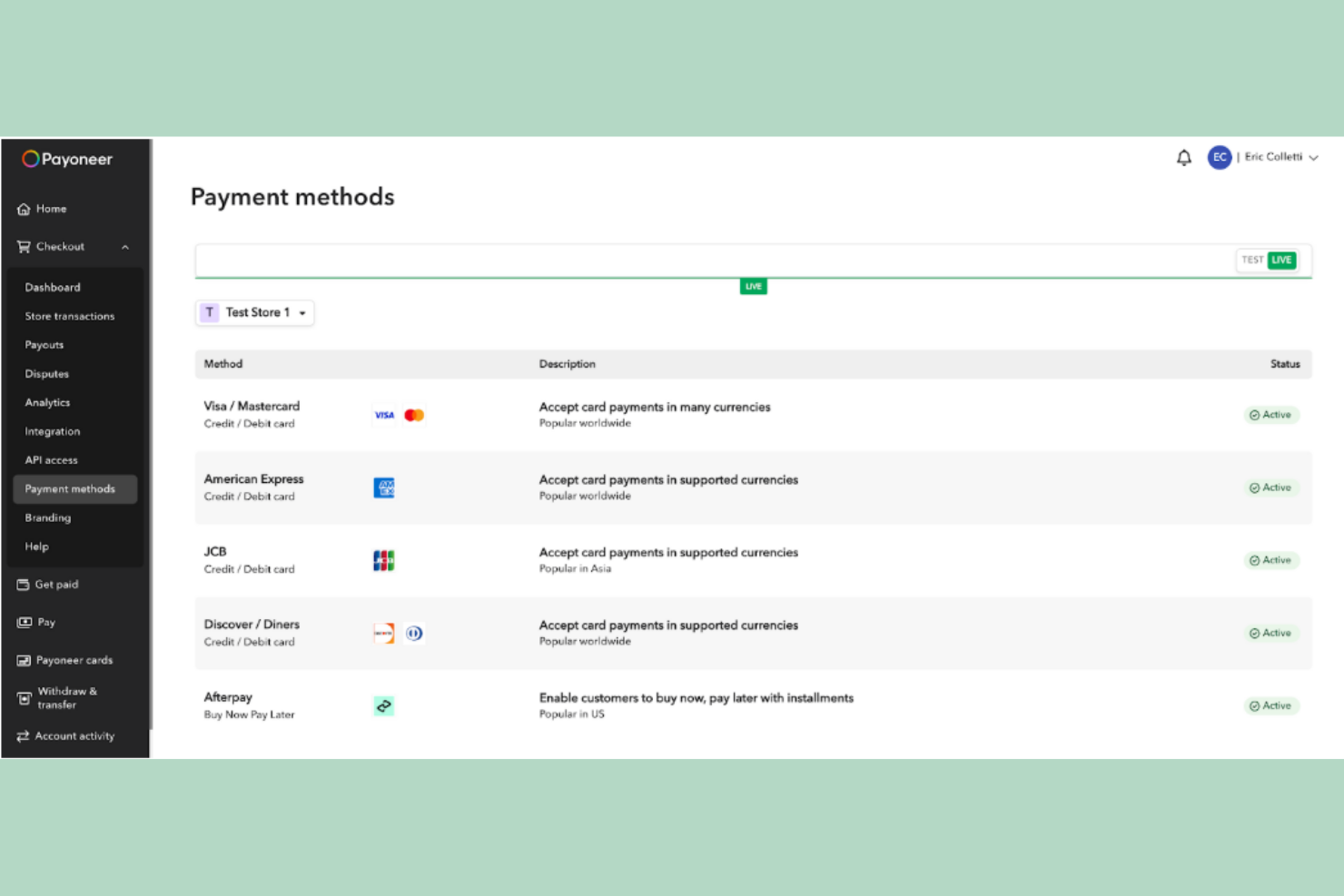

Payoneer is a financial services company that provides online money transfer and digital payment services, catering primarily to freelancers, businesses, and online sellers. It enables users to receive funds into their Payoneer account and withdraw them to their bank account or use them to make purchases online.

Why it's a good Shopify Payments alternative: Payoneer offers payment customization that lets your team tailor payment solutions to fit your business needs. With options like multi-currency accounts and local receiving, you can manage international transactions efficiently. The platform's global payment service allows you to pay suppliers and contractors worldwide. Additionally, Payoneer’s competitive exchange rates can help you save on foreign currency transactions.

Standout features & integrations:

Features include a prepaid MasterCard that you can use for purchases or ATM withdrawals. The platform also offers a billing service that allows you to send payment requests to clients. Payoneer’s currency conversion feature helps you manage multiple currencies with ease.

Integrations include Amazon, Fiverr, Upwork, Airbnb, Wish, Walmart, Adobe, Google, eBay, and Lazada.

Pros and Cons

Pros:

- Easy currency conversion

- Provides prepaid MasterCard

- Offers global payment service

- Supports multi-currency accounts

Cons:

- Occasional delays in customer support

- Complex onboarding process

- Limited local support in some regions

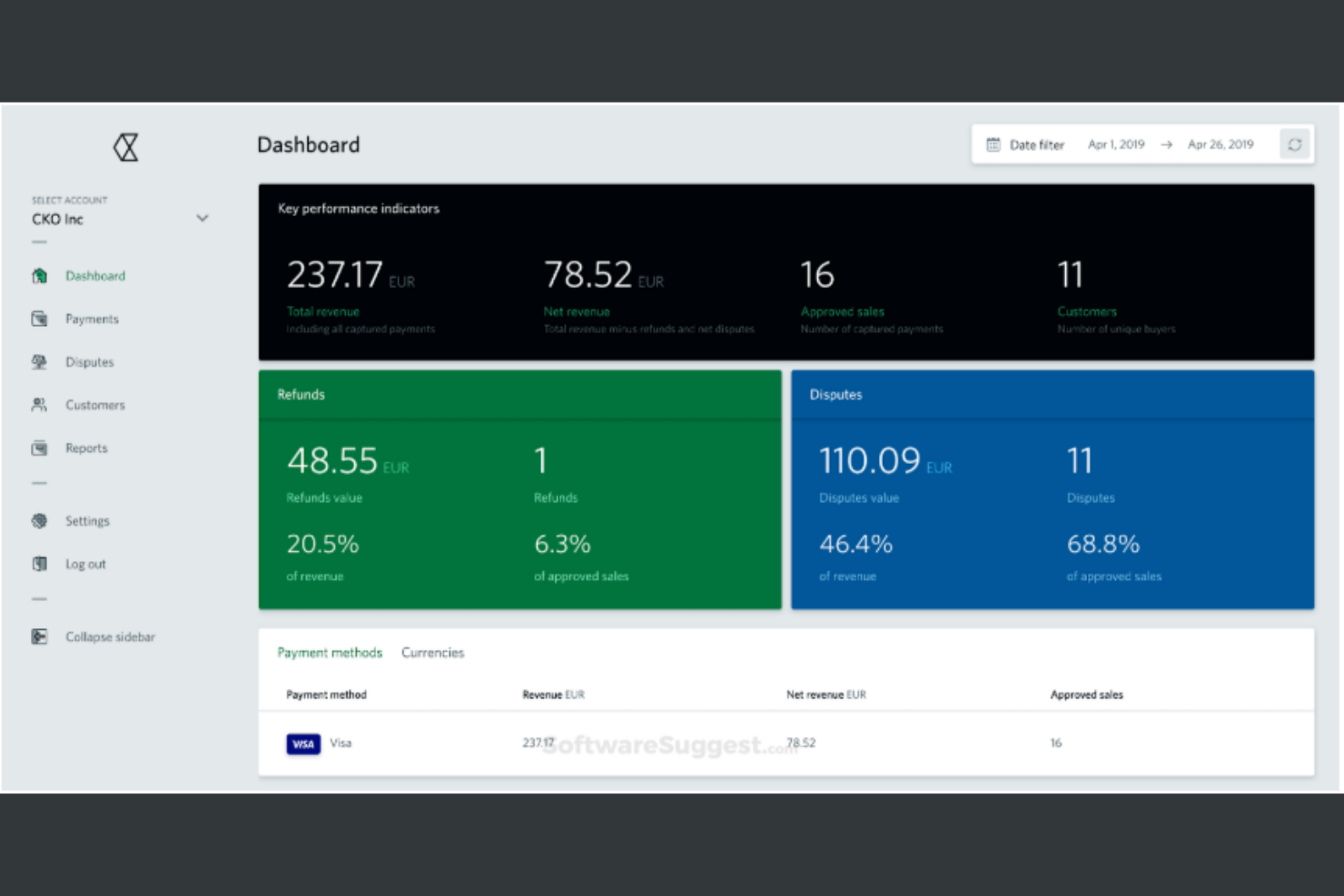

Checkout.com is a global payment service provider catering to industries like ecommerce, gaming, travel, and fintech. It offers a suite of payment services, including a global payments network, fraud detection, and risk management tools.

Why it's a good Shopify Payments alternative: With a focus on AI-driven fraud protection, Checkout.com provides tools like Intelligent Acceptance and Identity Verification to optimize payment acceptance and reduce fraud. The platform supports over 150 currencies, making it ideal for businesses operating in multiple regions. Easy integration through APIs and low-code solutions ensures that your team can quickly adapt to the platform. Additionally, Checkout.com emphasizes security and compliance, which are critical for maintaining customer trust.

Standout features & integrations:

Features include an extensive global payments network that supports over 150 currencies. The platform's risk management tools help minimize fraud and ensure secure transactions. Checkout.com also offers Intelligent Acceptance, which optimizes payment acceptance rates.

Integrations include Shopify, WooCommerce, Magento, BigCommerce, Salesforce, QuickBooks, NetSuite, SAP, Xero, and Oracle.

Pros and Cons

Pros:

- Emphasizes security and compliance

- Easy API and low-code integrations

- Strong AI-driven fraud protection

- Supports over 150 currencies

Cons:

- Limited support for small businesses

- Requires technical expertise

- Complex initial setup

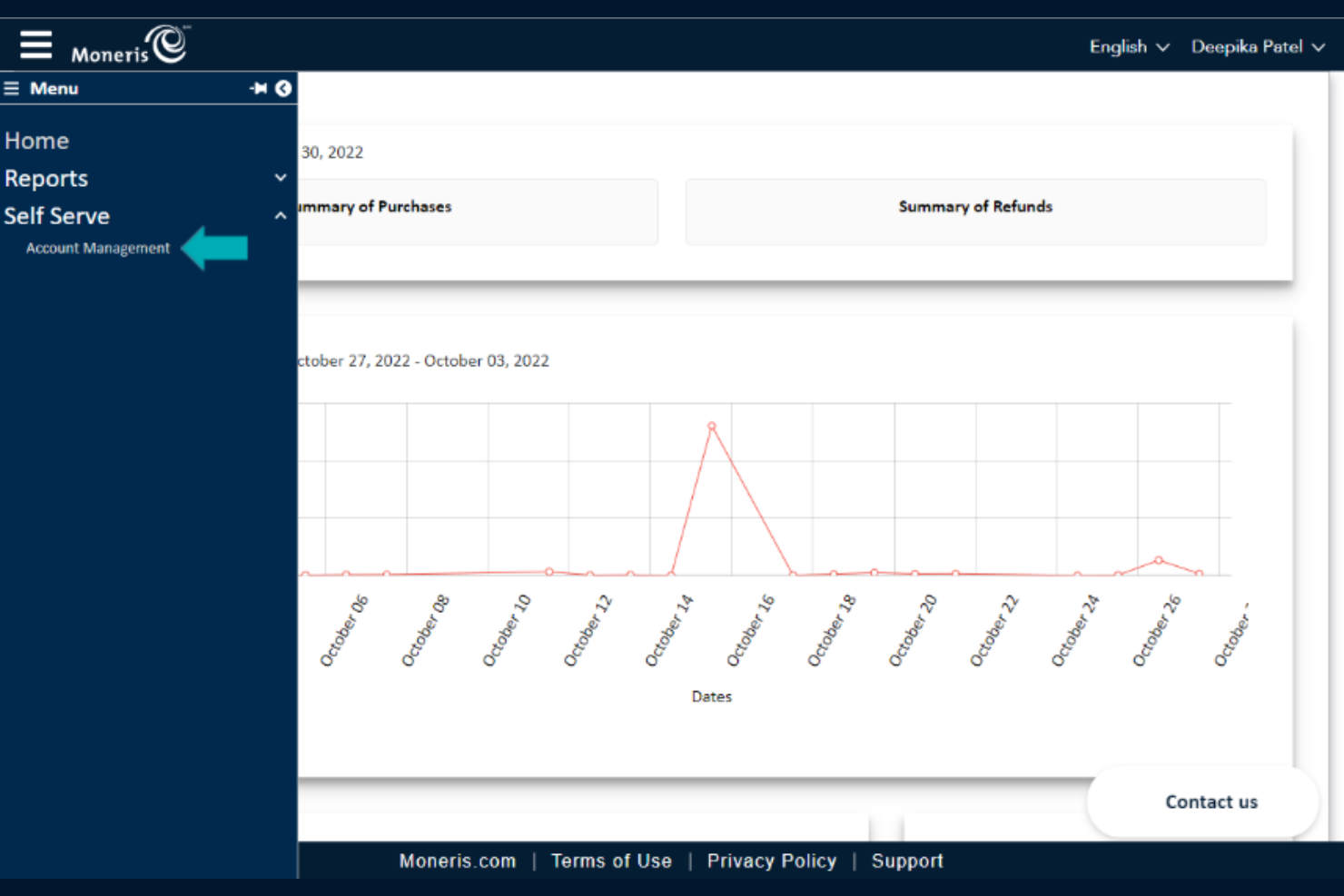

Moneris is a commerce solution provider that caters primarily to Canadian businesses across retail, restaurants, and professional services. It offers a range of services including point-of-sale systems, online payment processing, and fraud prevention.

Why it's a good Shopify Payments alternative: As a key player in the Canadian market, Moneris supports local businesses with features like the Moneris Go Plus terminal, which offers quick transactions and easy setup. Their solutions include advanced fraud protection and the option for customers to pay in installments, enhancing security and sales flexibility for your team. The platform's focus on local support and data-driven insights helps businesses thrive in the Canadian market.

Standout features & integrations:

Features include the ability to accept contactless payments directly on iPhones, making it easier for your team to handle transactions. Moneris also offers customizable electronic gift cards, which can be a great addition to your marketing strategy. Their merchant cash advance program provides quick funding with flexible repayment options.

Integrations include Amazon, Facebook, Google, Shopify, WooCommerce, Magento, PrestaShop, OpenCart, BigCommerce, and X-Cart.

Pros and Cons

Pros:

- Limited to Canadian businesses

- Offers merchant cash advance

- Quick and easy terminal setup

- Advanced fraud protection tools

- Strong focus on Canadian market

Cons:

- Limited international support

- Requires technical knowledge for setup

BlueSnap is a Global Payment Orchestration Platform designed to simplify payment processes for businesses, enhancing efficiency and reducing costs. It primarily serves ecommerce businesses, offering solutions for payment processing, fraud prevention, and chargeback management.

Why it's a good Shopify Payments alternative: BlueSnap's focus on payment customization allows your team to tailor payment solutions to fit specific business needs. With features like global reach, you can accept payments from over 200 regions with a single integration. The platform's modular technology and risk management tools provide flexibility and security, helping you manage transactions efficiently. BlueSnap's expert support further ensures you can optimize payment strategies effectively.

Standout features & integrations:

Features include intelligent payment routing, which helps improve authorization rates and reduce costs. The platform also offers local acquisition to avoid unnecessary fees, enhancing your business's bottom line. Additionally, customizable billing plans can improve customer satisfaction and retention.

Integrations include Shopify, WooCommerce, Magento, BigCommerce, Salesforce, QuickBooks, NetSuite, SAP, Xero, and Oracle.

Pros and Cons

Pros:

- Offers local acquiring options

- Strong fraud prevention measures

- Supports over 200 regions

- Highly customizable payment solutions

Cons:

- Occasional delays in customer support

- Complex setup for some features

- May require technical expertise

Global Payments is an enterprise-grade payment platform built for large businesses and high-volume transactions. It helps you manage online, in-person, and mobile payments across multiple regions and industries.

Why Global Payments is a good Shopify Payments alternative: You can manage large-scale payment processing across multiple countries and currencies with a single platform. Global Payments offers enterprise-level features like custom payment routing, fraud controls, and tokenization. Your team can also use it to support complex sales channels and handle high transaction volumes without delays. It’s a good fit if you need a solution that handles enterprise demands at scale.

Standout features & integrations:

Features include advanced reporting tools to track payment trends and performance. You can customize checkout flows to match your business setup. There are also tools to support recurring billing and loyalty programs.

Integrations include Oracle, SAP, Salesforce Commerce Cloud, Adobe Commerce, BigCommerce, WooCommerce, Magento, NetSuite, Shopify, and NCR.

Pros and Cons

Pros:

- Includes advanced fraud tools

- Customizable payment flows

- Built for complex sales environments

- Supports multi-region operations

Cons:

- Customization needs developer input

- Some features feel overly complex

- Takes time to set up

Other Shopify Payments Alternatives

Here are some additional Shopify Payments alternatives that didn’t make it onto my shortlist, but are still worth checking out:

- Elavon

For AI-driven fraud protection

- Authorize.net

For global tax compliance

- Worldpay

For multi‑currency global reach

- Helcim

For transparent pricing

- Airwallex

For international business accounts

- Stripe

For developer-friendly API

- Paypal Enterprise

For large-scale enterprise needs

- Payment Depot

For low transaction fees

- Stax Payments

For subscription-based pricing

- Merchant One

For personalized customer support

- Payline Data

For flexible payment options

Our Selection Criteria for Shopify Payments Alternatives

Here’s how I actually judge these payment processors—no hand-waving, no fluff. Each section below spells out what matters and how much it counts toward the final ranking.

Core functionality (25% of total score)

You can’t even make the list if you don’t cover the basics. I looked for:

- Ability to process credit and debit card payments

- Secure transactions and PCI compliance

- Multi-currency support for global sales

- Transaction reporting you can actually use

- Both online and in-store payment options

Additional standout features (25% of total score)

Some tools just do the minimum. I want more. Here’s what sets the best apart:

- Real-time fraud detection and prevention

- Customizable payment or checkout pages

- Advanced analytics and reporting

- Multi-language support for international teams

- Subscription billing and recurring payments

Usability (10% of total score)

If it’s a pain to use, it’s a non-starter. I checked for:

- Intuitive user interface and navigation

- Mobile accessibility for on-the-go management

- Customizable dashboards

- Clear, practical documentation

Onboarding (10% of total score)

Getting started shouldn’t require a PhD. I looked for:

- Training videos and walkthroughs

- Access to templates and guides

- Interactive product tours or demos

- Chatbot help or live webinars for new users

Customer support (10% of total score)

When things go sideways, you need real help—not a black hole. I weighed:

- 24/7 availability

- Multiple ways to reach support (chat, phone, email)

- Fast, useful responses

- Solid help center resources

- Personalized assistance if you need it

Value for money (10% of total score)

You want a fair deal, not just a big brand name. I factored in:

- Competitive, transparent pricing

- Flexible plans for different volumes

- Discounts for high-volume sellers

- The real bang-for-your-buck ratio

Customer reviews (10% of total score)

What do actual users think? I scanned for:

- Overall satisfaction ratings

- Reliability and uptime feedback

- Comments on ease of use and support

- Honest opinions on value for money

What is Shopify Payments?

Shopify Payments is Shopify’s built-in payment processing solution—meaning you can accept credit cards, debit cards, and digital wallets right from your Shopify admin, no third-party gateways or extra logins required.

It’s designed to make life easier for ecommerce store owners: setup is automatic, payouts are tracked in real time, and you get multi-currency support to reach customers around the world.

For most Shopify merchants, the big draw is simplicity—no need to wrangle external payment providers, and no extra transaction fees if you stick with Shopify Payments. You also get built-in fraud analysis, support for Apple Pay and Google Pay, and a customizable checkout page that matches your brand.

In short: it’s a streamlined, all-in-one way to process online transactions, manage chargebacks, and keep your store’s cash flow moving.

Why Look For A Shopify Payments Alternative?

Shopify Payments works for a lot of ecommerce businesses, but it’s not a one-size-fits-all solution—especially if you’re running into high transaction fees, limited payment methods, or you’re expanding internationally.

Maybe you need better fraud protection, more flexible payment options, or advanced reporting that doesn’t make you want to pull your hair out.

Here’s why many Shopify merchants start shopping around for a payment processor that actually fits the way they operate:

- You’re facing high transaction fees that eat into your margins

- You need support for more currencies or alternative payment methods

- Your team needs stronger fraud detection and chargeback management

- You’re selling in regions where Shopify Payments isn’t available

- Your business requires advanced reporting tools or better payout control

- You want a checkout experience that boosts conversion rates and matches your brand

If any of these pain points sound familiar, it’s time to consider a Shopify Payments alternative that’s built for how you really do business.

Shopify Payments Alternatives Key Features

Here’s what you should expect from any Shopify Payments alternative worth your time (and your transaction fees). If the provider you’re looking at can’t check these boxes, keep shopping:

- Integrated payment gateway. Seamlessly process credit cards, debit cards, digital wallets, and alternative payment methods—without a tangled mess of third-party plugins.

- Multi-currency support. Let customers pay in their local currency, whether you’re selling across borders or just want to make checkout frictionless.

- Fraud detection and protection. Real-time tools to flag suspicious transactions, stop chargebacks, and actually keep your team out of the fraud fire drill.

- Automatic or easy setup. Get up and running fast—no IT heroics required, and onboarding that doesn’t kill your week.

- Competitive, transparent pricing. No hidden fees, no gotchas. You want to know exactly what you’re paying for every transaction.

- Chargeback and dispute management. Built-in tools to help you fight and recover revenue from chargebacks, not just eat the loss.

- Payout tracking and control. See payout schedules and histories in real time, and control when and how you get paid.

- Mobile and digital wallet support. Accept Apple Pay, Google Pay, and other digital wallets for a customer experience that doesn’t kill conversions.

- Customizable checkout experience. Tailor your checkout page to match your brand and optimize for higher conversion rates.

- Reporting and analytics. Get real-time sales data, transaction reporting, and actionable insights—so you’re not flying blind.

Don’t Let Your Payment Stack Shortchange You

Shopify Payments is fine—until it isn’t. If you’re bumping into its limits, don’t settle for “good enough” when it comes to getting paid.

The right payment gateway or processor can save you money, open up new markets, and make your checkout experience less of a headache for everyone.

Take the time to actually compare your options. Look at the transaction fees, payment methods, fraud protection, reporting, and support that matter for your business—not just what sounds good in a press release.

A little research now can save you a lot of pain (and lost revenue) later.

If you're in the process of researching payment processing, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.

Retail never stands still—and neither should you. Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.