The Top 10 Credit Card Readers for iPhone You Should Consider

Use this shortlist to scan the market quickly. Each pick includes a “best for” tag so you can match your needs before diving into the full reviews and pricing details.

Get free help from our project management software advisors to find your match.

You’re here for the best credit card reader for iPhone—fast to set up, reliable at checkout, and clear on fees.

I cut through the noise and focused on what actually matters in-store: iOS compatibility, Bluetooth reliability, EMV/NFC support (including Apple Pay and Tap to Pay on iPhone), and total cost to run.

Long lines, failed swipes, missing deposits, and clunky POS apps kill margins.

I looked at transaction fees and monthly fees, hardware options (magstripe, chip, contactless), payout timelines, offline mode, and how well each reader plugs into a real point of sale workflow—inventory, invoicing, and exports you can trust.

What you’ll get here: how I ranked these providers, who each one is best for, and a side-by-side view of pricing models and functionality.

I also call out device compatibility (iPhone/iPad), supported payment methods and digital wallets, and any gotchas like long-term contracts or proprietary lock-ins.

I’ve spent 10+ years in retail and ecommerce software reviews and know how much the right payments setup impacts cash flow and customer experience.

Let’s get you taking in-person payments confidently—without surprises.

Why Trust Our Software Reviews

Comparing the Best Credit Card Readers for iPhone, Side-by-Side

This table shows monthly fees, per-transaction rates, hardware support (magstripe, EMV chip, NFC), and iOS compatibility. Find the right one for your brand.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for secure payments | Free consultation available | Pricing upon request | Website | |

| 2 | Best for real-time insights | Free app download available | Pricing upon request | Website | |

| 3 | Best for QuickBooks users | 30-day free trial | From/$17.50/month | Website | |

| 4 | Best for instant payouts | Free card reader trial available | From/1.10% + £0.07/transaction | Website | |

| 5 | Best for PayPal integration | Free app download available | Pricing upon request | Website | |

| 6 | Best for global transactions | Free trial available through partners | Pricing upon request | Website | |

| 7 | Best for versatile tools | Free Square reader available with account setup | Pricing upon request | Website | |

| 8 | Best for banking integration | Free consultation available | From/$49 | Website | |

| 9 | Best for simple setup | Free demo available | From 3.25% plus $0.15 per transaction | Website | |

| 10 | Best for Canadian businesses | Free consultation available | Pricing upon request | Website |

The 10 Best Credit Card Readers for iPhone, Reviewed

Each review highlights who it’s best for, key features, hardware compatibility, pricing notes, and the most relevant pros and cons—so you can compare without the fluff.

Verifone offers a range of mobile payment devices designed to provide secure and efficient payment processing for businesses of all sizes. Their services cater to businesses needing reliable and secure transaction solutions, with a focus on enhancing payment security.

Why I picked Verifone: The focus on secure payments sets Verifone apart, offering advanced encryption and security protocols to protect your transactions. With a variety of devices that support EMV, NFC, and mobile wallet payments, your team can accommodate diverse customer preferences. This security focus is crucial for businesses looking to safeguard customer data and build trust with their clients.

Standout Services: The end-to-end encryption feature enhances transaction security, protecting sensitive payment data from unauthorized access. The contactless payment capability allows you to accept payments quickly and hygienically, addressing modern consumer preferences for speed and safety.

Target industries: Retail, hospitality, transportation, healthcare, and financial services.

Specialties: Secure payments, EMV and NFC support, end-to-end encryption, contactless payment capability, and mobile wallet integration.

Pros and cons

Pros:

- Free consultation

- Offers end-to-end encryption

- Focus on payment security

Cons:

- Limited to specific industries

- Pricing not publicly available

CardPointe offers a mobile credit card reader and processing app for iPhone, enabling users to accept payments anywhere. Their services cater to businesses needing flexible payment solutions, particularly those in industries like plumbing and food delivery.

Why I picked CardPointe: Real-time insights are at your fingertips with CardPointe's reporting analytics, which help your team make informed decisions quickly. The mobile app supports various payment types, including EMV and NFC, making transactions efficient and versatile. Its portability suits businesses that require on-the-go payment processing, reducing invoicing delays.

Standout Services: The product catalog management feature lets your team organize and track inventory easily, enhancing operational efficiency. The cash acceptance option adds flexibility, allowing you to handle multiple payment forms seamlessly during transactions.

Target industries: Plumbing, electrical services, lawn care, food delivery, and contracting.

Specialties: EMV and NFC payments, mobile app integration, product catalog management, reporting analytics, and cash acceptance.

Pros and cons

Pros:

- Suitable for field-based businesses

- Supports multiple payment types

- Offers real-time reporting analytics

Cons:

- Limited to specific industries

- Pricing details not disclosed

QuickBooks GoPayment offers mobile credit card processing services integrated with QuickBooks accounting software, serving small to medium-sized businesses. Their services focus on simplifying payment acceptance and financial management for businesses that already use QuickBooks.

Why I picked QuickBooks GoPayment: The integration with QuickBooks makes managing your finances more efficient by automatically syncing transactions. This integration is especially beneficial for businesses already using QuickBooks, as you can easily track sales and expenses in one place. The mobile app allows your team to accept payments on the go, reducing the need for additional hardware.

Standout Services: The invoicing feature allows you to send invoices and get paid faster, directly integrating with your QuickBooks account. The recurring payments option helps manage subscriptions or regular customer billing, making it simple to automate your payment processes.

Target industries: Retail, services, small businesses, and freelancers.

Specialties: QuickBooks integration, mobile payments, invoicing, recurring payments, and financial tracking.

Pros and cons

Pros:

- Simplifies financial tracking

- Supports recurring payments

- Integrates with QuickBooks

Cons:

- Limited to QuickBooks users

- Pricing details not disclosed

myPOS offers mobile credit card readers that allow businesses to process payments quickly and efficiently. Their services cater to small and medium-sized businesses that need reliable payment processing and instant access to funds.

Why I picked myPOS: Instant payouts are a key feature, allowing you to access funds immediately after a transaction. With the myPOS card reader's portability, your team can accept payments anywhere, which is great for businesses on the move. The integration with a free business account simplifies managing your transactions and finances.

Standout Services: The free business account provides a convenient way to manage your funds and transactions without additional fees. The multi-currency acceptance feature allows you to handle payments in different currencies, which is ideal for businesses dealing with international clients.

Target industries: Retail, hospitality, food services, tourism, and small businesses.

Specialties: Instant payouts, multi-currency acceptance, mobile payment solutions, free business account, and portable card readers.

Pros and cons

Pros:

- Free business account

- Multi-currency payment options

- Instant access to funds

Cons:

- May require specific bank integration

- Pricing details not readily available

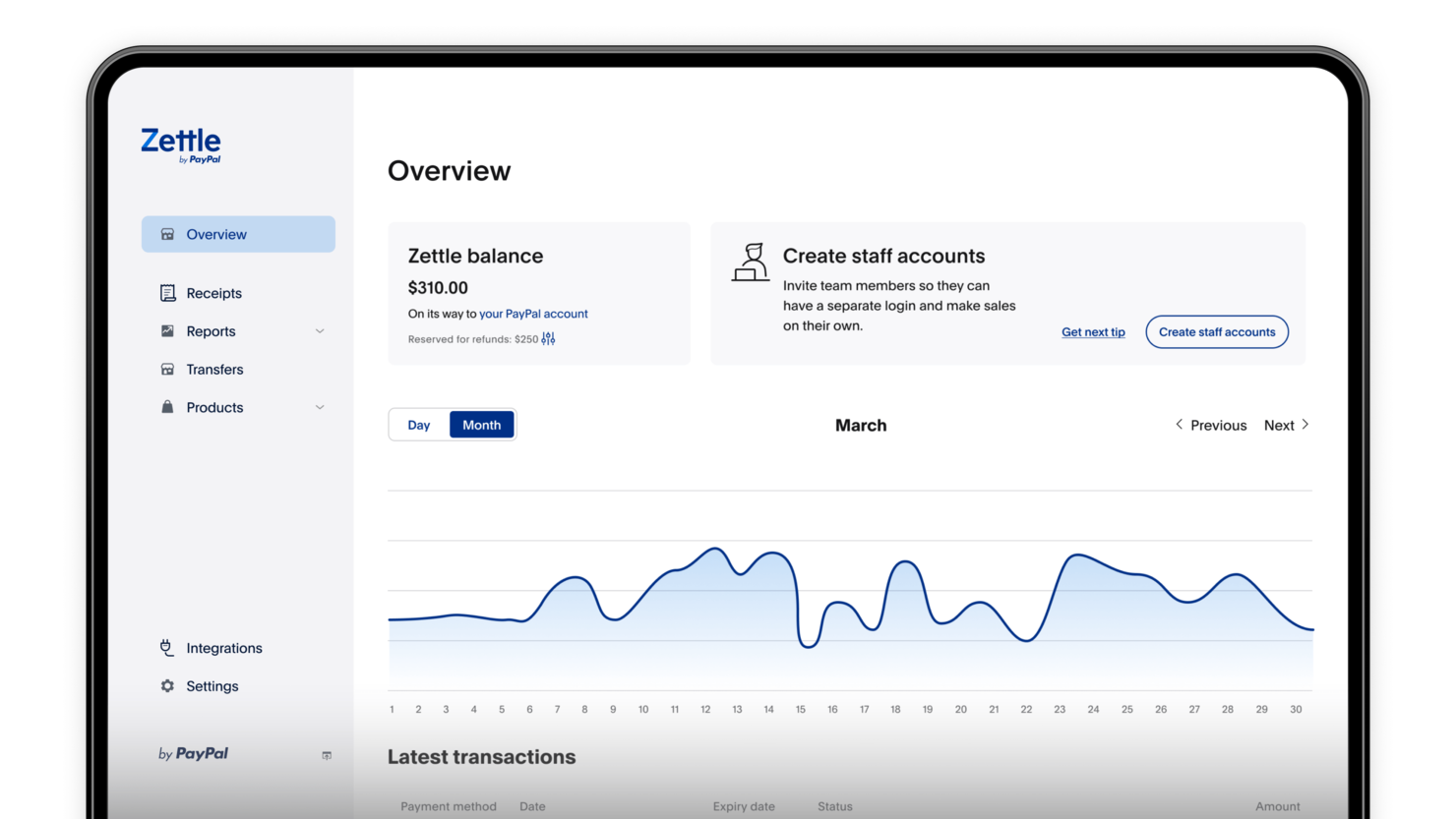

PayPal Zettle offers mobile card readers that integrate smoothly with PayPal, providing a straightforward payment solution for small businesses and entrepreneurs. Their services focus on simplifying transactions and financial management for businesses that rely on PayPal for their operations.

Why I picked PayPal Zettle: The integration with PayPal allows you to manage payments and funds efficiently, making it ideal for businesses already using PayPal. The card reader supports various payment methods, including contactless and chip cards, providing flexibility for your customers. This seamless integration helps your team streamline financial processes and improve cash flow management.

Standout Services: The inventory management feature helps you keep track of stock levels and sales, ensuring efficient business operations. The real-time sales analytics give you insights into your sales performance, helping you make informed business decisions based on up-to-date information.

Target industries: Retail, hospitality, food services, freelancers, and small businesses.

Specialties: PayPal integration, mobile payment solutions, inventory management, sales analytics, and contactless payment capability.

Pros and cons

Pros:

- Provides real-time sales analytics

- Offers inventory management

- Integrates with PayPal accounts

Cons:

- Limited to PayPal users

- Pricing not publicly available

Paysafe offers credit card reader services for iPhone through its Clover Go solution, which supports EMV and NFC contactless payments. Their services are tailored for businesses that require flexible payment processing and focus on providing seamless transactions for both small and large enterprises.

Why I picked Paysafe: Paysafe is ideal for global transactions due to its wide range of payment options, including digital wallets and cryptocurrency solutions. The Clover Go solution enhances mobility, allowing your team to process payments from anywhere using supported apps. Their focus on integrating payments into various business software makes them a versatile choice for diverse payment needs.

Standout Services: The Clover App Market offers over 200 apps for customizing your payment solutions, catering to unique business needs. The Mobile Pay feature turns any device into a mobile point-of-sale terminal, supporting multiple users and ensuring secure transactions.

Target industries: Retail, travel, iGaming, and small businesses.

Specialties: EMV and NFC payments, digital wallet acceptance, cryptocurrency solutions, software integration, and mobile-friendly services.

Pros and cons

Pros:

- Suitable for global transactions

- Offers digital wallet options

- Supports cryptocurrency payments

Cons:

- May not suit very small businesses

- Pricing not publicly available

Square offers a range of mobile card readers designed to facilitate easy and efficient payment processing for businesses of various sizes. Their services are tailored to meet the needs of retailers, service providers, and small businesses seeking flexible payment solutions.

Why I picked Square: The versatility of Square's tools allows your team to handle payments, track sales, and manage inventory all in one platform. With features that support both in-person and online transactions, you can cater to a wide range of customer preferences. This adaptability makes Square a great choice for businesses looking to integrate multiple functions into a single system.

Standout Services: The point-of-sale system enables you to manage sales, inventory, and customer data from one place, enhancing operational efficiency. The online store feature allows you to set up an ecommerce platform quickly, expanding your sales channels beyond physical locations.

Target industries: Retail, food services, small businesses, freelancers, and service providers.

Specialties: Versatile payment tools, point-of-sale integration, online store setup, inventory management, and sales tracking.

Pros and cons

Pros:

- Free reader with account

- Easy inventory management

- Supports both in-person and online sales

Cons:

- May not fit large enterprises

- Pricing details not disclosed

Chase Payment Solutions offers mobile credit card readers that enable businesses to process payments efficiently with tight integration to Chase banking services. Their main client base includes small to medium-sized businesses seeking a unified payment and banking experience.

Why I picked Chase Payment Solutions: The integration with Chase banking services allows your team to manage payments and banking in one place, saving time and reducing errors. Their mobile card reader supports various payment types, including EMV and contactless, catering to diverse customer preferences. This integration is particularly beneficial for businesses already banking with Chase, as it simplifies financial management.

Standout Services: The fraud protection feature helps safeguard your transactions with advanced security measures, ensuring peace of mind. The next-day funding option allows you to access your funds quickly, improving cash flow management for your business.

Target industries: Retail, food services, healthcare, hospitality, and small businesses.

Specialties: Banking integration, mobile payments, EMV and contactless payments, fraud protection, and next-day funding.

Pros and cons

Pros:

- Provides next-day funding

- Supports multiple payment types

- Integrates with Chase banking

Cons:

- Limited to Chase account holders

- Pricing not publicly available

SumUp provides mobile credit card readers that cater to small businesses looking for simple and efficient payment solutions. Their services focus on enabling easy transactions through a user-friendly interface, making it accessible for businesses with minimal technical expertise.

Why I picked SumUp: The intuitive setup process requires no extensive technical knowledge, allowing your team to start accepting payments quickly. SumUp's all-in-one payment system includes a mobile app that syncs seamlessly with its card reader, ensuring a hassle-free experience. This simplicity makes it ideal for small businesses seeking straightforward payment solutions without complicated integrations.

Standout Services: The invoicing tool allows you to send digital invoices directly from the app, helping you get paid faster. The analytics feature provides insights into your sales data, allowing you to make informed business decisions based on real-time information.

Target industries: Retail, hospitality, food services, small businesses, and freelancers.

Specialties: Mobile payments, easy setup, invoicing, sales analytics, and user-friendly interface.

Pros and cons

Pros:

- Offers sales analytics

- User-friendly interface

- Quick and easy setup

Cons:

- Limited advanced features

- Pricing not publicly available

Moneris Go Plus provides mobile credit card readers that cater to Canadian businesses requiring efficient payment processing solutions. Their services focus on delivering reliable payment terminals and software for retail and service industries.

Why I picked Moneris Go Plus: It's tailored for Canadian businesses, offering localized support and services that fit the unique needs of this market. The mobile card reader accepts various payment types, including EMV and contactless, ensuring your team can serve diverse customer preferences. Moneris Go Plus also integrates easily with existing systems, making it a practical choice for businesses looking to enhance their payment infrastructure.

Standout Services: The real-time reporting dashboard gives you immediate insights into your sales data, helping you make informed business decisions. The remote terminal management feature allows your team to update and manage payment terminals from anywhere, reducing downtime and enhancing efficiency.

Target industries: Retail, hospitality, food services, healthcare, and small businesses.

Specialties: Canadian market focus, EMV and contactless payments, real-time reporting, remote terminal management, and integration capabilities.

Pros and cons

Pros:

- Provides real-time sales insights

- Offers localized support

- Tailored for Canadian businesses

Cons:

- Requires specific bank partnership

- Limited to Canadian market

Other Credit Card Readers for iPhone

Here are some additional credit card reader providers for iPhone that didn’t make it onto my shortlist, but are still worth checking out:

- PayAnywhere

For flexible pricing

- SwipeSimple

For small retailers

- KORONA POS

For retail stores

- Helcim

For transparent pricing

- Stax Pay

For subscription models

- Shopify Tap & Chip

For ecommerce integration

- Merchant One

For personalized support

- Clover Go

For small business tools

- Stripe Terminal

For global reach

- Payline Data

For flexible payment options

- GoDaddy Poynt

For website integration

Our Selection Criteria For Credit Card Readers for iPhone

I scored each iPhone reader on seven weighted criteria—focusing on reliable iOS performance, EMV/NFC and Tap to Pay support, clear pricing, fast onboarding, solid support, and proven customer feedback.

Core functionality (25% of total score)

We only recommend readers that work reliably on iPhone in real retail conditions.

- Rock-solid iOS + Bluetooth. Fast pairing, stable connections, and instant wake from sleep.

- EMV + NFC coverage. Chip dips and contactless taps for Visa, Mastercard, AmEx, debit, Apple Pay, and Google Pay.

- Tap to Pay on iPhone. Hardware-free backup for contactless when lines spike or a reader dies.

- Offline acceptance. Queue transactions with clear limits and auto-sync when back online.

- Receipts, tips, taxes. Clean tip flow, custom tax rules, and email/SMS receipts that match your policies.

Additional standout features (25% of total score)

These are the difference-makers that turn a reader into a usable POS.

- Inventory + SKU sync. Item catalog, variants, and stock counts that update across iPhone/iPad.

- Invoicing + card-on-file. Send invoices, take deposits, and run recurring payments without hacks.

- Ecommerce + accounting integrations. Native hooks to Shopify/Woo and QuickBooks/Xero that actually reconcile.

- Hardware flexibility. Compact Bluetooth readers, all-in-one terminals, and modern charging (USB-C).

- Security depth. PCI DSS scope reduction, end-to-end encryption, and practical fraud tools.

Usability (10% of total score)

If staff can’t fly through checkout, nothing else matters.

- Clean POS app. Obvious cart, quick items, modifiers, and clear refund/discount controls.

- Speed at the counter. Minimal taps to charge and a fast tip screen that customers understand.

- Accessibility. Large buttons, dark mode, outdoor readability, and easy device handoff.

Onboarding (10% of total score)

You should be live in days—not stuck in paperwork.

- Self-serve signup. Streamlined KYC and instant account creation.

- Guided setup. In-app pairing checklist, sample catalog, and test mode.

- Payout readiness. Bank link flow that confirms deposit timelines and fees up front.

Customer support (10% of total score)

When Bluetooth flakes on Saturday, response time is everything.

- Live channels that answer. Phone/chat during trading hours and clear escalation paths.

- Hardware swaps. Fast replacements and transparent warranty terms.

- Status + docs. Real-time status page and troubleshooting mapped to real error codes.

Value for money (10% of total score)

We care about total cost to run—not teaser rates.

- Transparent pricing. Clear tap/dip rates, keyed-in premiums, and any monthly fees.

- No long-term lock-ins. Month-to-month terms and honest early-termination rules.

- Volume breaks. Discounts at realistic thresholds without forcing extra hardware.

Customer reviews (10% of total score)

We sanity-check marketing with operator reality.

- Recent iOS app ratings. Stability across current iOS versions and devices.

- Support + deposits. Themes around funding delays, outages, or reader failures.

- Feature truth. Real-world feedback on Tap to Pay, offline mode, and analytics accuracy.

What Are Credit Card Readers for iPhone?

A credit card reader for iPhone is a small device—or in some cases, a built-in iPhone feature like Tap to Pay—that lets you accept card and digital wallet payments through a mobile POS app.

Most support EMV chip, NFC contactless (Apple Pay, Google Pay), and sometimes magstripe.

Retailers, pop-ups, service providers, and mobile teams use them to take in-person payments, send receipts, and sync sales with inventory or accounting systems.

They solve common checkout challenges like speed, mobility, and secure transaction handling—without needing a full countertop POS system setup.

How to Choose a Credit Card Reader for iPhone Provider

Start by mapping your real-world checkout needs—where you sell, your average ticket size, payment mix, and how quickly you need funds. Then match a provider’s pricing model, hardware, and features to that pattern.

| Step | What to consider | Action tip |

|---|---|---|

| 1. Confirm iOS compatibility | Minimum iOS version, Bluetooth stability, USB-C charging for newer models | Test with your exact iPhone before committing |

| 2. Match fees to volume | Flat-rate vs interchange-plus, plus keyed-in, refund, and cross-border fees | Run a sample month’s transactions through each model |

| 3. Pick the right hardware | Tap to Pay on iPhone, Bluetooth reader, or all-in-one terminal | Choose based on payment types and line length |

| 4. Check payout timelines | Standard, same-day, or instant funding; weekend/holiday cutoffs | Confirm timelines with a $1 live test |

| 5. Test POS features | Inventory, invoicing, integrations, and exports | Verify must-have features in a live demo |

| 6. Pressure-test support | Response speed, replacement policies, support hours | Call or chat before you buy to judge quality |

Key Services to Look For in a Credit Card Reader for iPhone

When evaluating providers, focus on services that improve speed, reliability, and accuracy at checkout—because those are what keep sales moving.

- In-person payment processing. EMV chip card, NFC contactless, and magstripe options to handle all major cards, plus Apple Pay and Google Pay.

- Tap to Pay on iPhone. Built-in contactless acceptance for quick transactions without extra hardware when needed.

- Mobile app integration. A stable iOS app that pairs quickly over Bluetooth, processes payments, and syncs data in real time.

- Inventory management. Item catalogs, variants, and stock tracking directly in the app so sales and inventory stay aligned.

- Invoicing and recurring billing. Send payment links, handle subscriptions, and take deposits without additional software.

- Real-time reporting. Live sales data, taxes, and tips to support better staffing and purchasing decisions.

- Integration capabilities. Direct connections to accounting platforms like QuickBooks or ecommerce tools like Shopify.

- Security features. End-to-end encryption, PCI DSS compliance, and practical fraud monitoring that works in the background.

- Multi-device and cross-platform support. Sync across iPhone, iPad, and sometimes Android to keep operations consistent.

- 24/7 customer support. Access to live help when hardware, app, or payout issues hit.

Benefits of Credit Card Reader for iPhone

A well-chosen iPhone card reader can speed up checkout, cut operational headaches, and open new ways to serve customers. The payoff is better cash flow, smoother transactions, and tools that keep your business running efficiently—whether you’re behind a counter or on the go.

- Faster checkout. NFC taps and well-designed POS apps speed up transactions, cutting lines and reducing walk-aways.

- Mobility built-in. Take payments anywhere—on the shop floor, at a market stall, or curbside—without being tied to a counter.

- Better cash flow. Predictable payouts and instant funding options help you keep inventory stocked and bills paid.

- Customer-friendly payment options. Accept all major cards, contactless payments, and digital wallets to meet customer preferences.

- Real-time visibility. Live sales and tip data let you make staffing and inventory decisions on the fly.

- Built-in tools. Many readers come with invoicing, recurring billing, and inventory tracking—saving you from paying for separate apps.

- Scalable without the headache. Easily add more devices or staff logins without redoing your whole payment system.

- Security you can trust. Keep customer data safe with strong encryption and compliance baked in, protecting both you and your customers.

Costs and Pricing Structures of Credit Card Readers for iPhone

Pricing for iPhone card readers varies widely depending on your sales volume, hardware needs, and preferred fee model. Most providers work within a few common structures:

| Pricing Model | How it works | Best for |

|---|---|---|

| Pay-as-you-go | No monthly fee; flat percentage + per-transaction cost | Seasonal or low-volume sellers |

| Subscription + lower rates | Monthly fee in exchange for reduced per-transaction rates | Growing retailers with steady volume |

| Interchange-plus | Actual card network fees + provider markup | High-volume sellers seeking lower effective rates |

| Hardware-inclusive bundle | Monthly fee covers reader/terminal, support, and sometimes software | Teams standardizing across locations |

Cost factors to watch:

- Hardware costs. Bluetooth readers, all-in-one terminals, and USB-C charging bases may be extra.

- Card-not-present fees. Keyed-in or invoice payments often cost more than tap/dip.

- Payout speed fees. Some providers charge for same-day or instant deposits.

- Chargeback and refund costs. These can add up if not factored into your pricing model.

- Contract terms. Long-term agreements can lock you into unfavorable rates—check early-termination clauses.

Knowing the total monthly cost—including hardware, processing, and extras—before you commit will help you avoid unpleasant surprises once you start taking payments.

Credit Card Reader for iPhone FAQs

Here are some answers to common questions about credit card readers for iPhone:

How do credit card readers for iPhone work?

They either connect to your iPhone via Bluetooth or use Tap to Pay on iPhone for contactless transactions. Once paired with the provider’s POS app, you can accept EMV chip, NFC, and sometimes magstripe payments. The app processes the payment through your payment processor, sends a receipt via email or text, and updates your sales records. Many systems also sync inventory and customer data automatically, so your reporting stays accurate.

Do I need internet to take payments?

Yes—either Wi-Fi or cellular data is required to authorize and process payments in real time. Some providers offer an offline mode that lets you accept EMV or contactless transactions without a connection, but those sales are queued and processed once you’re back online. This is useful for markets, festivals, or areas with unreliable coverage, but you should confirm offline limits and risk policies before relying on it.

Which payment methods can I accept?

Most iPhone readers handle all major credit and debit cards (Visa, Mastercard, American Express, Discover) plus NFC contactless payments like Apple Pay, Google Pay, and Samsung Pay. Many also accept prepaid cards and, in some cases, alternative wallets or Buy Now Pay Later options. If you cater to international customers, check for multi-currency support and whether your provider accepts global card networks.

Are iPhone credit card readers secure?

Yes—when you choose a reputable provider. Look for end-to-end encryption, tokenization, and PCI DSS compliance as standard. Some also include fraud detection tools that flag unusual transactions in real time. Security certifications should be clearly listed by the provider, and updates to the POS app should be frequent to patch vulnerabilities.

Can I integrate the reader with my POS or accounting system?

Many readers integrate directly with POS platforms, ecommerce tools, and accounting software like QuickBooks or Xero. This means sales, taxes, and inventory updates flow automatically without double entry. Always confirm compatibility with your current setup and test the integration before rollout to avoid workflow disruptions.

How fast will I get my money?

Standard funding takes one to two business days for most providers. Some offer same-day or even instant payouts for a fee. Deposit timelines can also be affected by weekends, bank holidays, or your bank’s own posting schedule. If cash flow is critical, look for a provider that offers predictable deposit times and confirm cutoff hours for batch settlements.

Keep Your Checkout Moving

A well-matched credit card reader for iPhone helps you process payments quickly, keep customers satisfied, and maintain steady cash flow.

Look for solid iOS performance, clear pricing, and features that fit your daily operations. Test it in your real environment before committing, and you’ll have a reliable setup ready for every in-person sale.

If you're in the process of researching credit card readers for iPhone, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.

Retail never stands still—and neither should you. Subscribe to our newsletter for the latest insights, strategies, and career resources from top retail leaders shaping the industry.